KUALA LUMPUR, Feb 27 — Treasury secretary-general Datuk Johan Mahmood Merican has said that the government did not want to increase income tax rates for those with annual earnings above RM1 million, as it felt that the top tax rate of 30 per cent was already “sufficiently high”.

During the post-budget debate hosted by the Malaysian Economic Association today, Johan pointed out that Malaysians have their income taxed progressively, and not at a flat rate.

“By adjusting the tax rates up to RM1 million, all taxpayers earning more than that will also end up paying a higher tax rate,” he said at the Bukit Kiara Equestrian and Country Resort here.

When asked what was the reasoning behind beginning the income tax hike at the RM100,001 level, Johan stressed that only around 150,000 people will be experiencing a tax increase.

“Even though when you look at it, it looks like the tax rate increases from RM100,000 above, really you need to achieve about RM230,000 taxable income after reducing from all the reliefs before you start paying the higher taxes.

“So we are talking about people who earn RM20,000 a month.

“It’s only about one per cent of our labour force, so we’re not even talking about T20, we are talking about T1," he said.

T20 is the abbreviation commonly used to refer to the top 20 per cent of income earners, and similarly T1 for the top 1 per cent.

“Are we saying that even one per cent is too many people to pay more taxes?” Johan asked.

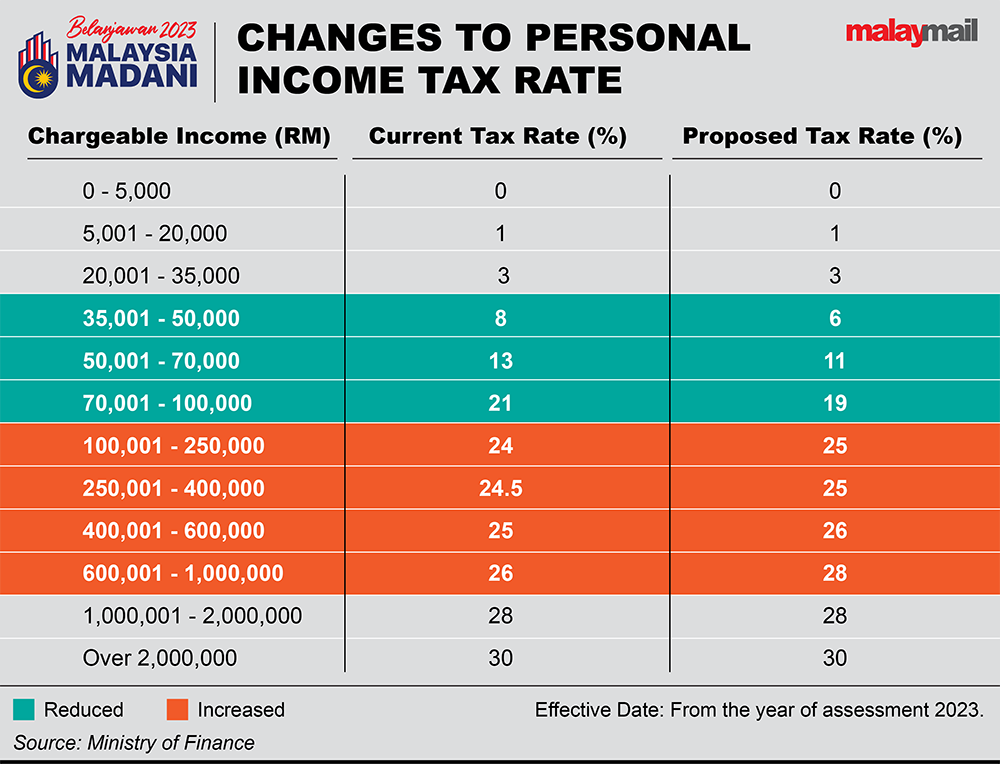

During the tabling of the national Budget last Friday, Prime Minister Datuk Seri Anwar Ibrahim announced that income tax rates would be reduced by two percentage points for those earning wages between RM35,000 and RM100,000 a year.

Meanwhile, annual income between RM100,001 and RM1 million will be taxed at a higher rate between 0.5 and two percentage points.

“The prime minister feels strongly that it’s not just about the government helping the poor, but those who are more fortunate should contribute a little bit.

“This is where he felt that a group such as 150,000 people who are the top one per cent of the labour force... it is not asking too much for the top one per cent of the labour force to contribute a little bit towards the well-being of the country,” he said.