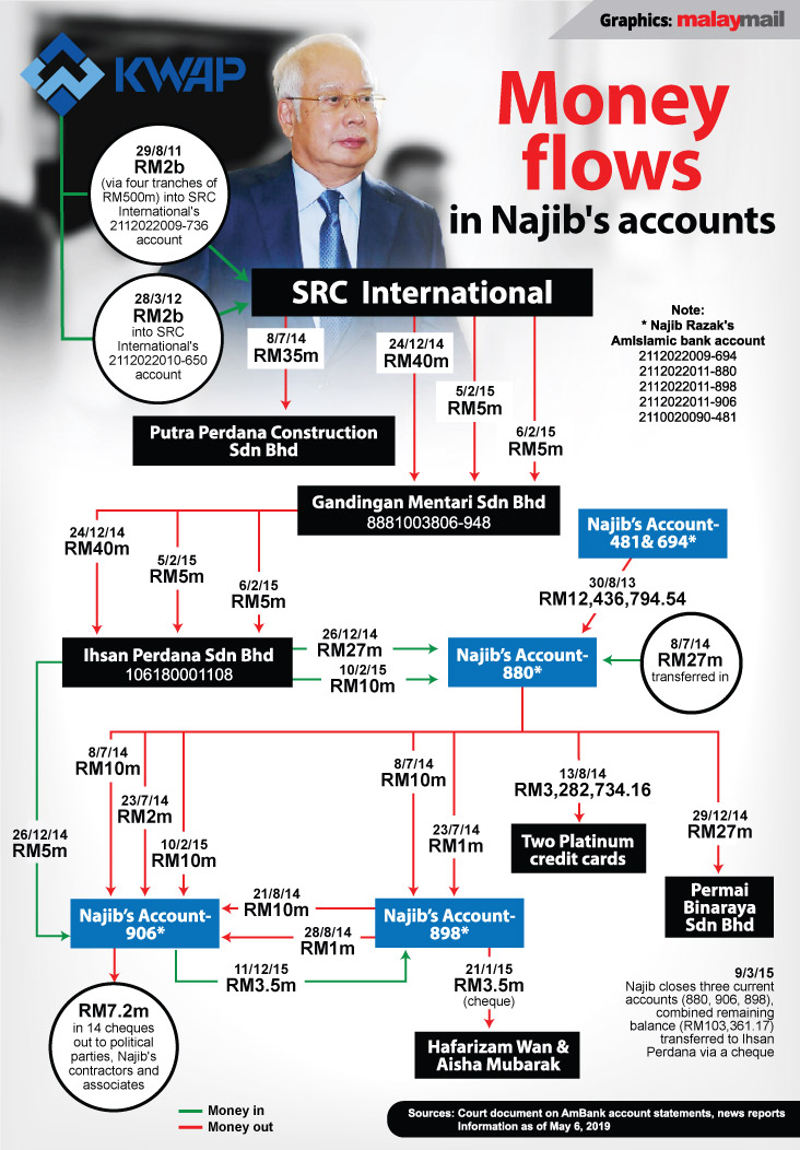

KUALA LUMPUR, May 7 — The investment guidelines for the Retirement Fund Incorporated (KWAP) were breached when it decided to give the first loan of RM2 billion to then 1MDB subsidiary SRC International Sdn Bhd in 2011, the High Court heard today in the trial of former prime minister Datuk Seri Najib Razak.

Amirul Imran Ahmat, 39, a former employee of the civil servants’ pension fund, stuck to his 30-page written witness statement which he had read out last week and yesterday.

The 29th prosecution witness confirmed that he had said the first RM2 billion loan by KWAP to SRC International had breached Paragraphs 2 and 5 of the KWAP Policy and Guideline under cross-examination from Harvinderjit Singh, the defence lawyer for Najib.

Today marks Najib’s 14th day on trial for seven charges of criminal breach of trust, abuse of position and money-laundering of RM42 million of funds belonging to SRC International, a former subsidiary of 1Malaysia Development Berhad.

Amirul also confirmed that these two parts were waived when KWAP’s investment panel approved the loan in 2011 that was backed by a government guarantee.

However, Amirul said the waiver was required due to the breach.

“There is pelanggaran, hence the need for waiver,” he said, prompting Harvinderjit to respond saying “There’s waiver, hence no pelanggaran.”

Pelanggaran is the Malay word for breach.

But Amirul replied that he stands by his witness statement: “I still stick to (it).”

Paragraph 2 of the policy and guidelines is that KWAP’s investment in the form of loans cannot exceed 10 per cent of its allocations for investment in domestic fixed income investments.

Amirul had said Paragraph 5 was breached as the loan amount exceeded the equity limit of shareholders, as SRC International only had RM1 million equity while the approved loan amount exceeded that.

Earlier under cross-examination by Harvinderjit, Amirul agreed that any potential breaches of KWAP’s investment guidelines along with the required waiver would be highlighted in investment papers for proposed investments such as the 2011 loan of RM2 billion to SRC International.

Harvinderjit: Up to the investment panel to approve the investment?

Amirul: Basically (if) they approve the investment, they have to approve the waivers as well.

Harvinderjit: If investment was approved with a waiver, the specific guideline is no longer in force?

Amirul: In that specific context, yes.

When asked by Harvinderjit if there could not be said to be a breach of guidelines as they would not be applicable, Amirul confirmed that the specific guidelines would no longer apply after the waiver.

Amirul was assistant vice-president of KWAP’s Fixed Income Department from January 2011 to August 2013, and was involved with the process of drafting of proposed investment papers and the seeking of supporting documents that eventually led to loans totalling RM4 billion to SRC International.

Previously, he testified that KWAP’s first RM2 billion loan to SRC International was while it was a 1MDB subsidiary, while the second RM2 billion loan was after the company’s ownership was transferred to the Finance Ministry’s Minister of Finance (MOF) Incorporated.

Amirul had yesterday testified that the waiver of KWAP’s investment policies and guidelines was no longer required for the second RM2 billion loan as it was government-guaranteed.

The first loan was finally approved after the government decided to back it with a government guarantee letter signed by former Finance Minister II Datuk Seri Ahmad Husni Hanadzlah, while the second loan was backed by a government guarantee letter signed by Najib who was then both prime minister and finance minister.