NEW YORK, Oct 8 — Wall Street fell sharply yesterday following a solid jobs report for September that increased the likelihood the Federal Reserve will barrel ahead with an interest rate hiking campaign many investors fear will push the US economy into a recession.

The Labour Department reported the unemployment rate fell to 3.5 per cent, lower than expectations of 3.7 per cent, in an economy that continues to show resilience despite the Fed’s efforts to bring down high inflation by weakening growth.

Nonfarm payrolls rose by 263,000 jobs, more than the 250,000 figure economists polled by Reuters had forecast. Money markets raised to 92 per cent the probability of a fourth straight 75 basis-point rate hike when Fed policymakers meet on November 1-2, up from 83.4 per cent before the data.

The job gains, lower unemployment rate and continued healthy wage growth point to a labour market Fed officials will likely still see as keeping inflation too high.

In the latest of a steady stream of hawkish messages by policymakers, New York Fed President John Williams said more rate hikes were needed to tackle inflation in a process that will likely increase the number of people without jobs.

The data cemented another jumbo-sized, 75 basis-point rate hike in November as “the labour market is still way too hot for the Fed’s comfort zone,” said Bill Sterling, global strategist at GW&K Investment Management.

“This was a classic case of good news is bad news,” he said. “The market took the good news of the robust labour market report and turned it into an ever-more vigilant Fed and therefore potentially higher risks of a recession next year.”

One economist said the Fed should not be reassured by the tight labour market because when the unemployment rate begins to rise, it does so quickly and is a leading indicator of a recession.

“We haven’t felt the full effects of the tightening,” said Joseph LaVorgna, chief US economist at SMBC Nikko Securities. “They’re going to keep going until eventually this thing turns over, and when it turns over you won’t be able to slow the momentum.”

Next week’s consumer price index will provide a key snapshot of where inflation stands.

Despite yesterday’s nosedive, a hefty two-day rally earlier in the week pushed the S&P 500, the Dow and the Nasdaq to post their first week of gains after three straight weeks of losses.

The Dow Jones Industrial Average closed down 630.15 points, or 2.11 per cent, at 29,296.79, the S&P 500 lost 104.86 points, or 2.80 per cent, to 3,639.66 and the Nasdaq Composite dropped 420.91 points, or 3.8 per cent, to 10,652.41.

Volume on US exchanges was 11.15 billion shares, compared with the 11.73 billion average for the full session over the past 20 trading days.

For the week, the S&P 500 rose 1.51 per cent, the Dow added 1.99 per cent and the Nasdaq gained 0.73 per cent.

All 11 major S&P 500 sectors declined, with technology falling the most, down 4.14 per cent.

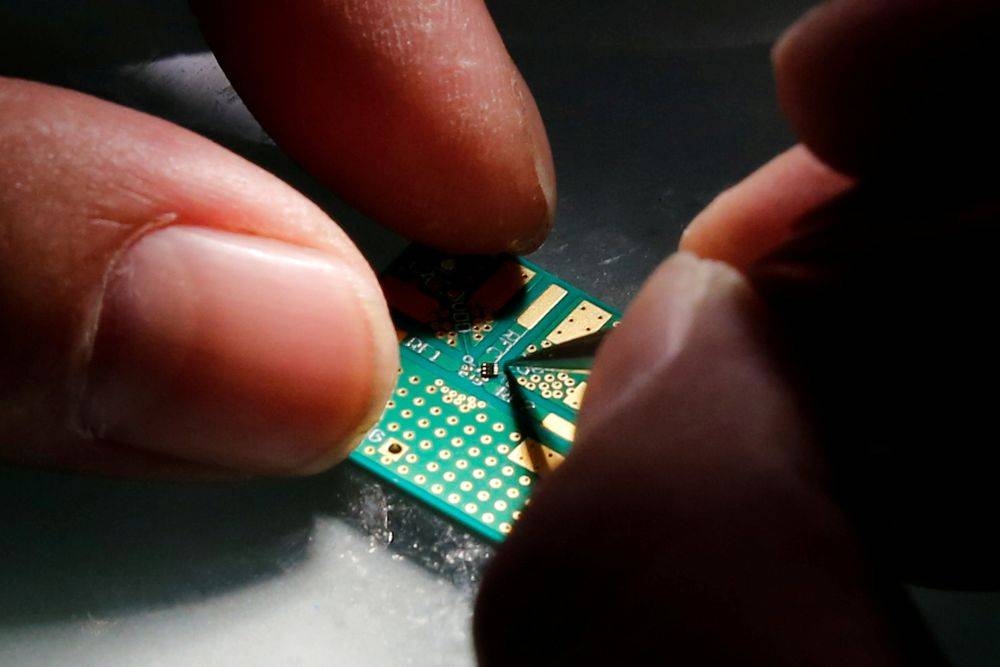

The Philadelphia SE Semiconductor index fell 6.06 per cent after a revenue warning from Advanced Micro Devices AMD.O signalled a chip slump could be worse than expected. The index posted its biggest single-day percentage decline in more than three weeks.

AMD shares fell 13.9 per cent as the company’s third-quarter revenue estimates were about US$1 billion lower than previously forecast. It was the largest declining stock on the Nasdaq 100.

FedEx Corp slid 0.5 per cent after an internal memo seen by Reuters showed the division that handles most e-commerce deliveries expects to lower volume forecasts as its customers plan to ship fewer holiday packages.

Declining issues outnumbered advancing ones on the NYSE by a 5.78-to-1 ratio; on Nasdaq, a 4.56-to-1 ratio favoured decliners.

The S&P 500 posted two new 52-week highs and 71 new lows; the Nasdaq Composite recorded 27 new highs and 337 new lows. — Reuters