KUALA LUMPUR, June 7 — In its bid to uplift low-income citizens ever since it came into power, the Anwar administration has set its sights on the top 20 per cent households, also known as the T20.

In the past few weeks, Prime Minister Datuk Seri Anwar Ibrahim who is also the finance minister and his deputy in the ministry, Datuk Seri Ahmad Maslan, have announced several perks that would no longer be available to the T20 from next year.

The bulk of it would be restructuring blanket subsidies, which critics claimed have disproportionately benefited higher-income individuals who consume more.

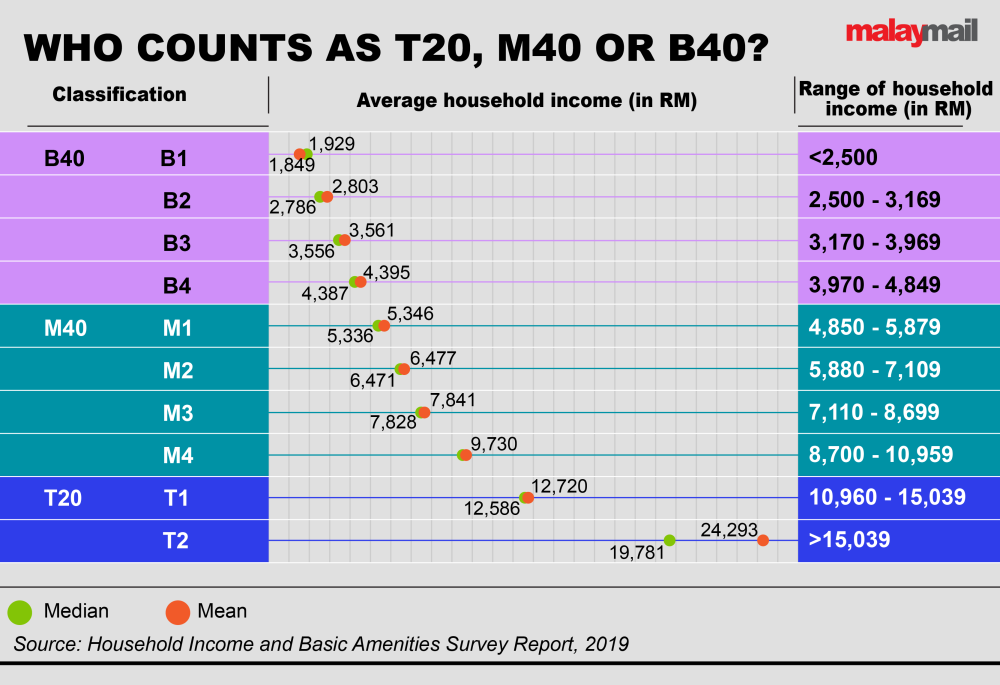

However, the classification of T20, the middle 40 per cent (M40) and the bottom 40 per cent (B40) is in itself problematic as it does not take into account costs of living — therefore does not quite accurately portray the supposed wealth of those in the upper bracket.

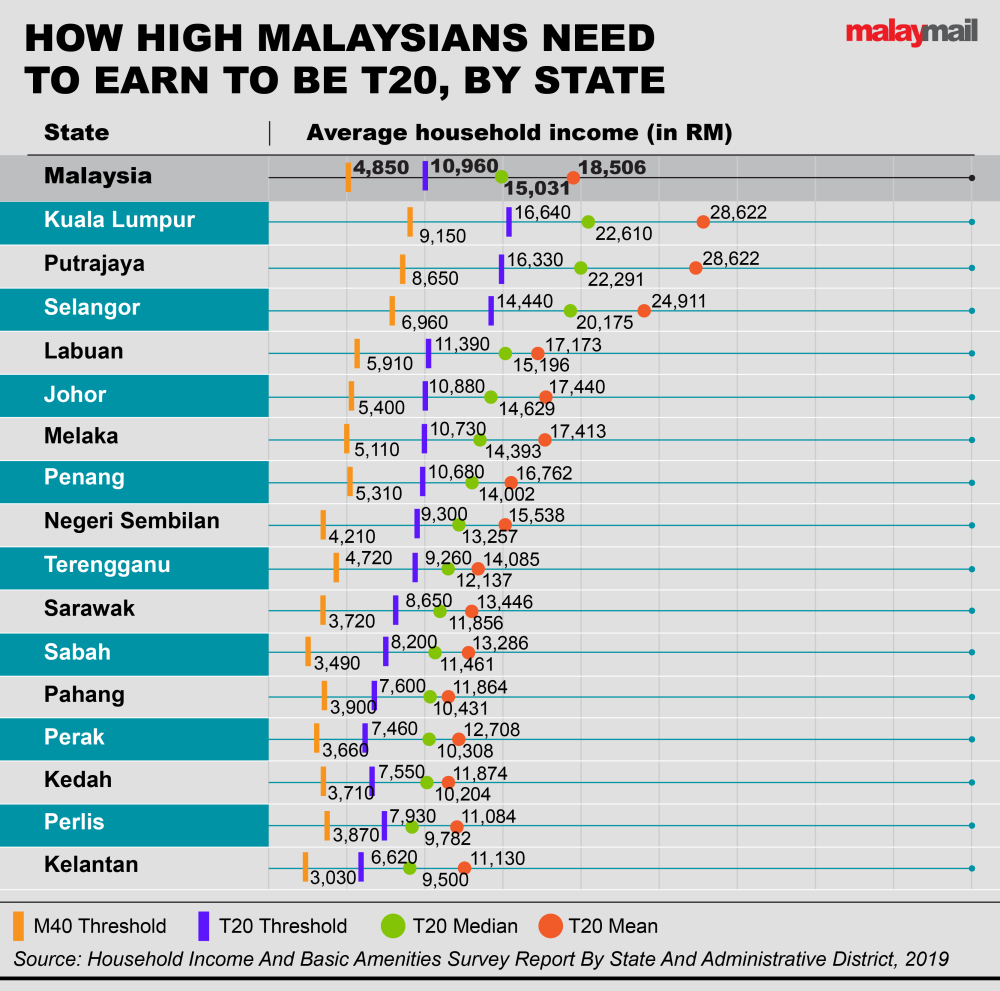

As covered by Malay Mail yesterday, depending on where you live, a household may be a top earner in one state but not necessarily in another.

For example, if a household is earning RM8,000 in total, it would be considered T20 in Kelantan — but in Kuala Lumpur, it would not even be considered M40. Instead, it would be considered B40 in Kuala Lumpur.

But nationwide, it would be considered M40 — more accurately in the M3 sub-category.

While Putrajaya figures out a more equitable way of singling out high-income earners, here is a list of subsidies that the T20 will not be able to utilise soon:

Fuel

During the year 2022, the government spent RM50.8 billion on fuel subsidies. Of that amount, approximately 35 per cent, or RM17 billion, was used by the T20.

A targeted subsidy, meant to benefit the poor more than the wealthy, has been talked about since at least since 2018, when Pakatan Harapan got control of the government after the 14th general election.

However, the initiative was delayed several times as stakeholders did not come to an agreement on the best method of implementation.

On May 19, Deputy Finance Minister Datuk Seri Ahmad Maslan announced that the T20 will no longer be given subsidies starting next year.

The mechanism for implementation is yet to be revealed, but it was announced that a newly created organisation called the Central Database Hub or Padu, will be in charge of figuring out how the targeted subsidies will work.

Ahmad said it could be in the form of identifying one’s MyKad, a new system of cards altogether, or based on the engine capacity of their automobiles — which would mean that a high-earner using a 1.0cc car would still be liable for subsidised fuel.

Electricity

Electricity subsidies for T20 households will also end next year, according to a speech in Parliament by Prime Minister Datuk Seri Anwar Ibrahim on May 22.

This comes after the government in January decided to stop electricity subsidies for medium voltage and high voltage users — which are mostly non-residential premises such as factories or large office buildings — until June 30.

At the time, farmers and animal breeders however were told that they would continue to benefit from a subsidy of two sen per kWH, which is the same amount enjoyed by domestic users.

In March, Natural Resources, Environment and Climate Change Minister Nik Nazmi Nik Ahmad told Parliament that the government had set aside RM10.76 billion for the expected cost of its electricity subsidies for the first half of 2023.

Implementation of the targeted electricity subsidy for next year will be implemented under Padu

Haj aid

In March, Tabung Haji chief executive officer Datuk Seri Amrin Awaluddin said that the cost of performing the Islamic pilgrimage of Haj had increased to RM30,850 in 2023, up from RM28,632 last year.

Noting the increase, Anwar on March 18 said that the government would be bearing an additional RM1,000 in Haj subsidies for the B40, and that it would halt subsidies for the T20.

He reiterated the stopping of Haj subsidies for the T20 once again in Parliament on May 22.

This comes following an announcement by Tabung Haji in April that Malaysia is applying for an extra 10,000 pilgrim quota from the Saudi Arabian government for this year.

In April 2022, then minister in the prime minister’s department Datuk Idris Ahmad said that the government spends between RM300 million and RM400 million per year on Haj subsidies.

Tax

During the tabling of Budget 2023, on February 24, Anwar announced that the government would raise the income tax rate of those earning between RM100,000 and RM1 million between 0.5 to 2 percentage points — the higher the income bracket, the larger the increase.

Additionally, Anwar announced that the government was working on imposing a tax on luxury goods, such as luxury watches and luxury clothing.

In Budget 2023, the government projected earnings of RM995 million from income tax and an additional RM7 million from other direct taxes for the current year.

Indirect taxes — such as sales tax and excise duties — was estimated to provide approximately RM248.9 million.

So do you count as T20 where you live? Take our quiz below to find out, and read more below as we dive deeper into the categories:

The huge disparity in who counts as T20 across the country has since fuelled debate on how Putrajaya will classify who belongs in the T20 group that would no longer receive subsidies next year.

This comes as property consultant Knight Frank announced in its recent report that last year Malaysia was among the top 10 countries with the fastest-growing population of ultra-rich individuals — which is defined as having a minimum of US$30 million or RM139 million in net wealth.

In 2017, there were already 491 ultra-high-worth individuals (UNHWI) in the country. By 2021, this number grew to 659 and then 721 people in 2022.

Last month, Economy Minister Rafizi Ramli announced that the government is planning to move away from using the B40, M40 and T20 income classifications to make decisions on matters such as subsidies — but will instead be implementing a metric using “household net disposable income”.

There is no timeframe yet as to when this will be announced.

Deputy Finance Minister Ahmad also explained that the government’s move to stop several subsidies for the top earners in Malaysia was an attempt to rectify its past policy mistakes, and the current administration is not aiming to be populist.

Prime Minister and Finance Minister Anwar also said that his administration will continue to look for methods to ensure subsidies are provided fairly to targeted groups, and that the B40 group will continue to be given attention in the provision of subsidies.

His administration has so far been reluctant to implement blanket capital gains tax and inheritance tax amid growing anger about wealth inequality, but had in Budget 2023 announced a tax on unlisted shares and luxury goods.

This article is part of Malay Mail’s series scrutinising the T20 classification amid the removal of some subsidies planned next year. Read more for other stories in this series: