KUALA LUMPUR, April 12 — The Malaysian Housing Financing Initiative (i-Biaya) is one of four components of the Home Ownership Programme (HOPE) and among the efforts of the Housing and Local Government Ministry (KPKT) to increase home ownership among the people.

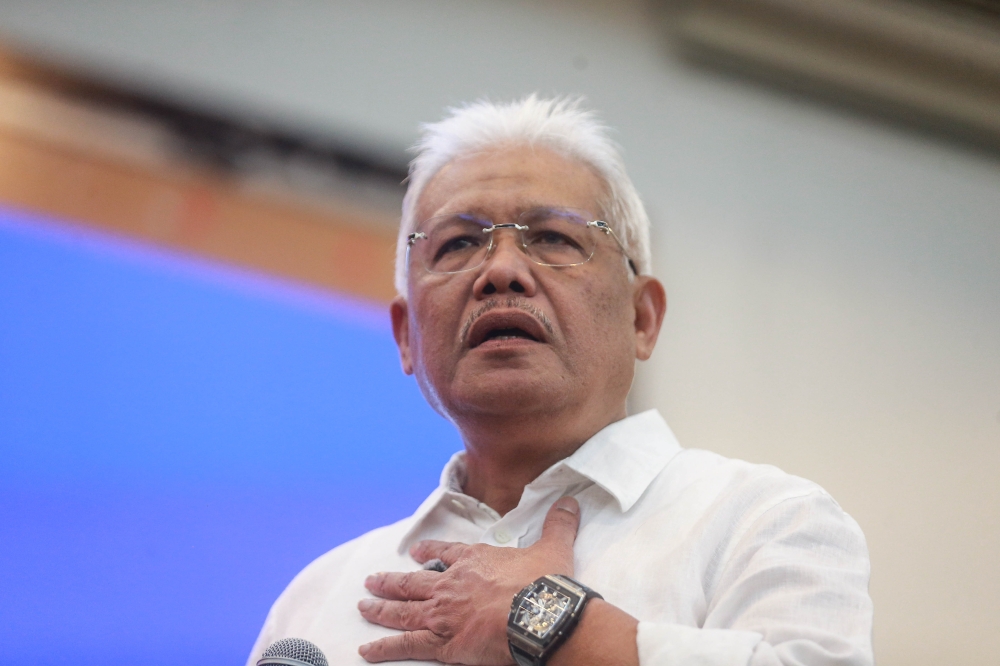

KPKT deputy secretary-general (Housing and Community Wellbeing), Datuk Azhar Ahmad said the initiative would focus on the B40 and M40 groups who still faced problems with access to house financing.

“Among the contributing factors to the financing issue are the failure to get housing loans due to poor credit record, the high level of risk and insufficient documents to support the ability to repay the loan.

“It is also a medium that supports the provision of 500,000 affordable homes as targeted in the 12th Malaysia Plan (12MP).”

Azhar said this at the media briefing on i-Biaya which will be launched on April 14 by KPKT Minister, Datuk Seri Reezal Merican Naina Merican and Finance Minister, Tengku Datuk Seri Zafrul Abdul Aziz.

There are three schemes to be offered through i-Biaya which are Skim Jaminan Kredit Perumahan (SJKP) via SJKP Berhad, Skim Rumah Pertamaku (SRP) by Cagamas SRP Berhad and Skim Rent-to-Own (RTO) by Perbadanan PR1MA Malaysia (PR1MA).

“The SJKP is to help first-time homebuyers who do not have a fixed income such as gig economy workers, business owners, traders or small entrepreneurs.

“This group usually does not have the usual documents to obtain housing loans such as no salary slips, earning a low income, no EPF contribution and so on,” said Azhar.

The SRP, on the other hand, helps first-time homebuyers from the M40 and B40 groups to own a house without having to pay the down payment and is open to self-employed individuals or employees whose gross household income does not exceed RM10,000 for single applicants or joint applicants.

Meanwhile, the PR1MA RTO Scheme will open up opportunities for the middle-income group (M40) to own a house through an affordable ownership scheme with a hire purchase concept for all existing PR1MA units throughout Malaysia.

All three schemes can be applied through the 26 banks involved. — Bernama