KUALA LUMPUR, May 9 — Construction activity in the residential property subsector recorded significant growth in the first quarter of 2025 (1Q 2025) where the number of completed units surged by 30.2 per cent to 9,329 units from 7,168 units in 1Q 2024.

According to director general of valuation and property services, Valuation and Property Services Department (JPPH), Abdul Razak Yusak, housing starts also rose by 32.5 per cent to 28,344 units in 1Q 2025 from 21,391 units in 1Q 2024, indicating a strengthening development trajectory for the residential subsector.

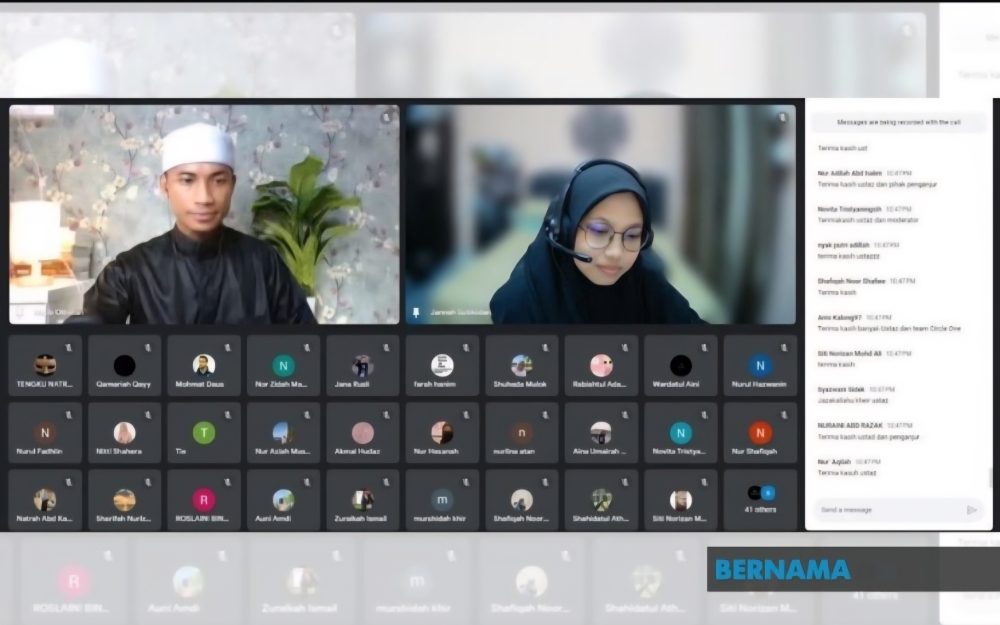

However, planned new development is seen decreasing to 8,300 units in 1Q 2025 compared to 11,000 units in 1Q 2024, he said during the launch of the Property Market First Quarter 2025 report via Facebook live under JPPH.

Meanwhile, he said there is encouraging performance of residential new launches which surged more than double to 12,498 units in 1Q 2025 from 5,585 units in the same period of 2024 with sales performance recorded at 10.8 per cent.

He noted that property transaction performance experienced a slight decline, with the volume and value of transactions decreasing by 6.2 per cent and 8.9 per cent to 97,772 transactions valued at RM51.42 billion, compared to 104,194 transactions worth RM56.47 billion in the same period of 2024.

Abdul Razak said although the property transactions began on a slower note, the robust pace of construction activity and the increase of residential new launches were supported to balance the property market growth and sustain its positive momentum in 2025.

“The continuous government support through initiatives such as the Program Residensi Rakyat (PRR), Projek Rumah Mesra Rakyat (RMR), and strategic infrastructure development have been a key driver in accelerating construction activity.

“Government-led initiatives aimed at strengthening Malaysia’s position in the global investment prospects, such as the Forest City Special Financial Zone, the Johor–Singapore Special Economic Zone (JS-SEZ), and the implementation of a duty-free zone in Pulau Satu, Forest City have started to demonstrate significant impact,” he said.

Abdul Razak said the performance of residential overhang recorded a total of 23,515 units valued at RM15 billion, reflecting a marginal increase of 1.6 per cent and 7.7 per cent in volume and value from 23,149 units worth RM13.94 billion in Q4 2024.

In addition, the occupancy performance for shopping complexes recorded a marginal increase, with the occupancy rate rising to 79 per cent compared to 78.8 per cent in 1Q 2024.

The Malaysian House Price Index (MHPI) in the first quarter 2025 stood at 225.3 points (an average price of RM486,070 per unit), with an annual growth rate of 0.9 per cent, he said.

Abdul Razak said the growth of the property market is expected to remain resilient driven by positive momentum in the construction sector and a continued rise in newly launched residential units.

“Special financial and infrastructure incentives under the JS-SEZ, the Special Financial Zone in Forest City Johor, and ongoing infrastructure development are expected to further stimulate long-term growth in the property market,” he added. — Bernama