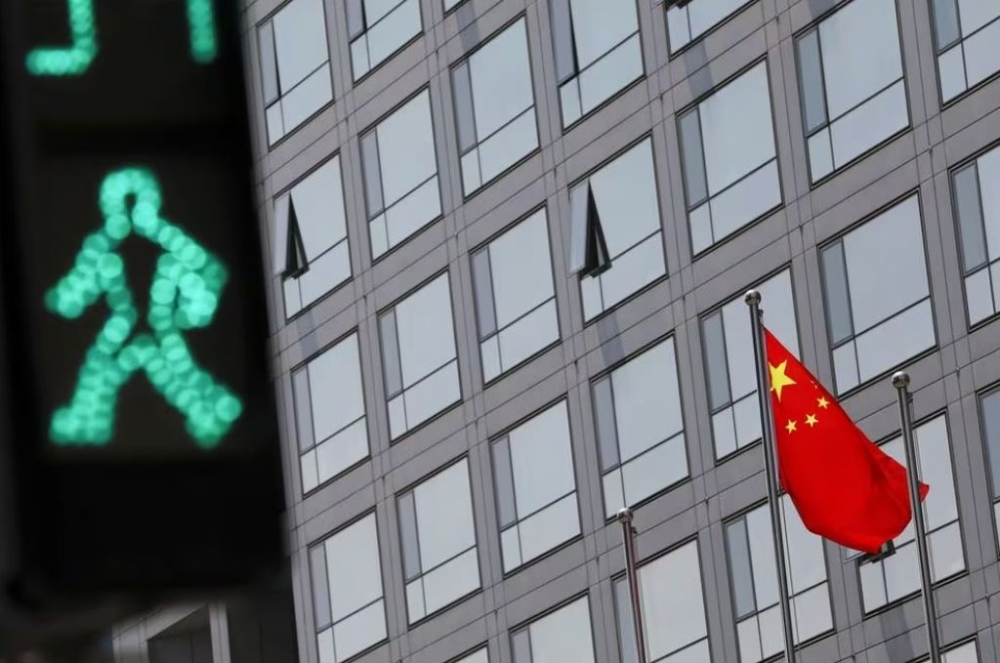

BEIJING, March 6 — China will protect small investors by cracking down on market misbehavior and improving the quality of listed companies, Wu Qing, head of the country’s securities watchdog said today.

The watchdog also said it would attract long-term investment and address deep-rooted issues in the world’s second-biggest stock market to revive investor confidence.

“We will further strengthen the protection of investors ... to attract more investment, especially long-term funds to participate in this market,” Wu, the newly-appointed chairman of the China Securities Regulatory Commission (CSRC), told a news conference in Beijing.

China’s stock market had fallen for three consecutive years, pressured by a slowing domestic economy, regulatory crackdowns on sectors like tech, a deepening property crisis, capital outflows and rising geopolitical tensions.

China’s blue-chip CSI300 Index hit five-year lows in early February. Soon after, China said Wu, a veteran regulator, would replace Yi Huiman as chairman of the CSRC.

The CSI300 has rebounded roughly 14 per cent since, after the securities watchdog ramped up efforts to restore confidence.

“As regulators, we must pay high attention to fairness ... especially in a market dominated by small investors,” Wu said today.

In Wu’s first month as CSRC head, the watchdog tightened scrutiny over quantitative trading, introduced fresh curbs on short selling, and vowed zero tolerance toward securities fraud.

“We will clamp down hard on fraud, market manipulation and insider trading,” Wu said. — Reuters