APRIL 14 — Raya on steroids.

Besides it being the first major festival without movement restrictions since 2020, a lot of money is set to flood the market.

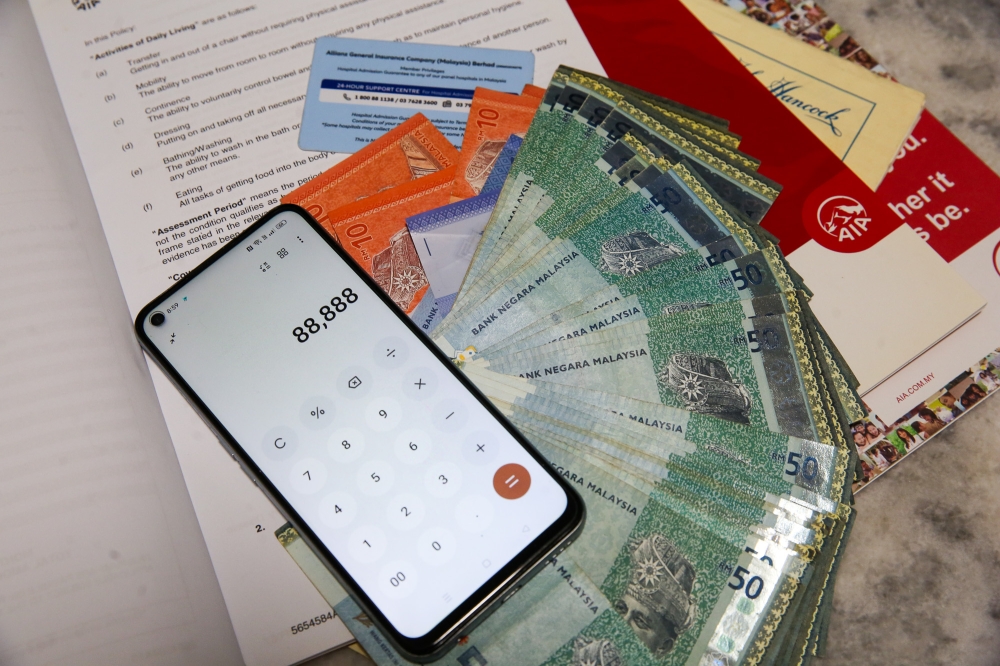

Up to RM63 billion to be precise drops down this shopping season. The Employees Provident Fund (EPF), or KWSP, starts RM10,000 member withdrawals on April 20. Some 6.3 million members are eligible.

Putting in members’ pockets wads of cash 10 days before Raya.

Suffice to say, popular shopping malls better get in additional staff for this Raya sale. A stampede beckons.

The meek object, but not too long

This is not new. It’s been a spate of withdrawals. Over the pandemic period, through the I-Lestari, I-Sinar and I-Citra, RM101 billion went back to members.

These events are natural in the land of populist politics. Blatant vote-seeking opportunists backed wholesale the right to withdraw funds in all forms. How is it related to votes? When voters have money on them, they’d support the party which got them the money, even if it is their own money.

Some objected with little conviction. The backers were relentless, and the argument simple.

It is the members’ money. If they want the money, then they should be able to pull out their money. It is their money.

By Johor state election last month, PKR capitulated and backed the programme. It is certainly easier to support than to rebut.

And since politicians on both sides of the divide are comfortable with the arrangement, the political pitfalls are capped. Still, EPF warned members of the risks despite being forced to comply.

The money is not topped up by invisible forces, there is no bunian in this play. Once gone, it’s gone.

Hard times, cold realities

Previous EPF withdrawals over the last two years have assisted people. With the government hamstrung to offer adequate wage subsidies — as the economy was halted to focus on Covid-19 prevention — using EPF was an easy out.

Even now, the withdrawals can assist with mounting debt among members. And it will.

The argument goes: What is the point of having money later if I starve today?

Yet the counter point exists.

It is later, and you’ve survived to now, but be ready to be really broke till you die, unless being broke kills you sooner.

This is not just fear mongering.

Some 3.6 million members have less than RM1,000 in their accounts. This is less than one month’s minimum wage. What happens to them?

It is bad news all around, because another 2.5 million have less than RM10,000. They’d stop being members if EPF allows them to withdraw the remaining in this round of withdrawal.

On this trajectory, as no good news is on the horizon, there’ll be millions of Malaysians forced to work in old age — if there’s work — or rely on the charity of relatives. Or sit in desolate city streets, homeless.

Rice bowl, not dust bowl

The utter hopelessness of the Great Depression in the early 1930s drove the formation of Social Security in the United States by President Franklin Delano Roosevelt in 1935. An institution to provide cover for Americans by setting aside a percentage of their salaries, so that they are protected.

Our EPF was formed in 1951 with similar objectives to protect our old. It has been a limited success but over the years a victim of political expediency.

The signs were there, as the World Bank back in 2018 chipped in “Financial awareness for retirement in Malaysia is low.”

A combination of low contributions due to low wages and non-adoption of EPF by scores of employers — only over 534,000 organisations participate — together with lax conditions for withdrawals have led us to this unfortunate juncture.

RM240,000 is the minimum amount necessary at retirement but for most Malaysians it is a pipe dream.

Screw complicated

The total absence of moral leadership in regard to EPF and other safety nets for the people is criminal.

This is not to begrudge millions of Malaysians set to spend over this holiday. It boosts the economy, this domestic spending at a time tourists are still away.

From the people’s viewpoint, widespread this opinion, the government will have the funds to care for the people in the future. That’s the government's job. If it fails, they can pick another. There were four Malay-exclusive parties contesting for power in Johor last month. One cannot get the job done, the others can fill the void is the belief.

The short termism and reliance on government for security is set to explode in our faces shortly.

The signs are everywhere that the free ride ends soon.

Public hospitals have “corporatisation charts” on walls and counters for full-paying customers. Ward care and medical services are present, but pharmacies setting controls to costs and procedures require uncovered expenses.

The government soft lands discussions on a GST constantly, waiting for a strong mandate to push out “differently named” consumption taxes.

How will old age play out in the next 10 years in Malaysia as family institutions reconstruct?

Those problems are swept by a giant broom of public relations under the carpet of indifference.

What alarms the most is the leaders we have.

They’d pass the question on to the next guy and meanwhile back any populist measure because it is not hard to sell.

They are convinced our masses are incapable of processing the situation, more so their financial predicament.

Better to stick to divisive issues and collect support on the basis they can direct the people’s hate to other factions.

Today is the Tamil New Year, though things remain very, very old and predictable in Malaysia. Raya is an amazing time for families and communities to come together, but what matters more is to maintain that feeling for years to come by building the collective nest egg, not destroy it at the altar of expediency fuelled by leadership apathy.

If there is one summary, one simple one, it is this. The fear is real, and they lull us with their lies.

* This is the personal opinion of the columnist.

.JPG)