KUALA LUMPUR, June 8 — The categorisation of Malaysians into bottom, middle and high-income earners — the B40, M40, T20 — have again come into the spotlight as Putrajaya announced it would abolish several subsidies for the top earning group.

Amid debates over the categorisation’s problems, economists polled by Malay Mail said Putrajaya’s recent announcement to move to “household net disposable income” instead as a metric to classify Malaysians’ income could make subsidies more effective in assisting those facing financial difficulties.

Intan Nadia Jalil, the regional head of CIMB Group’s Economics and Markets Analysis Department, said that the announced metric would be more accurate as it will consider more factors compared to the current system.

“Household (net) disposable income takes into account cost of living, by including parameters such as the number of household dependents and location. This provides a more accurate measure of households’ needs and therefore allows for more targeted assistance.

“Hopefully, it would also include other parameters affecting household welfare, such as health and educational requirements,” she told Malay Mail in a recent interview.

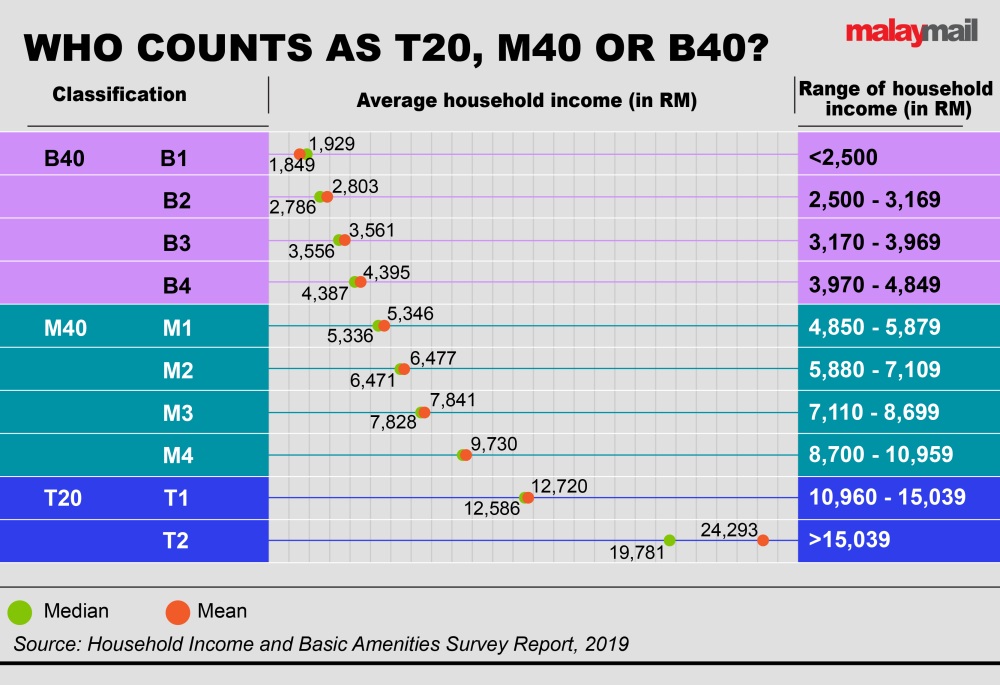

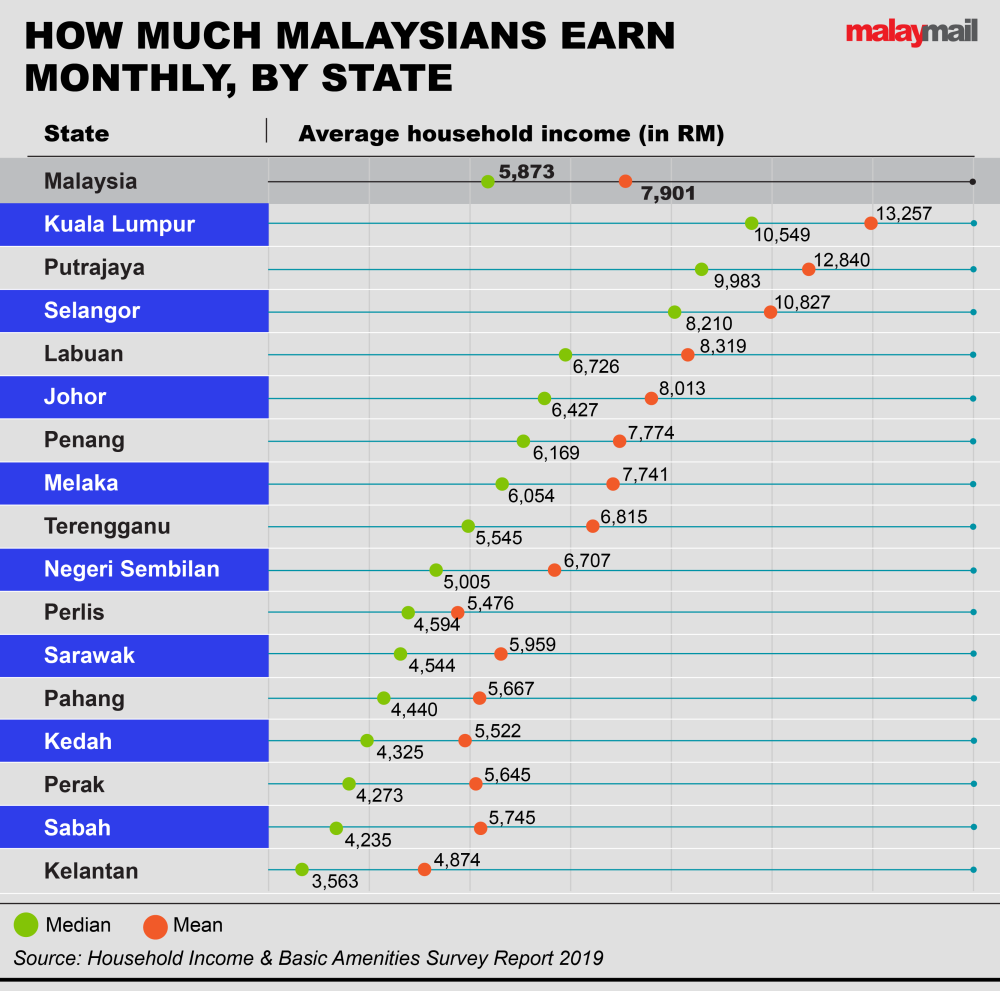

Malaysia currently divides households according to their household income — to the bottom 40 per cent, middle 40 per cent, and top 20 per cent — with financial aid and policies tailored to these.

However with millions of ringgit said to be saved from cutting off subsidies to Malaysia’s rich, Economy Minister Rafizi Ramli announced last month that the government’s shift to using “household net disposable income” for subsidy distribution will happen by January next year.

There is no timeframe yet as to when this will be announced.

Intan said that in the current system, households with different living costs — such as a single-parent household with four children earning RM5,000 a month, and a single adult household with the same income — would be classified as M40 without accounting for their distinct needs.

“Despite the fact that the first household may require social assistance, it would not qualify for assistance demarcated for B40 households,” she said.

Malaysian Economic Association president Prof Emeritus Datuk Norma Mansor said the thresholds for the current B40, M40 and T20 classification may also not be accurate, as these were determined through the Household Income Survey (HIS), which likely does not include enough information on the extremely rich or extremely poor.

“The very rich would refuse to be surveyed, and some of the very poor who live in geographically hard-to-reach areas such as in Sarawak would be missed,” she said.

The HIS is carried out by the Department of Statistics Malaysia (DOSM) twice every five years. The most recent one was released in 2019.

However, the economists also said that while the move to household net disposable income was promising, there was still not enough details available to conclusively say it would lead to more effective subsidies.

Economist Nungsari Ahmad Radhi, a former Malaysian Aviation Commission (Mavcom) executive chairman and former Balik Pulau MP, said that it was unclear what components would be deducted to calculate a household’s disposable income.

“Disposable income is income after subtracting something. What is that something? Expenditures for what items? If food, what sort of food is included/excluded? Et cetera et cetera.

“Once these are measured, I suppose the government will determine a threshold, below which the household gets the assistance. Perhaps it is not binary — get or don't get. Maybe there will be tiering so there are multiple thresholds,” he told Malay Mail.

He added that with the government now considering more factors and aspects, it will be more difficult to gather the necessary data to make accurate calculations.

“How efficient will the data collecting be and what would be the overall cost?” he mused.

Both Intan and Norma also said that it is important to look at the possibility of moving away from subsidies, to more targeted cash transfers for the needy.

“Empirical data and historical experience from around the world indicates that subsidies are less efficient and effective in terms of public expenditure as well as improving household welfare compared to direct cash transfers,” said Intan.

Norma added that Malaysia already has systems for targeted cash transfers, such as Sumbangan Tunai Rahmah (STR) which pays directly into the bank accounts of those eligible for the scheme.

“These systems can be expanded for needs such as fuel or others,” she said.

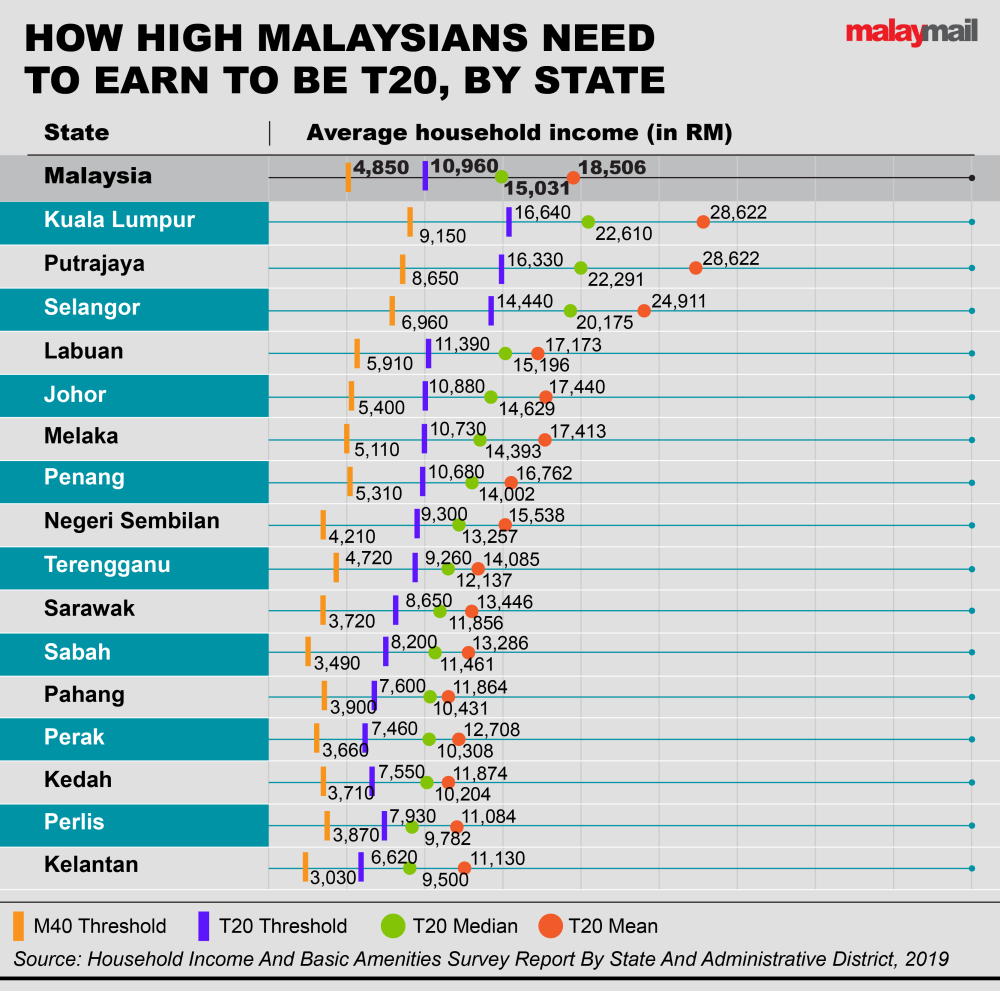

The huge disparity in who counts as T20 across the country has since fuelled debate on how Putrajaya will classify who belongs in the T20 group that would no longer receive subsidies next year.

This comes as property consultant Knight Frank announced in its recent report that last year Malaysia is among the top 10 countries with the fastest-growing population of ultra-rich individuals — which is defined as having a minimum of US$30 million or RM139 million in net wealth.

In 2017, there were already 491 ultra-high-worth individuals (UNHWI) in the country. By 2021, this number grew to 659 and then 721 people in 2022.

Deputy Finance Minister Ahmad also explained that the government’s move to stop several subsidies for the top earners in Malaysia was an attempt to rectify its past policy mistakes, and the current administration is not aiming to be populist.

Prime Minister and Finance Minister Datuk Seri Anwar Ibrahim also said that his administration will continue to look for methods to ensure subsidies are provided fairly to targeted groups, and that the B40 group will continue to be given attention in the provision of subsidies.

His administration has so far been reluctant to implement blanket capital gains tax and inheritance tax amid growing anger about wealth inequality, but had in Budget 2023 announced a tax on unlisted shares and luxury goods.

This article is part of Malay Mail’s series scrutinising the T20 classification amid the removal of some subsidies planned next year. Read more for other stories in this series: