KUALA LUMPUR, Nov 4 — The country’s health tourism industry could be hit if the government introduces the medicine price control mechanism for private healthcare, The Malaysian Reserve reported today.

Pharmaceutical Association of Malaysia (PhAMA) president Chin Keat Chyuan warned the industry could face setbacks as any price control mechanism would force drug companies to reconsider launching innovative medicines.

Chin said the absence of the latest solution would limit options for patients.

“Medical health tourism is expected to reach RM1.8 billion by year-end, registering 25 per cent growth.

“The growth is largely because patients from neighbouring countries seek treatment here, due to the relatively affordable and good private healthcare.

“Our drugs are accessible. We have innovative medicines at affordable prices and I think the figure is a testament to that,” Chin told the business daily.

He added that any intervention to cap prices would impact patients’ experience, minimise treatment options, impede access to innovative medicines and reduce Malaysia’s attractiveness as a health tourism destination.

Chin claimed that Malaysia is the only country where the government intends to regulate medicine prices in the private sector, stressing that the prices are only 14 per cent of the total “out-of-pocket” healthcare costs.

“By controlling this 14 per cent from the total out-of-pocket expenses, would that significantly reduce healthcare costs? What is the cost is being shifted to in-patient and outpatient costs?” he said.

Chin, who heads the 48-member-association comprising multinational and local companies said the Health Ministry is only zooming in at single-source drugs, large multinational companies and research and development-based firms.

He added that any action, which would be deemed as discriminatory would impact investors.

“It could pull foreign investors away,” he said.

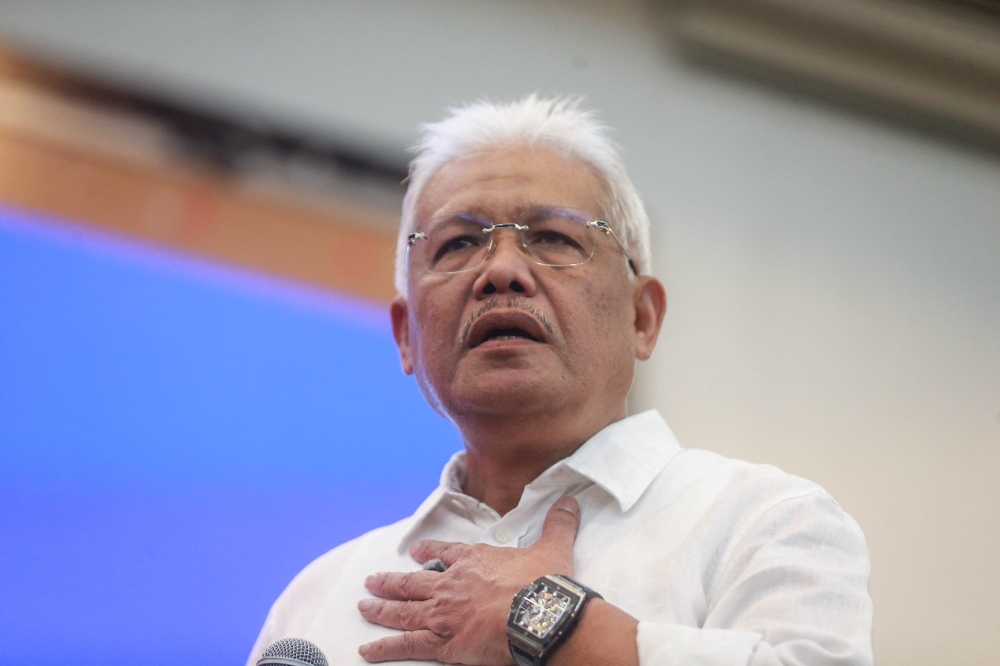

Previously, Health Minister Datuk Seri Dzulkefly Ahmad announced that the ministry intends to use external reference pricing (ERP) to benchmark drug prices in Malaysia against seven to eight selected countries by choosing the average three lowest reference prices to determine the ceiling price sold to dispensing channels in Malaysia.

The ministry also plans to impose a ceiling price at supply, namely wholesale through ERP and retail levels.

The PhAMA has since proposed a price transparency mechanism instead, where industry players will share their wholesale prices and the government can compare the retail prices among players.

“By doing this, it will be easier for the government to determine which area has been marked up along the value chain.

“What we want from the government is to not rush their decision,” said Chin.