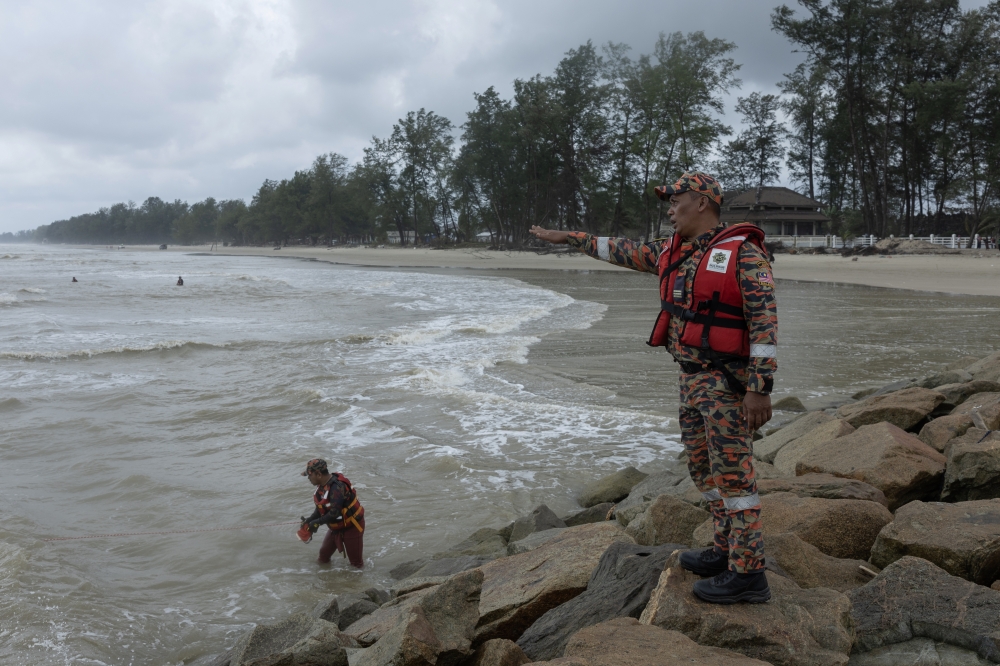

KUALA LUMPUR, March 14 — Flash floods have once again hit several areas in the Klang Valley.

In some instances, the heavy downpour has led to people needing to be rescued from their partly submerged vehicles as seen on social media.

Hundreds of cars were reportedly damaged, following rising waters in many areas of the city.

Floods not only leave cars caked in mud but could also cause damage to their structural integrity.

Damages are usually worse in cars that have a large number of electric and electronic components installed in them.

Here are some quick tips on what to do if you find yourself in such a situation.

What to do during a flood?

If you are stuck in your vehicle and water levels are rising and you are unable to drive away, immediately turn off your engine.

Keep your engine turned off until the water level recedes or help arrives.

Do not attempt to drive through floodwaters especially if they are at the same level as the floor of your car’s body or higher, as this encourages water to enter a car through its ventilation streams.

Monitor the water level closely; when you get a chance remove all valuables from within the vehicle – especially if these have not come into contact with water yet.

Next, move yourself and those you are traveling with to higher ground and call for help.

It is important to stay out of the flood waters, as underwater currents can easily sweep you away. Particularly during storms.

Leave it as it is first

If your car is immersed in water more than halfway up its wheels, do not attempt to start the car as this could damage it beyond repair.

Starting the engine can cause damage to your car’s electronic engine control unit (ECU), which can be expensive to fix, with prices running into thousands depending on the model of your car.

If your car is not blocking any traffic, it is best to leave it where it is parked and allow it to dry.

Keep your car doors and windows open, and drape towels over your car’s seats and floor. A wet car can lead to the growth of mould, and that is one extra headache that you will definitely want to avoid.

At the same time, look out for debris that may have lodged itself in your car’s underbody, tires or brakes.

When to call for professional help?

Check your vehicle’s oil dipstick and ensure there are no droplets of water there. Also take a close look at your car’s brake pads and coolant reservoir, as these are easily damaged and contaminated by water.

It is always important to get an expert to properly examine your car. Call your preferred mechanic or car service centre and have them take a look at your car.

They will be able to evaluate the situation and provide a detailed explanation of the damages you are dealing with and a rough estimation of the cost.

What about insurance?

Remember to record all important details such as the location, time and date of where the car was stranded. Also, take a picture of your car in the floods as this may come in handy when you are filing for an insurance claim.

Even if you have comprehensive auto insurance it does not necessarily mean the insurance company will pay for repairs or pay you the car’s value if it’s totalled.

Floods still usually fall under additional coverage which you need to have paid for.

Most insurance policies only cover damages that aren’t too extensive and don’t involve flood damage.

However, it is important to call your insurance agent and let them know about the condition of your car so you can decide how to proceed.

According to a joint statement by Persatuan Insurans Am Malaysia (PIAM) and Malaysian Takaful Association (MTA), “special considerations” may be given on a case-by-case basis.

“Policy/certificate holders are advised to contact their insurers or takaful operators for further advice as the scope of cover, terms and conditions including relief measures accorded by one insurer or takaful operator may differ with another,” the two associations said recently.

Expect to be without a car for a long time

Whatever decisions you make, it is imperative that you do it soonest possible. Extended flood exposure to your vehicle may have lingering effects.

Any delays in repairs will cause your engine and other electrical components to corrode.

If you have a comprehensive insurance plan, apply for the claim process immediately and provide all relevant documents and information you can to the agent.

Insurance claims generally take time, especially when it involves damaged cars.

There may also be a delay in getting spare parts for your vehicles, so the faster you apply for the claim the shorter the wait will be.

With flash floods becoming a regular occurrence in the country, it is time to ensure you are financially protected.

Without insurance coverage, you are likely to have to fork out a lot of money to pay a hefty repair bill.

When renewing your car insurance, make sure you look at the add-on offers on your policy to ensure you are protected.