GEORGE TOWN, Nov 6 — Two backbenchers including Lim Guan Eng raised their constituents’ concerns over the state’s assessment rate review at the Penang legislative assembly and urged the state government to reconsider.

During their respective debates in the morning and late yesterday night, both Lim (DAP — Air Putih) and Ong Khan Lee (PKR — Kebun Bunga) said ratepayers have complained against the assessment rate review that were seen as too high.

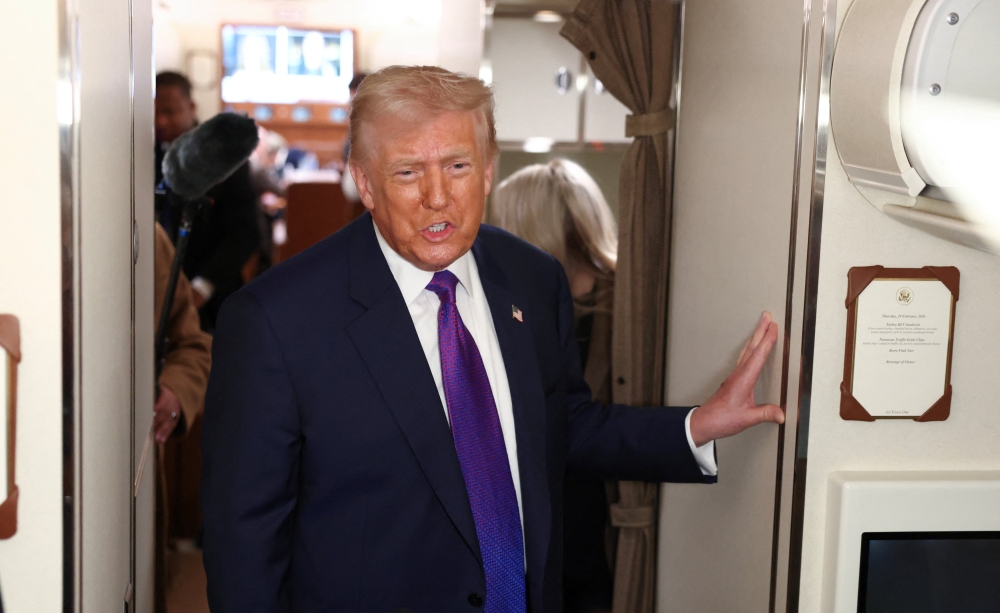

Lim, who is Malaysia’s finance minister, told the assembly that he met and agreed with a ratepayer recently who complained that the increase was excessive.

“The rate review as too high, maybe the state should consider reviewing the rate increase,” he said.

Late last night, Ong asked the state to defer the assessment rate review for another two years.

“The proposed rate review may be in accordance with the law but it did not take into account the people’s income that had remained stagnant all these years,” he said when debating the Supply Bill at the legislative assembly.

He said people are already struggling with skyrocketing costs of living and stagnant wages.

“The assessment rate increase would only reduce the disposable income of ratepayers and can be a burden for them,” he said.

He added that there was an economic slowdown now, so the review should be deferred.

“The hike in assessment is against the Pakatan Harapan government’s wishes to stabilise property prices in Penang,” he said.

He pointed out that home owners also must pay the real property gains tax when they sell their property, including those they inherited, so the assessment rate review will further burden them.

Lim introduced the perpetual 5 per cent RPGT this year.

The assessment rate review for both the Penang Island City Council (MBPP) and Seberang Perai City Council (MBSP) will be effective from 2020.

A total of 322,549 properties on the island and 327,401 properties in Seberang Perai will be affected, with assessment fees expected to go up between 50 per cent and 98 per cent due to a review of the annual property value that had not been reviewed for 15 years.

The assessment rates have been reduced but the annual value of properties were adjusted to reflect current values that had brought the total rates payable up.