KUALA LUMPUR, May 11 — The risk of recession in three of the world’s largest economies could threaten Malaysia’s post-pandemic recovery but not enough to drag growth down, according to three local analysts polled by Malay Mail.

The impending interest rate increase in the United States, energy supply disruption in the European Union and lockdowns in China have prompted warnings about a potential global slowdown, with implications for export-reliant emerging economies.

The US and Chinese markets account for close to a third of Malaysia’s total exports. Nazmi Idrus, head of economics research department at CGS-CIMB Securities, said the chances of the US plunging into recession is more than likely, citing data that points to contraction in the first quarter.

Meanwhile, pundits have slashed China’s growth to just 5.0 per cent on the back of strict Covid-19 curbs, slowing down demand for exports from the world’s second largest economy. China is Malaysia’s largest export destination to date.

“If anything, we could already be getting in one already. The US gross domestic product for the first quarter of 2022 annualised is already negative, and another quarter of negative growth would mean a technical recession,” he said.

“By definition, a technical recession is when there are two quarters of consecutive GDP decline.”

Weak growth in the two countries would dampen Malaysia’s exports, Nazmi noted, but with the spillover effect likely to be contained as Putrajaya and the Central Bank have relatively managed to keep inflation under control.

“This has kept the erosion of consumer purchasing power minimal, relative to other countries,” he said.

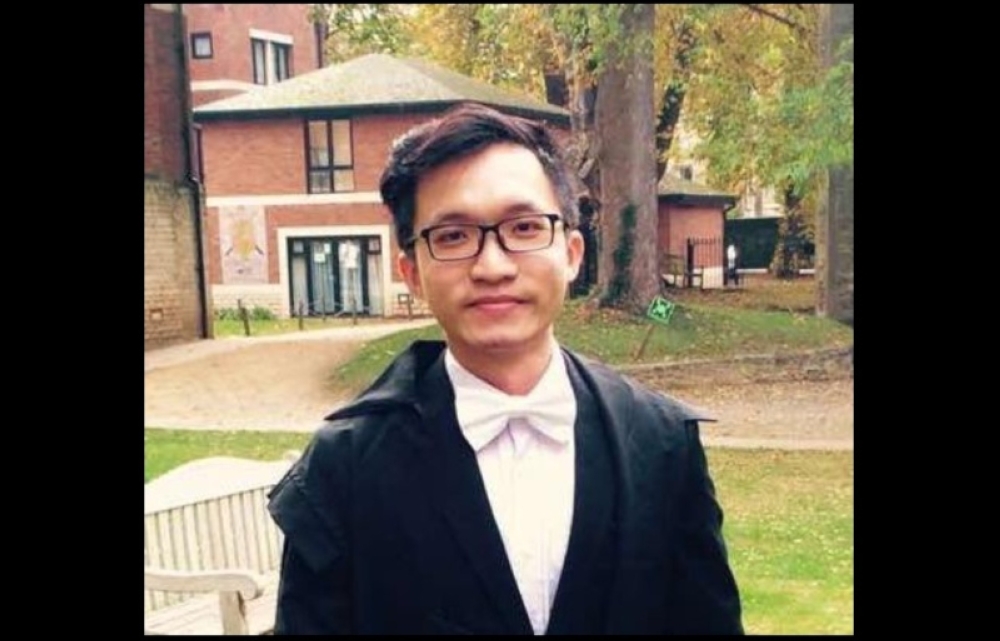

Afiq Asyraf Syazwan Abdul Rahim, Kenanga Investment Bank economist, said Malaysia may not fall into a recession yet, but warned that a global recession, possibly in 2024, could have ripple effects on the domestic economy.

“As an export-dependent country, reduced demand from Malaysia’s key trading partners (i.e. China, Singapore, US) due to increasing inflationary pressure and rising-rate environment may derail domestic economic recovery,” he told Malay Mail.

“Consequently, (this may) lead to an increase in the unemployment rate, further decreasing Malaysians’ purchasing power.”

MARC Ratings Bhd noted last month that Malaysia’s pace of recovery is already relatively slow despite a significantly larger fiscal size seen in the post-2008 Global Financial Crisis.

The probability of a US recession in the next year may be as high as 35 per cent, Bloomberg reported last month citing economists at Goldman Sachs Group Inc, who cut the bank’s growth forecasts due to the soaring oil prices and the fallout from the war in Ukraine.

Bank of America Corp was quoted in the same report as saying that the risk of an economic downturn is low for now, but higher next year.

Meanwhile, European stocks value have tumbled as investors began shedding Old World equities, the most exposed to the Ukrainian-Russian conflict. Malaysia’s trade value with the Eurozone rose to RM79.94 billion or a 26.66 per cent increase in the first half of 2021 compared with the same period last year, making the EU a crucial market.

Afiq Asyraf said Malaysia could be in a “recessionary gap” and eventually slide into contraction if China continues to pursue its strict Covid-19 policy, a prolonged Russia-Ukraine war and the Federal Reserve hiking rates above the neutral threshold.

Still, the probability of that happening is “relatively low”, he added.

Julia Goh Mei Ling, analyst at UOB Bank, said Malaysian businesses will need to adapt to prolonged periods of higher commodity prices and cost drivers including the weaker ringgit, even as the prospect of a global recession remains relatively far.

“Based on several signposts and indicators monitored, a global recession is not expected for at least over the next six to twelve months,” she said.

“Key risk is how the global economy navigates through higher inflation and interest rates while liquidity conditions tighten. Lingering risks to supply chains and delivery times also need to be factored in.”

Exporters have enjoyed strong demand owing to post-pandemic recovery so far but that may gradually subside based on a baseline assumption of the slowdown that may hit global trade in the future, Nazmi said.

“But on a worst case assumption, the reduction in global demand is sharper, and exporters may face lower than normal growth... recovery efforts will continue but at a lower pace in my opinion.”

.jpg)