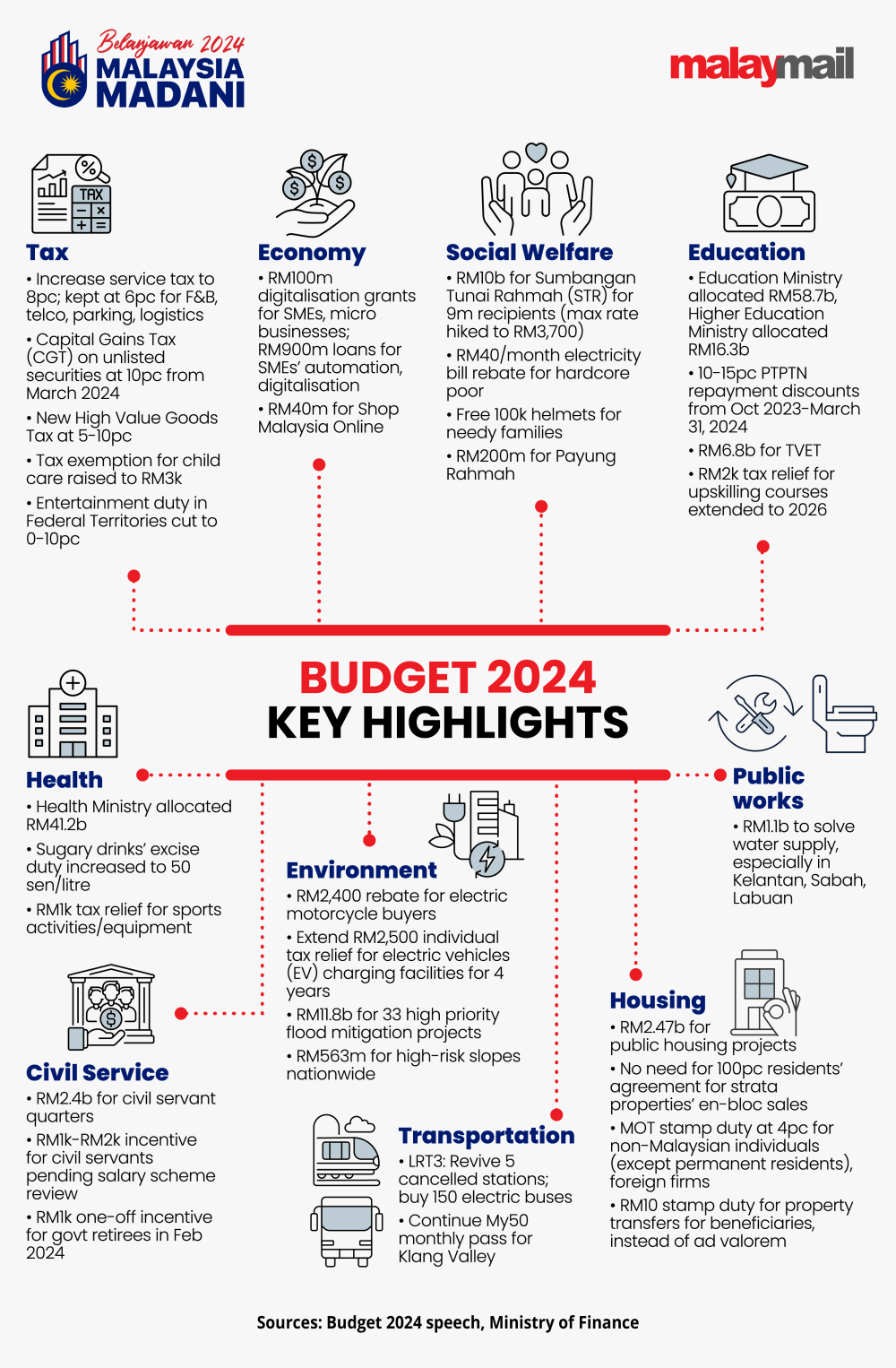

KUALA LUMPUR, Oct 14 — This year, Budget 2024 landed with aplomb, bringing forth a whopping allocation of RM393.8 billion, the largest in Malaysia’s history.

The Budget’s main objectives are to breathe new life into the economy, ease the people’s financial burdens, and propel Malaysia toward a prosperous future.

Let’s take a closer look at the winners and losers of this grand fiscal plan.

WINNERS

Entertainers

If you’re an entertainer or a fan of "live" performances, you’re in for a treat.

The government is doing away with the 25 per cent entertainment tax for various categories in the Federal Territories.

Local stage performers will perform tax-free, and theme parks, family recreation centres, indoor game centres, and simulators will enjoy a reduced 5 per cent tax.

It’s time to get your dancing shoes and popcorn ready for a night out! Read More

Padi farmers

Agriculture takes centre stage in this Budget with an allocation of RM2.6 billion for subsidies and incentives to support farmers and fishermen.

Padi farmers, in particular, are set to benefit from an increased rate of the Paddy Rice Subsidy Scheme, jumping from RM360 to RM500 per metric tonne.

Moreover, the floor price for paddy has been raised to RM1,300 per metric tonne, promising relief to the hardworking rice farmers. Read More

Sports enthusiasts

Are you a fitness fanatic or someone looking to jumpstart a healthier lifestyle?

The government is on your side, offering a RM1,000 tax relief when you purchase any sports equipment.

This tax relief will also extend to fees for sports training.

Get ready to score big both in your health and wallet! Read More

Government servants

It’s time for a change in the retirement scheme for government servants.

While the new mechanism is still in the works, the government is offering a generous RM2,000 to all government servants ranked at least Grade 56, including contract workers.

On top of that, an extra RM1,000 will be given to those holding top positions in the public sector, including police, fire and rescue personnel, Armed Forces, and all uniformed personnel. Read More

LOSERS

Shopaholics

The Service Tax is set to increase from 6 per cent to 8 per cent next year, hitting the pockets of consumers.

Additionally, luxury goods tax (LGT) will be introduced for items like watches and jewellery, though it won’t affect services such as food and beverages or telecommunications.

This comes as the capital gains tax (CGT) of 10 per cent on unlisted shares is on the horizon, but this is unlikely to affect most people.

The government justifies these measures, noting that Malaysia’s tax collection, at 11.8 per cent of GDP, is lower than Singapore (12.6 per cent) and Thailand (16.4 per cent). Read More

Sweet tooths

If you’ve got a sweet tooth, this Budget might leave a sour taste in your mouth.

The excise duty on sugary pre-mixed beverages has been bumped up by 10 sen per litre, from 40 sen to 50 sen.

This hike is part of a larger effort to curb health risks associated with excessive sugar consumption.

So, think twice before you reach for that extra sugary soda. Read More

As Prime Minister Datuk Seri Anwar Ibrahim presented Budget 2024, it became clear that the government is committed to fostering economic growth and ensuring social welfare.

This Budget aims to strike a balance between providing support to those who need it most and optimising the country’s fiscal position. With an allocation of over RM393 billion, Budget 2024 is set to steer Malaysia on a path to prosperity.

* A previous version of this story contained an error which has since been corrected.