KUALA LUMPUR, Feb 3 — Are you looking for an affordable medical insurance policy in Malaysia, especially for costly treatment of serious illnesses at private hospitals?

Soon, you will be able to buy basic medical insurance, known as base medical and health insurance/takaful (MHIT), which insurance companies must start offering as an alternative next year.

Here are the nine things you need to know based on the government’s recently-released White Paper on the Base MHIT Plan:

1. What is the base MHIT plan?

- It’s not a social insurance

It was developed with the support of regulator Bank Negara Malaysia, the Finance Ministry and Health Ministry:

This is not an insurance plan subsidised or operated by the government.

Instead, you can buy this from private insurance companies using your own money (e.g. your income, or savings or even from your retirement fund EPF’s Akaun Sejahtera.)

Akaun Sejahtera is where 15 per cent of your EPF savings is locked until you turn 50 years old, but you are also allowed to withdraw from this EPF account before age 50 for pre-retirement needs such as housing, health, education and insurance.

But it’s all up to you whether you want to use your EPF savings to buy the base MHIT plan.

- It’s not compulsory

Malaysians will continue to have all these other options: public healthcare; individual private medical insurance that you buy for yourself; and group medical insurance that a company buys to cover their employees and which you can rely on as long as you still work there and are within age limits.

So it’s voluntary and up to you whether you want to buy the base MHIT plan, based on your needs and finances.

- Premiums go into insurance coverage only, not investment

This is a standalone medical insurance plan, not an investment-linked medical insurance plan.

You might be more familiar with the investment-linked version, as more than 70 per cent of those who have medical insurance in Malaysia buy this type.

(For the investment-linked medical insurance that Malaysians typically buy, your coverage can be affected by whether the investments are performing well enough for your insurance to continue covering you until the desired age, and whether you withdraw or top up money into the investment accounts tied to the insurance plan.)

2. Who is the base MHIT plan targeted at?

The maximum age where you can still buy this plan is 70, and it will cover you until age 85.

A): You do not have an individual medical insurance policy yet, but actually you may be able to buy one if it’s affordable

In Malaysia, only 22 per cent of the population has such individual plans now, which means the rest will have to pay out of their pockets if they go to private hospitals.

B): You already have medical insurance, but it’s getting too expensive because the monthly premium has gone up too much (especially if you are in an older age group)

This could be a lifeline for those who still want to have the option of going to private hospitals, but just cannot afford their medical insurance anymore.

During January 2024 to June 2025, there were 340,000 persons who surrendered or stopped their medical insurance, after premium prices increased amid medical inflation.

3. What will the base MHIT cover?

The standard package of benefits will cover mainly private hospital bills, including:

• ambulance fees;

• hospital room and board;

• hospital supplies and services;

• surgery costs (surgical fees; operating theatre fees; day surgeries);

• anaesthetist fees;

• in-hospital physician visits;

• services immediately before and after hospitalisation (including consultation, diagnostics tests, medications) ;

• medications linked to a treatment episode;

• Health Ministry’s list of selected high-cost outpatient medications for serious illnesses (e.g. cancer);

• intensive care.

The base MHIT plan will reimburse costs before and after hospitalisation up to certain limits (including referrals, follow-up consultations and medications at private clinics; physiotherapy, home nursing services).

To be confirmed: It might also cover outpatient treatment for dengue, influenza A and B, bronchitis, pneumonia and bronchopneumonia

4. Two versions of Base MHIT: Standard and Standard-plus

Here’s the annual limit or how much you can claim every year:

Standard plan: RM100,000 (if below age 61); RM150,000 (if aged 61 or more)

Standard-plus plan: RM300,000

Standard

The standard plan has a lower annual limit and higher monthly premiums, but it has a lower deductible: RM500 (below age 61) or RM1,000 (if aged 61 or more) per disability or per illness.

What this means is even if you are admitted to the hospital many times due to the same cause or related cause, or due to complications from that same medical cause, you only have to pay RM500 or RM1,000 once before the insurance covers the rest of the hospital bill.

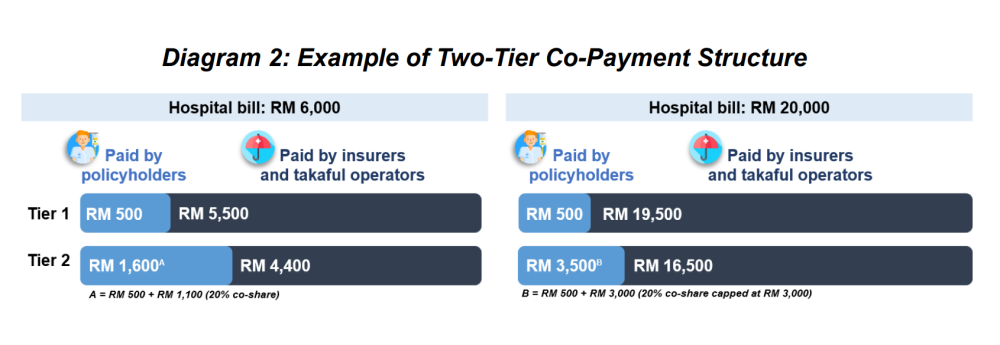

If you go to a private hospital that is “in-network” or more cost-efficient (Tier 1), you don’t have to pay a separate “co-share” payment for the hospital bill.

But if you go to a private hospital that is “out-of-network” (Tier 2), besides paying for the deductible, you also have to pay a 20 per cent co-share at a maximum RM3,000 per disability.

Standard-plus

The standard-plus plan has a higher annual limit, but cheaper monthly premiums, because you will be paying a higher deductible (not finalised yet but sums of between RM10,000 and RM15,000 are being considered).

Remember, deductible means you are the one that has to pay that amount, before the insurance kicks in for the rest of the bill.

Who is standard-plus for:

- You are already covered by your employer’s medical benefit plans;

- You have more cash and can pay a larger part of the hospital bill and only want protection against “catastrophic” healthcare costs (namely unexpected, expensive and serious medical emergencies).

5. What can RM100,000 in annual limit cover? (99 per cent of most common conditions)

According to the White Paper, data on medical insurance claims in Malaysia in 2024 suggests the RM100,000 limit will be enough to cover 99 per cent of medical treatment bills for common medical conditions, even after including possible multiple hospital admissions.

What happens if you need highly complex medical treatment that costs more than RM100,000 or the base MHIT plan’s annual limit?

You can then go to the public hospitals, since the base MHIT plan does not replace the public healthcare system but only complements it.

When you turn 61, the base MHIT plan will automatically increase your annual limit to RM150,000, since the hospital bill could go up as older individuals may be more likely to have multiple and more complex medical conditions.

6. How much do you have to pay every month?

Premiums will be based on your age, gender and health, but the plan is to put limits on the loading or additional amount you have to pay based on your health status.

Just like other medical insurance plans sold by private insurance companies, it is still possible for the base MHIT plan’s monthly premium to go up in the future.

The authorities will periodically review the premium amount, to make sure it is still enough to pay the medical claims.

The base MHIT’s monthly premiums have not been finalised yet, but there is an estimated or “indicative” range for now for three age groups, just for you to get an idea:

For the standard plan: Ages 31 to 35 (RM80 to RM120), ages 61 to 65 (RM280 to RM350), and above age 75 (RM500 to RM780).

For the standard plus plan: Ages 31 to 35 (RM50 to RM70), ages 61 to 65 (RM220 to RM280), above 75 (RM400 to RM660).

7. Other side benefits

Those who buy the base MHIT plan can buy these at a discount: health screening services to encourage early detection of illnesses, selected vaccinations and other services to promote healthier lifestyles.

8. What you can expect in the future?

For all of the insurance companies that want to sell their own medical insurance plans, they must also offer the base MHIT plan as a separate option.

The insurer’s medical insurance plans – that have more coverage – must always include the base MHIT plan’s standard package of benefits.

This will make it easier for you to switch from a pricier plan to the base MHIT plan with the same insurer; or switch from group/employee benefits plans to the base MHIT plan; or switch to another insurer for the base MHIT plan.

This means you can continue to have medical insurance coverage, even when you change your insurance company; you can no longer afford more expensive insurance plans; or there is a change in your employment status.

9. When will the base MHIT plan be available?

It will be launched next year, 2027, so details are still being finalised. You might see a pilot version in the second half of this year.

Recommended reading:

- White Paper on Base MHIT Plan

- Co-payments in MHIT plan meant for cost control, not to burden patients, says second finance minister

- Malaysians at 50: Withdraw some, all, or let your EPF savings in Akaun Sejahtera grow? Here’s EPF’s take

- Here’s why Malaysians will have the option to pay partially for hospital bills in exchange for cheaper insurance