KUALA LUMPUR, June 16 — If you are a senior citizen living alone, the capitals of Kedah, Kelantan and Terengganu would be the cheapest cities in Malaysia for you with an estimated minimum monthly budget of RM2,100, while Klang Valley would be the costliest with at least RM2,520 needed, a new spending guide has shown.

As for retired couples, they would need a higher budget of between RM2,600 and RM3,200 every month if they live in any of the 12 cities in Malaysia included in the Belanjawanku 2022/2023 spending guide.

In the Belanjawanku 2022/2023 guide commissioned by the Employees Provident Fund (EPF) and prepared by Universiti Malaya’s (UM) Social Wellbeing Research Centre (SWRC), senior citizens were defined as those aged 60 and above. The mandatory retirement age in Malaysia is now 60 years old.

According to the spending guide, the top five most expensive cities in Malaysia for solo retirees and retired couples were consistently the Klang Valley, Georgetown in Penang, Johor Baru in Johor, Kota Kinabalu in Sabah, and Seremban in Negeri Sembilan.

For solo retirees in these cities, they will need at least RM2,200 to RM2,500 every month, while retired couples in these top five costliest cities would need RM2,900 to RM3,200 at minimum every month.

Ipoh in Perak, a popular place to retire in Malaysia, comes in sixth at RM2,840 for a retired couple and RM2,190 for a solo retiree.

What would a retired person’s minimum monthly budget look like?

In Alor Setar, Kedah, a senior citizen living alone could live with at least RM2,020 every month, which will cover food (RM530), transportation (RM490), housing (RM400), utilities (RM150), ad-hoc or one-off spending (RM120), discretionary expenses (RM120), social participation (RM100), personal care (RM60), and healthcare (RM50).

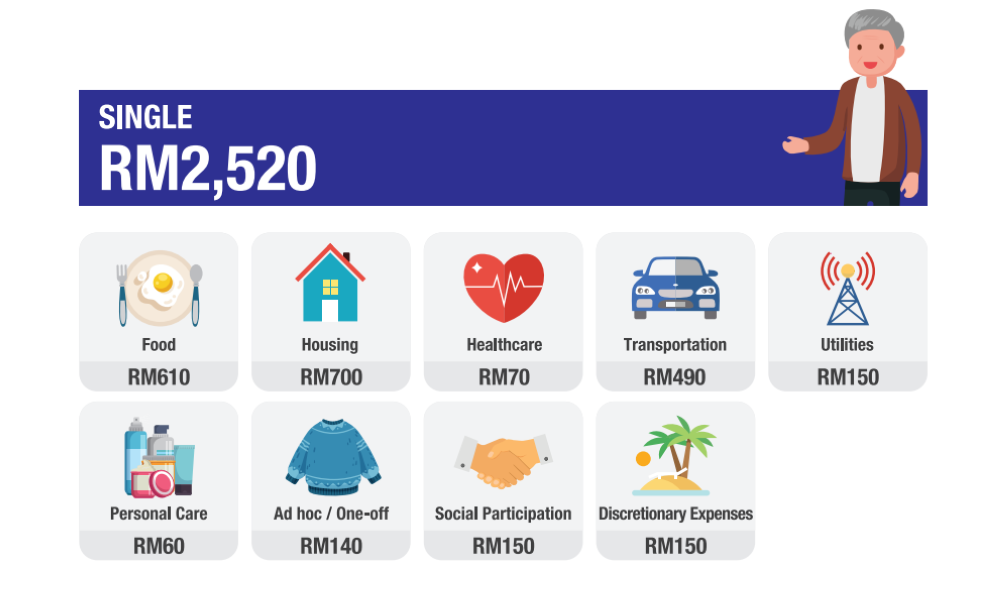

In the Klang Valley, a solo retiree’s monthly budget will be RM500 more expensive than Alor Setar, with a minimum RM2,520 required.

The Klang Valley’s solo retiree budget is mainly bumped up by housing estimates of RM300 more than Alor Setar, which means housing in the Klang Valley would be RM700. (This matches the trend of higher housing prices in more developed cities, while Klang Valley property prices are also influenced by higher demand, population growth, increased construction costs and housing market fluctuations, the spending guide said.)

Things expected to cost more for the Klang Valley retiree would be food (RM610), social participation up by RM50 to become a minimum RM150, discretionary expenses up by RM30 (RM150), healthcare up by RM20 (RM70), ad-hoc spending also up by RM20 (RM140), while costs that are estimated to be the same as Alor Setar are transportation, utilities and personal care.

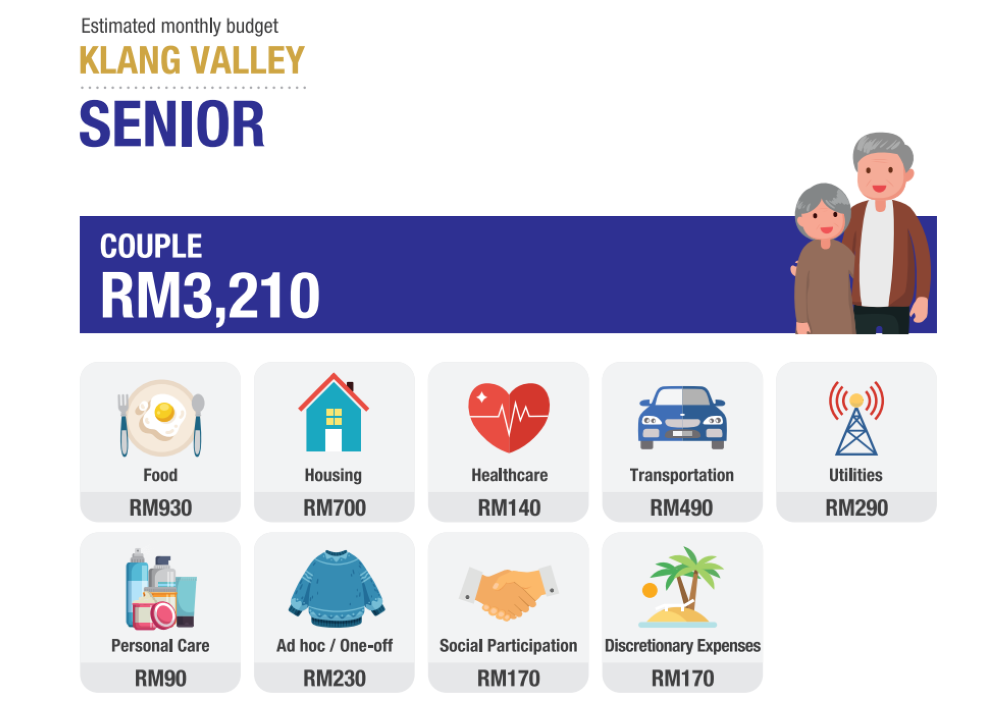

In the Klang Valley, the minimum monthly budget goes up by 27 per cent or RM690 more for a senior couple (RM3,210), when compared against a senior single (RM2,520).

How do you calculate a retiree’s minimum budget?

Whether you are living alone or as a couple, retirees are assumed to live in a house (rather than in a room) but still have lower housing costs as compared to married couples and single parents (categories which are assumed to rent or own a housing unit with three to four bedrooms).

“This is due to cheaper mortgage repayment as the property is assumed to have been purchased 20 to 30 years ago,” the spending guide said, in a nod to the cheaper prices to buy properties in the past which will result in lower housing loan instalments for retirees.

While transportation costs are expected to be RM490 for both solo retirees and retired couples in all 12 cities in the guide, it is lower than all other household categories (except for singles using public transport) as senior citizens are assumed to have only one car.

The lower transportation costs for senior citizens are also because they are expected to commute less and spend less on entertainment compared to younger working adults, the guide said.

The budget is calculated on the basis that there is universal healthcare, but with the understanding that it would be unrealistic to visit government hospitals each time for common illnesses such as cold, influenza, sore throat, and toothache.

The healthcare budget for different household categories in the spending guide is also on the assumption that households are generally in good health and not suffering from any chronic illnesses or severe allergies, but also considers that senior citizens would need to spend relatively more as they are prone to illnesses and that healthcare costs tend to go up as people age.

Healthcare costs are also higher for senior citizens due to the importance of maintaining good health among the elderly, the guide said.

The spending guide’s minimum monthly healthcare budget is based on three visits to private general practitioners and one visit to private dentists in a year, with this annual sum divided over 12 months. The highest estimate is RM140 for a senior couple (Klang Valley), and RM70 for a solo senior (Klang Valley, Kota Kinabalu).

Unlike younger age groups, the spending guide does not include “savings” as an item in senior citizens’ minimum monthly budget. This means they are assumed to not have an allocation for personal savings.

(The personal savings amount for other households who are not considered senior citizens are based on feedback from focus groups in the study, based on their own indication of their ability to save and how much is considered to be sufficient. It is also based on how much they would ideally like to save every month as a buffer for emergencies and for short-term and long-term financial targets.)

How much will you save as a retiree living outside of the Klang Valley?

If you are a solo retiree now, living in Alor Setar means you will spend at least RM500 lesser than if you were in the Klang Valley.

But if you are located in Ipoh or Melaka City, you will save at least RM330 to RM340, while living in Georgetown would not be much of a difference as it will only be RM70 cheaper than being in the Klang Valley.

Do you have enough to retire comfortably?

The Belanjawanku spending guide is not meant to be a “standard” that you must follow, but is just a reference on how much money you would need to have a “reasonable standard of living” (paying for basic needs, be involved with the community, family and friends, living a meaningful life).

“Moving forward, Belanjawanku is useful for measuring poverty level, debt counselling, credit scores and purchasing power calculation.

“It can be a valuable tool for an individual’s prudent financial management as well as for policymakers to use as a guide in designing appropriate minimum wage policies and adequate income support measures to ensure social inclusion for all Malaysians,” the guide said, with EPF and SWRC to update the figures annually and to issue a comprehensive report every two years.

EPF had in the past set a Basic Savings figure, which is the minimum targeted amount of EPF savings that members should have by the age of 55 and the amount considered sufficient to support their basic needs for 20 years until age 75 in line with the Malaysian life expectancy.

EPF in 2008 first set the Basic Savings target by age 55 at the minimum level of RM120,000, and in 2014 updated it to RM196,800, and in January 2017 updated it to RM228,000, with the latest update being in January 2019 where the target is now EPF savings of at least RM240,000.

In September last year, EPF chief strategy officer Nurhisham Hussein was reported saying by local daily The Star that those retiring in 20 to 30 years’ time will need a “bare minimum” of at least RM900,000 to RM1 million, after factoring in factors such as inflation and medical bills.

Nurhisham was reported saying those retiring in the next few years would need about RM600,000 in savings to have a dignified retirement in Kuala Lumpur, but with this figure not covering major medical needs and just covering ordinary outpatient medical needs or visits to general practitioners.

Even for Alor Setar which would be the cheapest for a comfortable retirement, RM480,000 would be needed for a person to retire there. This amount is twice the Basic Savings target of RM240,000, he reportedly said.

Based on the latest statistics on EPF’s website, Malaysians aged 60 to 64 would on average have EPF savings of RM113,713 per person, while their median savings would be RM8,149 per person as of last December 31. This means half of the around 580,000 members in this age group have RM8,149 or less in EPF savings as of last December.

The EPF savings of those aged 65 and above (with about 990,000 in this age group) as of last December is at an average of RM65,989 and a median amount of RM2,186.

(Median figures would be a better indicator as it is the midway point for all those in the age group, while average figures can be skewed — for example if there are some with extremely high or extremely low savings in the same age group.)

Read here for what the Belanjawanku 2022/2023 spending guide estimates to be the minimum monthly budget for those in the age group of 18 to 40 years old, namely single individuals either using public transport or owning a car; and married couples with either no children, one child or two children.

Read here for the Belanjawanku 2022-2023 summary, and here for the spending guide’s full detailed report.