KUALA LUMPUR, Nov 6 ― PetroSaudi International (PSI) CEO Tarek Obaid diverted money from US$500 million (RM2.06 billion) that was borrowed from 1Malaysia Development Berhad (1MDB) for a purported investment, by ordering 82 million Swiss Francs from the US$500 million to be sent to Low Taek Jho's company's account, the High Court heard today.

The US$500 million was a September 2010 loan from 1MDB to a company called 1MDB PetroSaudi Limited for the latter to purportedly invest by buying shares in French oil and gas company GDF Suez.

The 1MDB PetroSaudi Limited was initially a joint venture company between 1MDB and the purported partner PSI, but 1MDB had sold its stake in the joint venture company that turned 1MDB PetroSaudi Limited into a company fully controlled by PSI.

Datuk Shahrol Azral Ibrahim Halmi, formerly the 1MDB CEO, was today shown court documents where 1MDB had on September 14, 2010 instructed for US$500 million to be paid out from AmBank to 1MDB PetroSaudi Limited (via the intermediary of JP Morgan Chase Bank via Chase Manhattan).

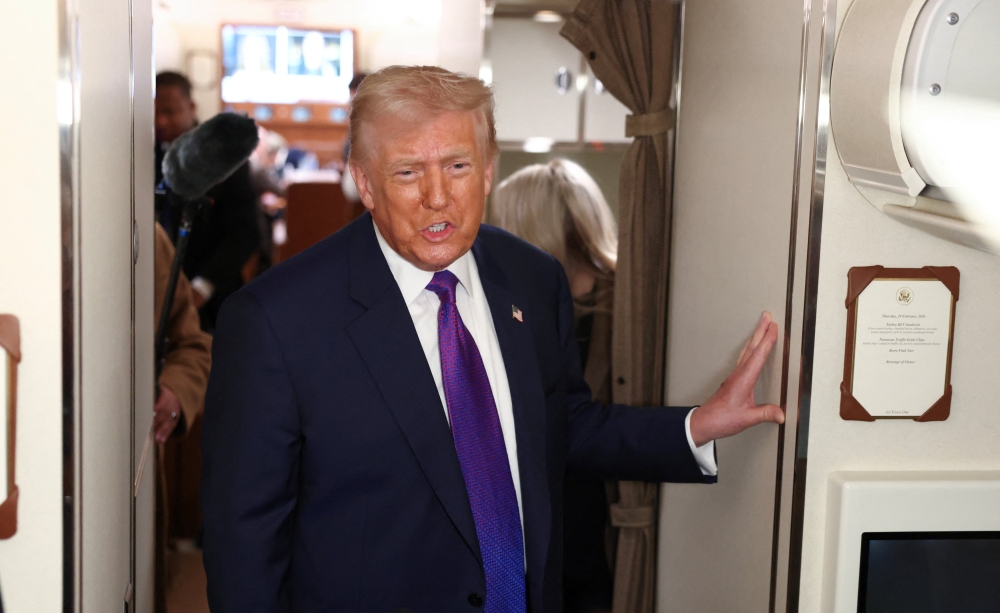

Shahrol was shown these documents while testifying as the ninth prosecution witness in former prime minister Datuk Seri Najib Razak's corruption trial over 1MDB funds.

Najib's lawyer Tan Sri Muhammad Shafee Abdullah pointed out documents which showed PSI CEO Obaid as having allegedly used his Blackberry phone to instruct his JP Morgan banker on September 23, 2010 to transfer 82 million Swiss Francs from 1MDB PetroSaudi Limited into his private account.

Noting that this was about a week after the US$500 million was paid by 1MDB to 1MDB PetroSaudi Limited, Shafee said: “Tarek is telling please transfer 82 million Swiss Franc to his private account, which is not the PetroSaudi Holdings account, take it out from there and transfer to his account.”

Shafee further noted that Obaid had asked his JP Morgan banker to further transfer the 82 million Swiss Francs from his account to Good Star Limited's RBS Coutts bank account in Zurich, Switzerland.

“So within a week, US$500 million happily sent to PetroSaudi Holdings, and within a week, a minimum of 82 million Swiss Franc was hijacked into this account by Tarek into Good Star where Jho Low benefited, we know already who is Good Star,” Shafee claimed, referring to Good Star which is owned by Low.

Shafee said 82 million Swiss Francs was equivalent to around US$83 million.

He also noted that 1MDB PetroSaudi Limited at one point had its name changed to PetroSaudHoldings.

Shahrol suggested however that the reason why the diversion of 82 million Swiss Francs from the US$500 million could happen was due to 1MDB PetroSaudi Limited or PSI Holdings coming under the full control of PSI officials like Obaid.

“But they could do as they like because it's their company,” Shahrol said.

He confirmed that 1MDB officials, including himself, were no longer signatories of 1MDB PetroSaudi Limited's account after March 2010 as 1MDB had sold off its stake in the company.

Shahrol however said that he could only conclude from the bank documents that 82 million Swiss Francs was diverted to Good Star Limited, but said it could not be concluded if the rest of the US$500 million loan was not used for PSI's original intended purpose of buying shares in French company GDF Suez.

“I'm not comfortable to guess what their plans are… Just that now you showed me this, I can see 82 million diverted from what was represented to be investment in GDF Suez to Good Star, for what plan, for what purpose, I don't know,” Shahrol said, confirming that he was never told that Good Star was also involved in the purported buying of GDF Suez shares.

Shahrol said he had never been shown the statement of account of PSI Holdings or 1MDB PetroSaudi Limited as it was formerly known, and would therefore be unable to confirm what the US$500 million was spent on.

Why the 82 million Swiss Francs transfer?

Shafee then showed a document where JP Morgan banker Jonathan Conner recorded the contents of his September 23, 2010 phone conversation with Obaid, where the latter claimed to have met with Saudi royals King Abdullah and Prince Turki and to have been invited to join the Saudi king and Saudi royals in a large real estate development in Mecca.

Conner also recorded Obaid as having claimed that he would be sending 82 million Swiss Francs on that day to RBS Coutts for the “investment” in the purported real estate development in partnership with a large property firm allegedly owned by six wealthy Saudi families.

Shafee then showed a separate RBS Coutts bank document which recorded the incoming transfer of 82 million Swiss Francs from Obaid's account to Good Star's account as purportedly being for the “repayment of a loan/investment based on an investment management agreement (private equity)”, although the bank had noted that there were no supporting documents at the moment and that its client Good Star would be asked to provide the purported investment agreement.

The document had also recorded that two other transfers of unspecified sum to Good Star were previously made on October 5, 2009 and January 13, 2010.

The 9 million Swiss Franc transfer

Shafee then showed bank documents which showed another transfer of 9 million Swiss Francs from Obaid's JP Morgan account to Good Star's RBS Coutts account on September 30, 2010.

Shafee also showed an RBS Coutts bank document dated October 1, 2010 which recorded the 9 million Swiss Franc transfer into Good Star's account for the same purported reason of “repayment of a loan/investment based on an investment management agreement (private equity)”, with the additional claim that the 9 million Swiss Franc transfer was the “second part of the repayment” with the first allegedly received on September 24.

Shahrol then noted that the bank had said there were no supporting documents and that the client Good Star had told the bank that it would bring along the document when visiting the bank in the “near future”.

“So the bank asks him for document, he said I provide later at my convenience,” Shahrol said.

Shafee then said “Jho Low seems to be able to make many bankers dance to his tune.”

Quizzed by Shafee, Shahrol said he had not seen these internal bank documents on the transactions from Obaid's account to Low's Good Star account.

Shahrol said investigators did not show him these documents as the investigation was purely focused on what he had seen and what he knew, noting that he was only shown the “high-level money trail” originating from 1MDB into other entities such as Good Star.

“But only at a very high level, but not detailed document… because there's no way I can add any value to it because I was nowhere near,” he said.

Previously, Shafee had also shown bank documents where Obaid pocketed US$85 million from Good Star on October 5, 2009, before Obaid sent money to PSI official Patrick Mahony and PSI's law firm White & Case.

Prior to the US$85 million transfer, Good Star had received a US$700 million payment from 1MDB.

The prosecution had previously said it will show that US$20 million of the US$700 million paid to 1MDB passed through Good Star and other entities before eventually reaching Najib.