KUALA LUMPUR, Oct 14 — Several economists polled by Malay Mail have expressed optimism over the Budget 2024 announced by Prime Minister Datuk Seri Anwar Ibrahim yesterday, praising its commitment to fiscal sustainability and reform.

Speaking to Malay Mail, they expressed satisfaction over the commitment to explain revenue through implementations of new taxes although there was scepticism over growth next year with the volatile global economy.

“They also make the first step of reforms to address the long-term structural weakness of the country to build a sustainable economy, long term.

“If I choose the word, talk about this budget, I will say this is the budget to secure sustainable growth and reform,” Socio-Economic Research Centre executive director Lee Heng Guie told Malay Mail when contacted yesterday.

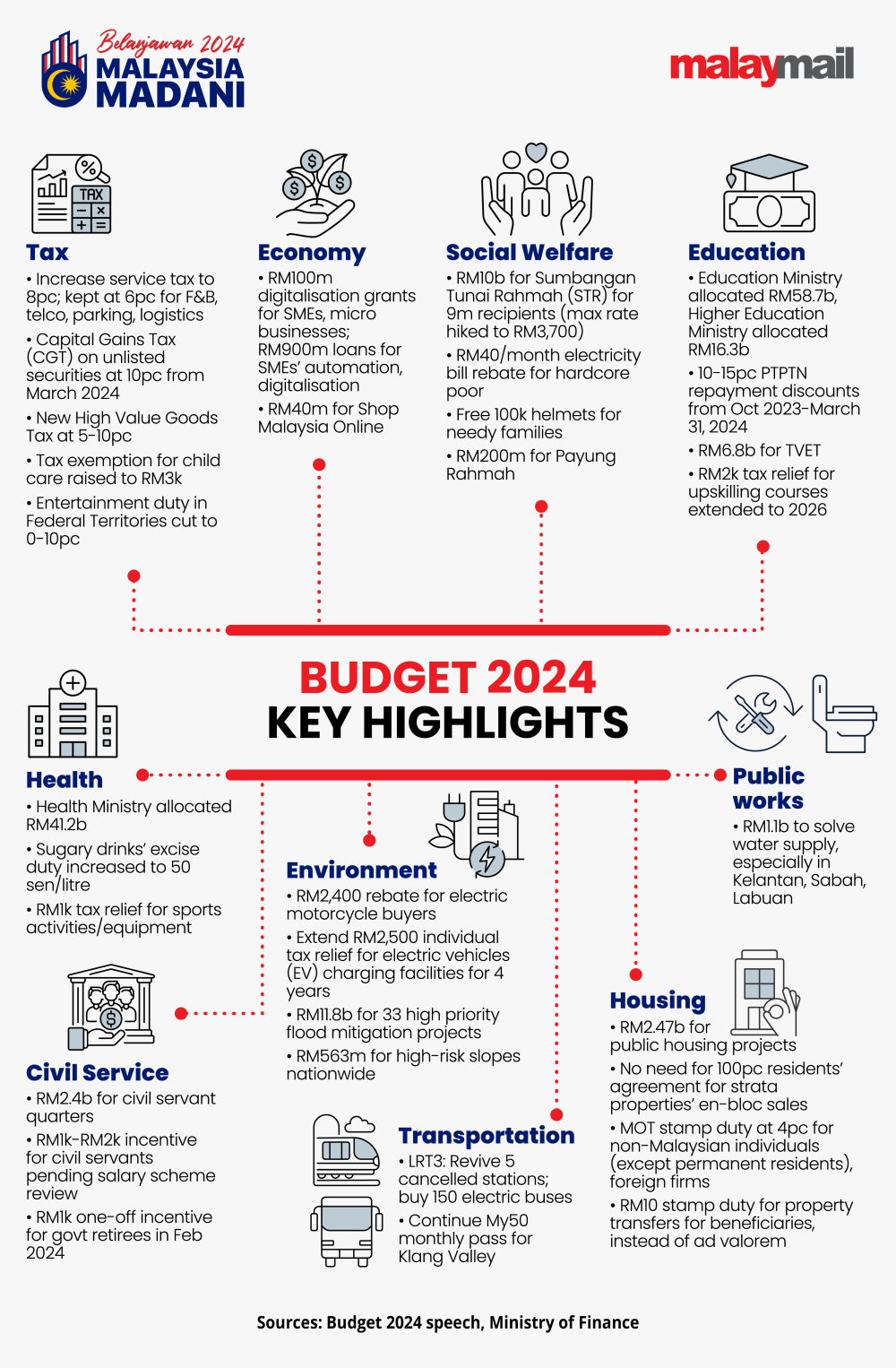

Commenting further, he said that the wide scope of the service tax introduced in the Budget 2024 will also help the government with extra revenue amid concerns that Putrajaya needs to broaden its revenue base.

“So they decided to increase the service tax rate from 6 per cent to 8 per cent. The exception is the food and drinks and also the telco services, because these two will directly impact a lot of people.

“And then a wide scope of service tax, entering the logistics or the karaoke place, this and that. So they widened the scope to get about RM3.45 billion for the increase in the service tax. So that helped to give them extra revenue,” he said.

Malay Mail's report last month showed that Malaysia is not only relying more on personal income tax compared to its neighbours, but income tax in total contributed just 11.8 per cent compared to the gross domestic product (GDP) — below the Asia-Pacific average of 19.8 per cent, and the Organisation for Economic Co-operation and Development (OECD) average of 34.1 per cent.

Similarly, Malaysia University of Science and Technology's dean of the Institute of Postgraduate Studies Geoffrey Williams highlighted how Putrajaya managed to plan merely a minor increase in spending to cover inflation while at the same time proposing a higher revenue from better management — leading to a smaller probable deficit.

The Finance Ministry said that Putrajaya is aiming to reach a 3.5 per cent deficit-to-gross domestic product (GDP) ratio by 2025. The ratio is estimated to be at 5 per cent this year, and projected to be 4.5 next year.

“This still allows plenty of space for government spending without excessive borrowing and is more fiscally responsible than previous budgets,” the professor said.

Williams pointed out that the spending announced was directed towards the needy, rather than a series of initiatives catering to special interests.

“Again this shows clearer focus and better fiscal responsibility,” he said.

Lee said the launch of the luxury goods tax and capital gains tax (CGT) on unlisted shares that have been previously announced in Budget 2023 showed that Putrajaya has finally found a way to implement them.

Williams echoed the sentiment, saying these would target those earning higher without impacting the lower-income group.

He added that this will contribute to the anticipated rise in revenue, while demonstrating that it is possible to adjust tax mechanisms in a small but substantial way without resorting to the goods and services tax (GST).

However, Universiti Tunku Abdul Rahman's economics professor Wong Chin Yoong expressed worries over the Finance Ministry's optimistic outlook for 2024.

The ministry has projected a GDP growth of between 4 to 5 per cent, after an estimate of 4 per cent this year.

“I'm a little bit worried about the optimistic projections of the growth next year, because wherever the tax revenue that we expect to get next year, or whether the deficit ratio or the debt ratio, it's based upon the view that the world economy is going to be getting better next year.

“Based on the projection, I’m really worried given what's going on in the world economy at this moment, like for example, the US starts to see the impact of the interest hikes. And then we are not sure about how bad the Chinese economy is,” he said.

He pointed to the two currently ongoing wars that may escalate next year: the Russian invasion and Israel's retaliation against Hamas in Gaza.

Wong further said that the Budget 2024 also had a major focus on digitalisation and was also aligned with the net zero with the allocation for green transition, particularly with the installation of solar panels and electric vehicle development.

However, he suggested that it is also important for the government to place an incentive to encourage local companies to go globally.

“I would hope to see more incentive to encourage our SMEs to go global because that's the only way that we can really push the instruction to the world industrial adjustment or restructuring our production in the country,” he said, referring to the small and medium enterprises.

Almost eight months after Prime Minister Datuk Seri Anwar Ibrahim tabled his first federal budget since coming into power, yesterday's tabling of Budget 2024 was the government's biggest federal spending yet at RM393.8 billion to date.

As Anwar's government seeks to rationalise existing subsidy spending with the intention of consolidating the country’s fiscal position, Budget 2024's amount is over RM7.66 billion than the one tabled last February according to Ministry of Finance's Fiscal Outlook and Federal Government Revenue Estimates 2024 report.