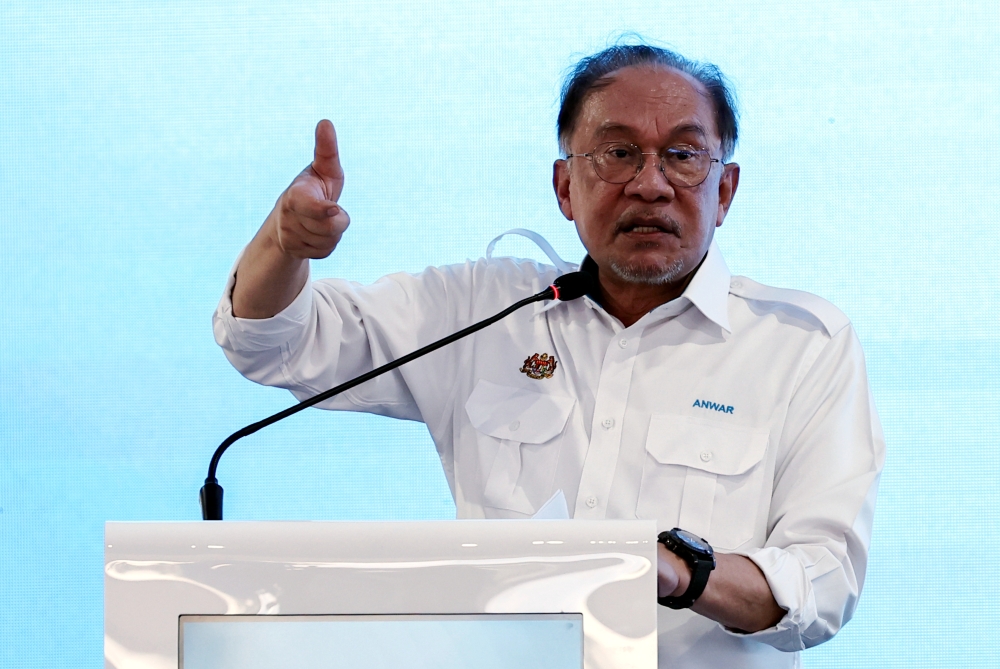

KUALA LUMPUR, March 21 — Prime Minister Datuk Seri Anwar Ibrahim today said that the government will utilitise Islamic financing loan method in relation to emergency loans made with EPF (Employees’ Provident Fund) saving as collateral.

He said this will ensure that service cost is kept at a minimal.

"The instrument we will use is Islamic financing so that the service cost is minimal.

"But we won’t use measures taken by conventional banks, however, we will not prevent if there are members who are Muslim or especially non-Muslims who choose to borrow through conventional methods.

"For EPF, it has chosen to ask members to use the Islamic financing loan method with the lowest interest rate, which is of course lower than the market loan rate,” Anwar told the Parliament today during the Prime Minister’s Question Time.

He added that for withdrawals from EPF Account 2, guidelines and criteria have not changed.

On March 9, Anwar, who is also the finance minister, announced that the government is deliberating to greenlight the use of EPF savings as collateral for emergency loans, following repeated calls from the Opposition to allow further withdrawals.

In his winding-up speech for the policy stage of Budget 2023, Anwar pointed out that this would only apply to those who are really struggling with their financial circumstances.

Anwar also stressed that it was unfair to make Malaysians keep dipping into their retirement savings when these have already been drawn down repeatedly during the Covid-19 pandemic, saying the government would instead look for alternatives to help.

When asked by Umno’s Sungai Besar MP Datuk Muslimin Yahaya if the savings used as collateral would contravene the EPF Act, Anwar said EPF legal advisers and the attorney general have been consulted, and there is no contradiction with Section 51 of the EPF Act.

“However, in terms of guarantee, the interest of the borrower is preserved; for example, the dividend will continue, even if collateral is given, for example the borrower makes RM50,000 as a loan, but the dividend will be given in full according to the original EPF (regulations).

“(It will) not (be) deducted. So EPF feels that in a few years, returns will be obtained, so if some small amount fails to make repayment, it is not affected seriously because the principal amount and dividends have been added and deducted, and from the dividend angle, the risk, as I understand, it is very minimal,” Anwar said.

Acknowledging grouses on the ground, Anwar said he had explained that EPF is not the only method utilised by the government to help reduce the burden of farmers and fishermen.

“Don’t consider the EPF as the only way to ease their burden, that’s one.

“But we are bound by the EPF setup, not like MARA (Majlis Amanah Rakyat) or ASB (Amanah Saham Berhad), this is EPF, indeed it is clearly our agreement that it is for old age, that’s why there are clear fatwas in this regard, for example, not being taxed,” he added.