KUALA LUMPUR, April 21 — The management and board of the Finance Ministry-owned 1Malaysia Development Berhad (1MDB) had said they were under pressure from the company’s sole shareholder to have audit firm KPMG sign off on the company’s financial statements in 2013, KPMG’s managing director Datuk Johan Idris said today.

Johan explained that KPMG had not signed off on the audit due to lack of information from 1MDB to enable verification of the purported value of the company’s US$2.318 billion investment.

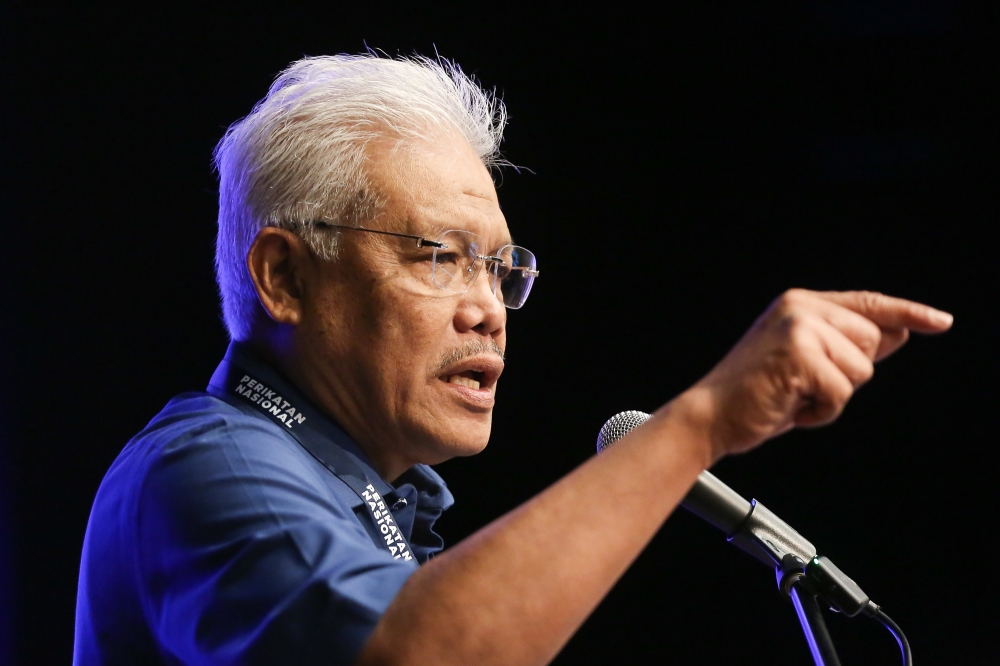

Johan said this while testifying as the 14th prosecution witness in the trial of former prime minister Datuk Seri Najib Razak over the misappropriation of more than RM2 billion of 1MDB.

1MDB’s sole shareholder was the Finance Ministry’s MOF Inc, while Najib as the finance minister then was also the representative of 1MDB shareholder for shareholder resolutions and decisions.

In this trial, Najib is often referred to interchangeably by lawyers and prosecution witnesses — including Johan — as the shareholder of 1MDB.

Under cross-examination by Najib’s lead defence lawyer Tan Sri Muhammad Shafee Abdullah on whether the 1MDB management and board were trying to impress on KPMG that 1MDB’s purported overseas investment was truly worth US$2.318 billion, Johan today said the 1MDB management and board were “under pressure” by the 1MDB shareholder to have KPMG sign the 2013 accounts despite not actually knowing if the investment value was correct.

“The management doesn’t know, they want us to sign. The board doesn’t know, they want us to sign,” Johan said, adding that KPMG then had no alternative but to push to see 1MDB’s shareholder to get clarification.

“So that’s what we do, to seek clarification whether he knows anything that the board or the management doesn’t know, and tell him that we are doing our job professionally, and that we did not apply any new rigorous standards, but just applying international auditing standards to verify the underlying assets,” he added.

Shafee then argued that it should be the board of directors which makes decisions first before it is submitted to the shareholder to either accept or overrule the board’s decisions, and also challenged the remark that the 1MDB management was under pressure from shareholder as he said it would mean that the shareholder is the one who ran the entire 1MDB.

But Johan replied: “In 2013, the management and the board, some representatives of the board came, and they were under pressure for us to sign, because the shareholder wanted the account signed.”

Shafee then asked “how did you know this”, and Johan then replied “the management and board told me”.

Johan did not specify who in the 1MDB board and 1MDB management had told him of being under alleged pressure by the company’s shareholder.

The 1MDB financial statements for the financial year ending March 31, 2013 was due to be audited within a six-month period or by September 2013, but the audited statements had yet to be signed off by December 2013 as 1MDB was unable to provide key documents that would enable KPMG to audit and check the purported underlying assets of the US$2.318 billion purported investment by 1MDB.

It was on November 29, 2013 that 1MDB met with KPMG to discuss details relating to the US$2.318 billion investment, and KPMG later met with then finance minister Najib on December 15, 2013 to obtain clarification about that investment.

On November 29, 2013, KPMG was represented by its then incoming managing partner Johan and the engagement partner Ahmad Nasri Abdul Wahab who was handling 1MDB’s audit met with 1MDB’s then chairman Tan Sri Che Lodin Wok Kamaruddin and then director Tan Sri Ismee Ismail and 1MDB’s then CEO Mohd Hazem Abd Rahman and then chief financial officer Azmi Tahir. KPMG had recorded two sets of minutes for the November meetings, with the second minutes being what had happened in Hazem’s and Azmi’s discussions with KPMG after Lodin and Ismee left earlier.

As for the December 15, 2013 meeting held between KPMG as represented by Johan and with Najib at the latter’s house at Jalan Duta, Johan was the one who recorded the minutes.

Citing the December 15, 2013 meeting where Najib had said he would like to see KPMG signing off on 1MDB’s accounts by December 31, 2013, Shafee then asked Johan if it showed any pressure by Najib on the 1MDB management or board for the audit to be signed, based on these minutes alone.

Shafee: So far, I’ve shown you, based on your own minutes, is there any pressure put by prime minister on the management or the board, thus far that I’ve shown you?

Johan: No.

Asked by Shafee if Najib had placed any pressure by telling Johan that he would be sacked if KPMG did not sign off by December 31, Johan reiterated “he said he would like to see the account closed”.

Shafee remarked that “so until the end he didn’t put pressure on anyone”, but did not stop to enable Johan to respond and continued asking the next question.

Shafee then asked why Johan had not responded in the December 15 meeting to Najib’s wish to have the audited accounts signed by December 31, Johan said: “I didn’t respond because I cannot commit whether I can sign by that date unless I have received all information”.

Earlier today, Johan had described Najib’s statement on December 15 that he wished to see KPMG to sign off on 1MDB financial statements by December 31 as akin to an “order”.

In the end, KPMG did not sign off on 1MDB’s 2013 financial statement as the information required was still not provided to the auditors.

1MDB’s sole shareholder, Minister of Finance (Incorporated) (MoF Inc), on December 31, 2013 terminated KPMG as the auditor for 1MDB with immediate effect, and replaced it with Deloitte KassimChan.

This afternoon, Johan said that it is the company 1MDB that has the duty to ensure its funds are properly valued and audited and agreed with Shafee that such a duty starts from the senior management and then board members.

Shafee then suggested “this is not the function or the business of the shareholder, he may be interested because he is the shareholder, but this is not his duty because it is micromanaging the company”, to which Johan agreed.

Among other things, Johan agreed with Shafee’s suggestion that there was nothing wrong about a shareholder to be concerned as 1MDB’s account audit was already past the six-month period and overdue, also agreeing that a shareholder would want to see the long-overdue accounts of the company closed by December 31 as requested by the 1MDB board.

Among other things, Johan said he has heard of Low Taek Jho or Jho Low’s name, but said he was “not aware” when Shafee suggested that Low was completely controlling 1MDB and purportedly directing 1MDB management to cover up the crime of 1MDB money being sent off elsewhere.

Johan also said that he had spoken to KPMG partner Ahmad Nasri, noting: “As far as I spoke to him, none of us have met Jho Low.”

Najib’s 1MDB trial before High Court judge Datuk Collin Lawrence Sequerah resumes on May 9, where lead prosecutor Datuk Seri Gopal Sri Ram is expected to re-examine him.

Sri Ram is also expected to re-examine 1MDB’s former CFO Azmi who was the 12th prosecution witness, while the prosecution today also informed the High Court that former 1MDB chairman Tan Sri Mohd Bakke Salleh is expected to be available on May 9 as the next prosecution witness.