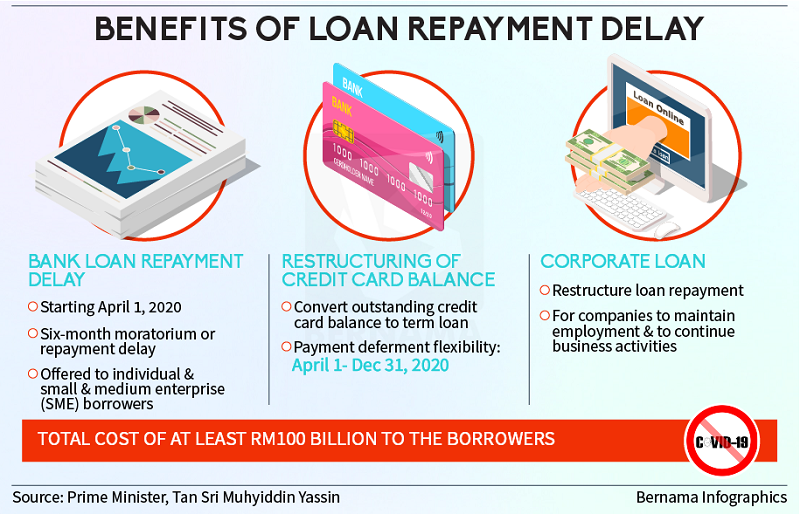

KUALA LUMPUR, March 25 — The Association of Banks in Malaysia expressed support for Bank Negara Malaysia’s directive for a six-month moratorium on all loan repayments due to the unique challenges face by the country stemming from the Covid-19 pandemic

ABM chairman Datuk Abdul Farid Alias said the association’s members are in full agreement with the moratorium, which they believed to be a necessary solution at this time.

“The measures announced have been designed not only to support customers in this highly unusual global environment, but also to ensure that banks can continue to play their role in sustaining the country’s economy.

“We hope it will provide customers some breathing space and allow them to focus on other critical aspects of their livelihoods at this time.” he said in a statement today.

The moratorium will take effect from April 1 and is an automatic extension of credit facilities for a period of six months to retail and SME customers, excluding credit cards.

While interest will accrue during this period, there will be no payment of interest and principal required for credit facilities for the six month period.

However, other segments not included in the moratorium will be reviewed on an individual basis and such customers are urged to contact their respective bankers to discuss the specific relief sought, ABM said.

ABM said its members were currently working out the full details of the proposals to ensure they will be efficiently executed with minimum inconvenience to the customers.

ABM also stated that from the outset of the Covid-19 pandemic, they have been in discussion with the central bank on possible measures that can be taken to address the impact of the outbreak, particularly looking at how borrowers can be provided relief even as the government focuses on combating the spread of the virus and ensure the country's economic growth is sustained.