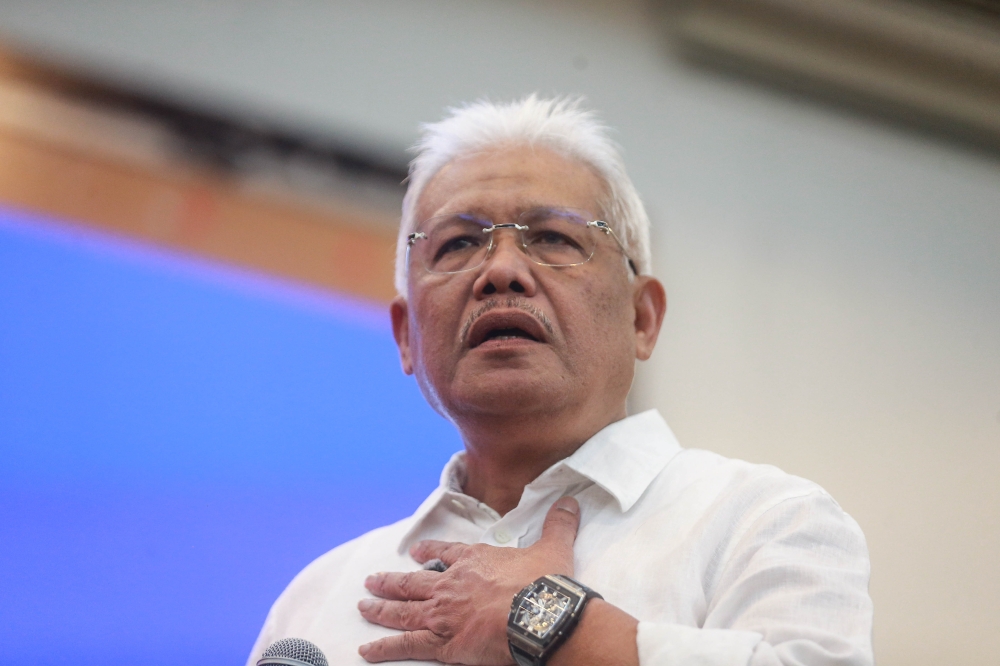

KUALA LUMPUR, Dec 11 — The Financial Action Task Force’s move to upgrade Malaysia’s status to “Regular Follow-Up” status, the highest category under the mutual evaluation process, reflects a whole-of-nation commitment and efforts, Bank Negara Malaysia Governor Datuk Seri Abdul Rasheed Ghaffour said today.

Global financial crime watchdog FATF and Asia/Pacific Group on Money Laundering (APG) in its Mutual Evaluation Report (MER) upgraded Malaysia to “Regular Follow-Up” for its anti-money laundering, countering terrorist financing and proliferation financing (AML/CFT/CPF) framework from “Enhanced Measures Regular Follow-Up” in 2015.

This upgrade, following the previous mutual evaluation in 2015, reflects Malaysia’s strong technical compliance and improved effectiveness in combating money laundering, terrorism financing, and proliferation financing (ML/TF/PF).

“This achievement reflects Malaysia’s whole-of-nation commitment and efforts to safeguard the integrity of its financial system and combat money laundering, terrorism and proliferation financing.

“We will continue to strengthen our AML/CFT/CPF framework to address emerging risks, maintain global confidence in Malaysia’s financial sector, and ensure Malaysia remains an attractive and competitive investment destination,” Abdul Rasheed said in a statement today.

BNM said that the MER recognised the key strengths in Malaysia’s AML/CFT/CPF4 regime, such as the comprehensive legal and institutional framework to combat ML/TF/PF, including recently amended legislation such as the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001, Penal Code, Companies Act 2016, Labuan Companies Act 1990, Trustees (Incorporation) Act 1952 and Trustee Act 1949.

The central bank said Malaysia’s sound and deep understanding of ML/TF/PF risks, robust domestic coordination and cooperation, significant asset recovery and advanced financial intelligence capabilities were also acknowledged by the MER.

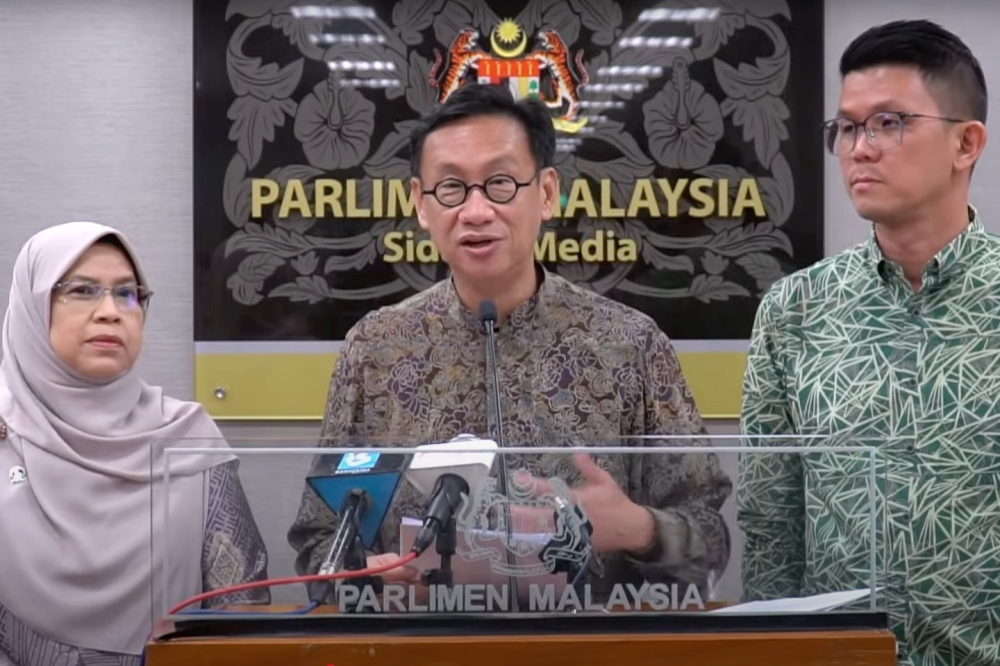

“The MER underscores Malaysia’s strong alignment with international standards, reflecting the country’s commitment to safeguarding the integrity of the financial system,” it said.

BNM stated that this positive outcome reinforces global confidence in Malaysia as a safe and transparent investment destination, supporting economic growth and long-term prosperity.

“It also strengthens trust and promotes cross-border collaboration, paving the way for deeper networks and partnerships with other countries.

“Following the publication of the MER, the National Coordination Committee to Counter Money Laundering will develop and implement comprehensive national strategies and action plans to address the risks and recommendations outlined in the report and further strengthen the country’s AML/CFT/CPF framework,” it added. — Bernama