KUALA LUMPUR, July 3 — Hong Kong’s Securities and Futures Commission (SFC) has today banned Tim Leissner, top investor for US bank Goldman Sachs who was linked to the 1Malaysia Development Bhd (1MDB) scandal, for life.

“The SFC considers that Leissner’s conduct demonstrates a serious lack of honesty and integrity and called into question his fitness and properness to be a licensed person,” it said in a statement.

SFC said the decision was made after Leissner pleaded guilty to the United States Department of Justice’s charges against him in August last year for conspiring to commit money laundering and to violate the Foreign Corrupt Practices Act.

The US court has since found Leissner guilty of both offences and ordered him to forfeit US$43.7 million (RM180.8 millon) as a result of his crimes.

Goldman is facing criminal charges filed by Malaysia that alleged US$2.7 billion (RM11 billion) was stolen from the proceeds of three bonds worth US$6.5 billion that the bank had arranged for Malaysian state investment firm 1MDB.

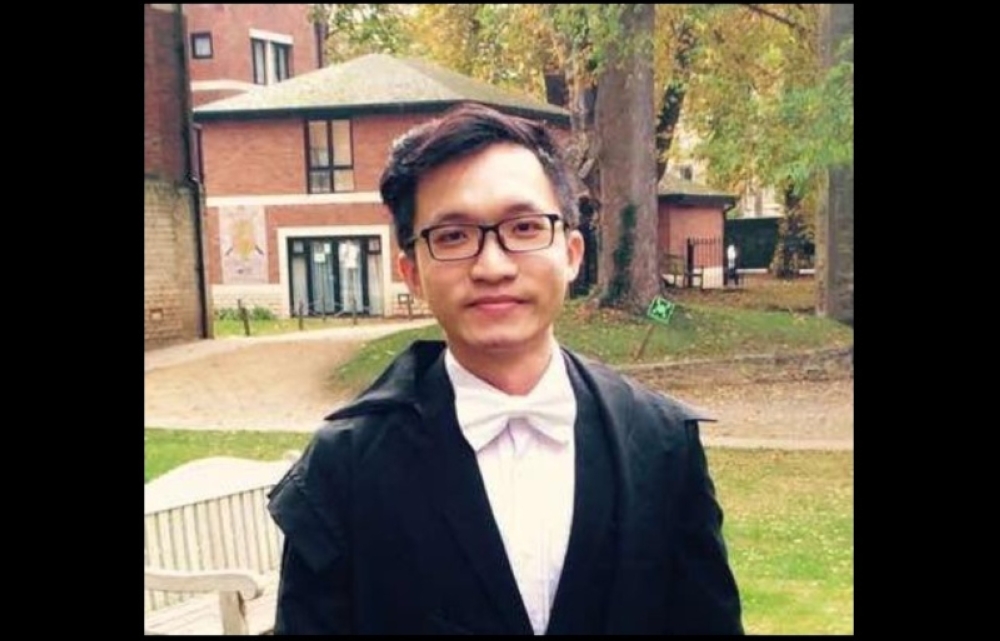

Leissner, who was Goldman’s South-east Asia chairman, resigned from the bank in 2016 after allegedly breaking company rules.

The scandal is the worst to hit Goldman since the financial crisis as the fund is the subject of corruption and money-laundering investigations in at least six countries.

The US investment bank has said that its role in 1MDB is the result of a few bad employees, rather than something broader about firm or its culture, and Leissner was called “the biggest ever threat” to Goldman’s reputation.