KUALA LUMPUR, March 30 — The RM250 billion Prihatin economic stimulus package is an emergency move to cushion the slowdown in economic activities, and should not be mistaken as a move to spur economic growth, Malacca Securities Sdn Bhd said.

Consequently, the move is seen as largely neutral, with little impact on the stock market, it said, adding that the near-term market outlook remains sluggish despite the key index’s recent near term 11.2 per cent recovery from the 1,207.80 level in the past week.

“The FBM KLCI managed to recover its position above the 1,300 level in recent days, mainly spurred by the United States’ (US) massive US$3 trillion economic stimulus package, coupled with the anticipation of Malaysia’s economic stimulus announcement towards end of the week.

“As it is, the recovery has left the market at the crossroads again as the focus may return to the rising number of Covid-19 cases, softer economic data performances in coming months and corporate earnings from US next month will partly reflect the impact of Covid-19,” it said in a note today.

The research house said the market may consolidate towards the 1,300 psychological level or even back towards the 1,210 support level over the near term in the absence of fresh buying catalyst.

Much of the market’s near-term direction will also continue to be dictated by the performance of key overseas bourses.

“On the upside, we think there will be limited room for further gains to come towards the 1,400 and 1,455 levels due to the potentially upcoming insipid earnings performance.

“Following the conclusion of unexciting corporate earnings growth in fourth quarter of 2019 that was impacted by the US-China trade war, we will now be beset by further weakness in corporate earnings amid the global economic standstill,” it said.

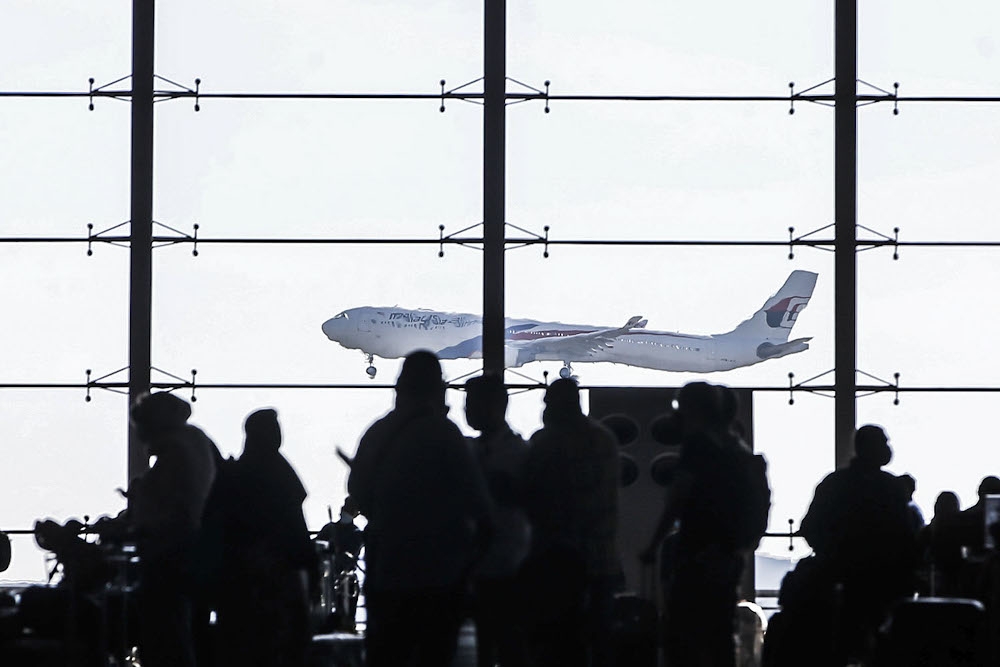

Malacca Securities expects much of the earnings contraction to come from the tourism, leisure, airlines, consumer and retail sectors, while the slump in commodities price performance from both the crude palm oil and crude oil may see earnings in the plantation and oil and gas sector to remain bleak.

It said the economic stimulus package came in a timely manner to address the disruption of economic activities stemming from Covid-19 that has brought global economic activities to a standstill.

The RM250 billion stimulus package (inclusive of the previously announced RM20 billion package) is also the largest ever declared by Malaysia, representing approximately 17.4 per cent of Malaysia’s gross domestic product (GDP) in 2019.

This has been compared to the RM67 billion stimulus package announced to combat the subprime mortgage crisis that represented only 8.8 per cent of Malaysia’s GDP in 2008.

Nevertheless, Malacca Securities said, the rollout comes at the expense of widening the country’s fiscal deficit beyond the targeted 3.2 per cent level, potentially up to 4.0 per cent-6.5 per cent of GDP in 2020 through issuance of debt papers. — Bernama