KUALA LUMPUR, June 16 — Overseas bank accounts including one under the name of “Prince Faisal Bin Turkey Bin Bandar Al Saud” sent funds totalling US$670 million in five transactions from 2011 to 2013 to one of former prime minister Datuk Seri Najib Razak’s AmBank accounts, the High Court heard today.

AmBank’s SWIFT unit manager Wedani Senen said that there were 12 transactions of money transferred from overseas to two of Najib’s AmIslamic Bank accounts during the period of 2011 to 2014 via the international funds transfer system SWIFT.

Testifying as the 29th prosecution witness in Najib’s trial over the misappropriation of more than RM2 billion of 1Malaysia Development Berhad (1MDB) funds, Wedani said these two AmIslamic bank accounts belonging to Najib are “AmPrivateBanking-MR” with the account number 2112022009694 and “AmPrivateBanking-1MY” with the account number 2112022011880.

Citing banking documents, Wedani today confirmed five overseas funds transactions totalling almost US$670 million which had made it to Najib’s bank account which had the codename of “AmPrivateBanking-MR”.

Wedani confirmed two transactions of US$10 million each made by a Riyad Bank account under the name of “Prince Faisal Bin Turkey Bin Bandar Al Saud” on February 24, 2011 and on June 14, 2011 to Najib’s account “AmPrivate Banking-MR”, with the actual sums that were transferred amounting to US$9,999,977 and US$9,999,970 after bank transfer charges of US$23 and US$30 were deducted.

She also verified two successful transfers of US$5 million and US$25 million from Blackstone Asia Real Estate Partners’s Standard Chartered Bank account in Singapore to Najib’s account “AmPrivateBanking-MR” on October 30, 2012 and on November 19, 2012, with the actual sums entering his account amounting to US$4,999,988 and US$24,999,988 after bank charges were deducted.

She verified Tanore Finance Corp’s Falcon Private Bank account in Singapore had sent US$620 million on March 22, 2013 to Najib’s account “AmPrivateBanking-MR”, with the actual amount entering his account being US$619,999,988 after a US$12 amount was deducted as bank charges.

From the five transactions verified by Wedani, it would come up to a total of US$669,999,923 or over US$669 million, after the bank charges are deducted.

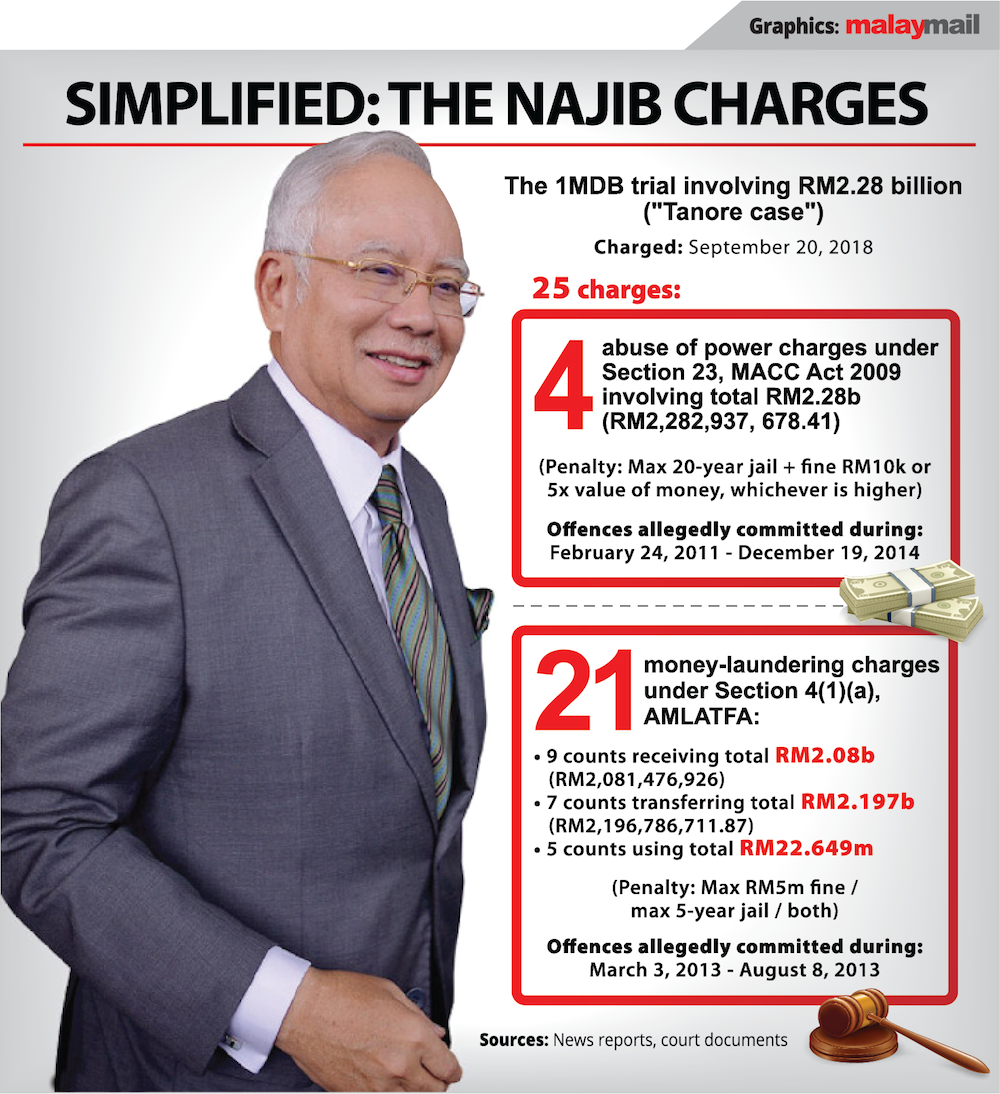

On the first day of trial, the prosecution had said it would show that 1MDB funds had been transferred in multiple transactions to Najib’s accounts, namely US$20 million equivalent to RM60,629,839.43 or over RM60 million from the first phase of the 1MDB scheme, US$30 million equivalent to RM90,899,927.28 or over RM90 million (second phase), US$681 million equivalent to RM2,081,476,926 or over RM2 billion (third phase), and transactions in British pound that were equivalent to RM4,093,500 and RM45,837,485.70 or a combined total of RM49,930,985.70 million or over RM49 million (fourth phase).

For example, the prosecution had said it would show an individual known as Prince Faisal had transferred US$10 million twice on February 24, 2011 and June 14, 2011 to Najib from the first phase, and a company called Blackstone Asia had paid US$5 million on October 30, 2012 and US$25 million on November 19, 2012 to Najib’s account under the second phase, and that Tanore which was controlled by Low Taek Jho’s associate Eric Tan had allegedly paid US$681 million to Najib’s account between March 21, 2013 and April 10, 2013.

The total of 1MDB funds that the prosecution had said it would prove had entered Najib’s accounts from all four phases would come up to a total of RM2,282,937,678.41 or over RM2.28 billion.

Najib’s 1MDB trial before High Court judge Datuk Collin Lawrence Sequerah resumes next Monday, with Wedani expected to continue testifying.

Earlier today, Mohamed Fairudz Mohd Hanif who is a legal expert for business policy at Labuan Financial Services Authority testified as the 28th prosecution witness in this trial.

Mohamed Fairudz said he had in July 2018 received a request from the Malaysian Anti-Corruption Commission to assist with the 1MDB case by obtaining information on offshore companies registered in the British Virgin Islands, Seychelles, Curacao and Cayman Islands.

Mohamed Fairudz said he had in August 2018 prepared a letter to request information from the British Virgin Islands Financial Services Commission on 12 companies registered with the commission, with the request being made in relation to the 1MDB case.

He said the British Virgin Islands Financial Services Commission had then in April 2019 provided information on 11 of the companies, including Blackstone Asia Real Estate Partners and Tanore Finance Corp.

Based on documents verified by him in court today, he confirmed that Blackstone was renamed from a BVI-registered company called Foreign FX Trading Ltd in May 2011 and that Blackstone’s sole director had on April 30, 2013 resolved to appoint a voluntary liquidator for the firm.

As for Tanore, he confirmed that it was incorporated in the British Virgin Islands on October 19, 2012, and that there were various other related documents such as a certificate of dissolution dated April 3, 2014.