KUALA LUMPUR, March 2 — The BSI Bank made huge profits out of its largest-ever client 1Malaysia Development Berhad (1MDB), but this Malaysian government-owned company and the resulting fiasco eventually resulted in this century-old bank ceasing to exist, the High Court heard today.

Malaysian man Kevin Michael Swampillai, who used to work as BSI's Singapore branch's head of wealth management services until his suspension and resignation in 2016, acknowledged that the Swiss-based bank's history of over 140 years ended due to the 1MDB debacle.

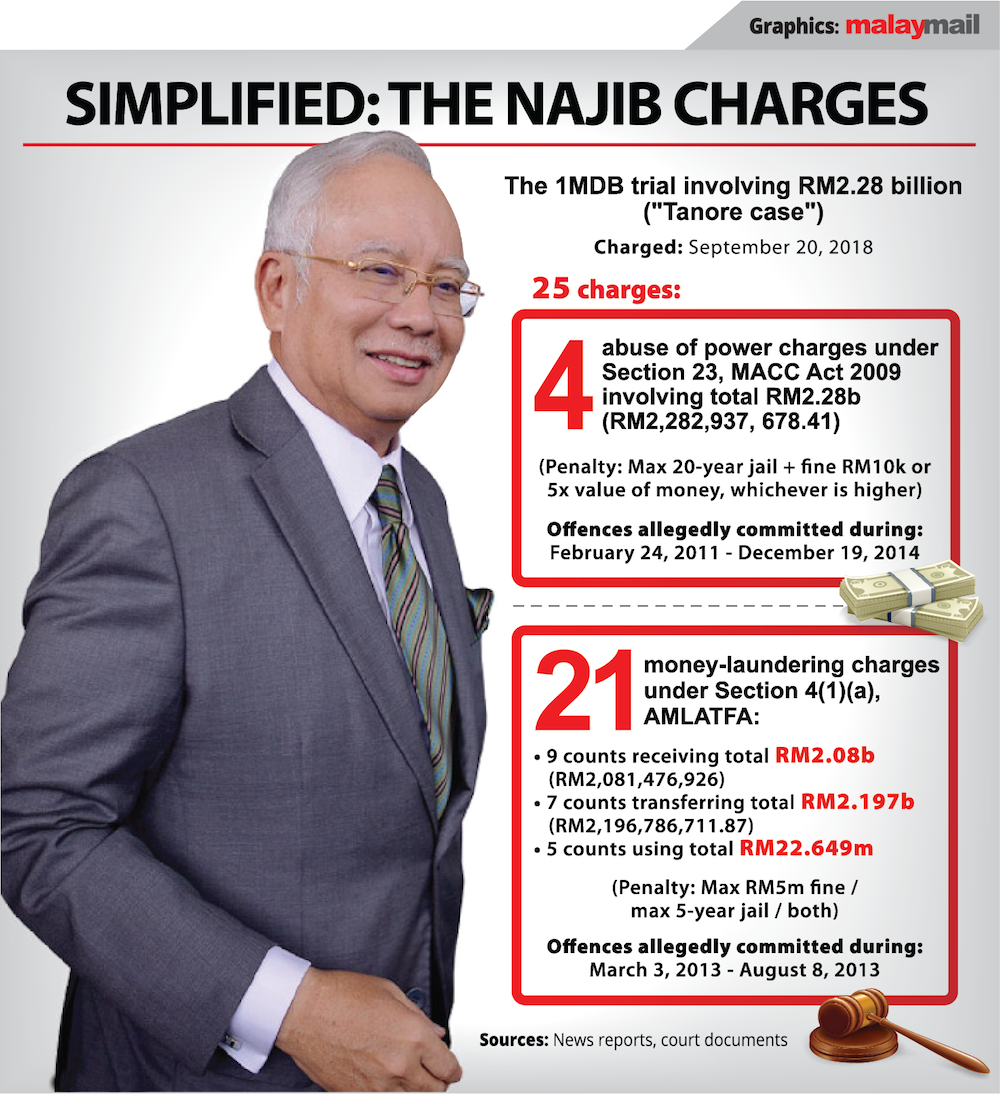

Swampillai said this while testifying as the 44th prosecution witness in Najib's trial over the misappropriation of RM2.28 billion of 1MDB funds allegedly into the former prime minister's private bank accounts.

Swampillai explained why BSI Singapore relationship manager Yak Yew Chee had taken the unique step of keeping the bank's senior management and compliance division in the loop about activities and transactions involving the bank's clients 1MDB, SRC International Sdn Bhd and related companies, and why those transactions had attracted attention from both BSI Singapore and BSI's head office.

Swampillai said these Finance Ministry-owned companies and sovereign wealth funds would have usually been clients of commercial banks, investment banks or large private banks, instead of a small or medium-sized private bank like BSI Bank which would not have hoped “to actually receive a client of that stature — a sovereign wealth fund”.

“On another level, it was the size of transactions as well. It ran into multiple billions of dollars, many, many transactions. That too was unique, once again, private banks would deal with high net worth individuals who typically transact in millions of dollars rather than hundreds of millions of dollars,” he said when highlighting the huge sums by the group of BSI clients including 1MDB, its subsidiaries and related companies.

“I'm sure the bank has some corporate clients but certainly nothing of that size. The 1MDB group of clients was the largest group of clients in BSI bank not just in Singapore, but globally,” he told deputy public prosecutor Mohamad Mustaffa P. Kunyalam.

Swampillai confirmed that the directors and employees of these clients — such as 1MDB — never complained about the transactions where money was being sent out, and that they also never gave any instructions to stop the banking transactions.

“The only complaint we ever received is we were not moving fast enough to move these transactions, so that was a consistent complaint,” he said.

Swampillai said BSI Singapore was put under intense pressure by the 1MDB group of clients to carry out the transactions, despite these transactions actually requiring a bit of time to process and it involves multiple banking personnel such as 20 persons from different departments including risk management and operations — instead of just pushing a single button.

“The speed of transactions from 1MDB group of clients was at light speed, the amount of pressure put on the bank to process these transactions, get it out of the account, get it out of the system — that was unprecedented. The amount of pressure was so intense, was unique in that sense because we never had that kind of pressure from any clients in the bank,” he said.

Swampilllai said BSI Bank “doesn't exist anymore”, noting: "The bank had its licence withdrawn by the Monetary Authority of Singapore (MAS) but concurrent to that, the bank was already going through a sale process. It was in the process of being sold to another entity. Through a combination of licence suspension, sale of BSI to another Swiss private bank, BSI does not exist anymore at this point in time.”

“I believe the MAS withdrew BSI's licence due to various failures, control failures, shortcomings in terms of client due diligence, adherence to money-laundering regulations and processes. It was substantively determined by the MAS, I believe, there were serious shortcomings in these areas, and they saw it fit to pull the licence to the bank," he said, adding that the MAS decision was clearly in relation to the 1MDB group of clients and the activities BSI undertook for these clients.

Later, Najib's lead defence lawyer Tan Sri Muhammad Shafee Abdullah suggested that BSI which had a long history had to be shut down due to the offences by the bank through its various officers.

But Swampillai said he believed it was a collective failure by BSI Bank as a whole which led to its shutting down, instead of just being due to the failure of several individuals at the bank.

“I won't say it was due to the offences of the people involved. I mean, there were some people who were charged, some given custodial sentences, and some people banned by MAS, but I wouldn't actually lie it on the feet solely of those people. I think it was a collective failure of the bank. There were back office functions that could have done more, there was lack of oversight by the main board in Lugano, so you know, from my perspective, based on what I had observed, all that was also called into question,” he said.

Shafee: You did say the closing down and revoking of the licence are mostly pertaining to the 1MDB debacle, would that be correct?

Swampillai: Yes, that would be correct.

Shafee: 1MDB including SRC and the rest in the stable?

Swampillai: That's correct.

Swampillai later said he and other bank colleagues had highlighted their suspicions and concerns to the higher-ups in BSI about the 1MDB group of companies, but said the higher-ups had instead encouraged the continuing of those profitable banking transactions.

Najib's 1MDB trial before judge Datuk Collin Lawrence Sequerah resumes this afternoon, with Shafee expected to continue cross-examining Swampillai.