KUALA LUMPUR, July 4 — Bursa Malaysia turned slightly higher at the close yesterday, supported by continued buying in selected heavyweights led by financial services, industrial products and services counters amid a mixed regional markets’ performance, an analyst said.

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) gained 1.20 points, or 0.08 per cent, to 1,550.19 from yesterday’s close of 1,548.99.

The index opened 1.75 points higher at 1,550.74 and hovered between 1,547.70 and 1,551.78 throughout the day.

The broader market was positive with 489 gainers compared to 466 decliners, while 509 counters were unchanged, 923 untraded and 21 suspended.

Turnover fell to 3.43 billion units worth RM2.47 billion against 5.09 billion units worth RM2.9 billion yesterday.

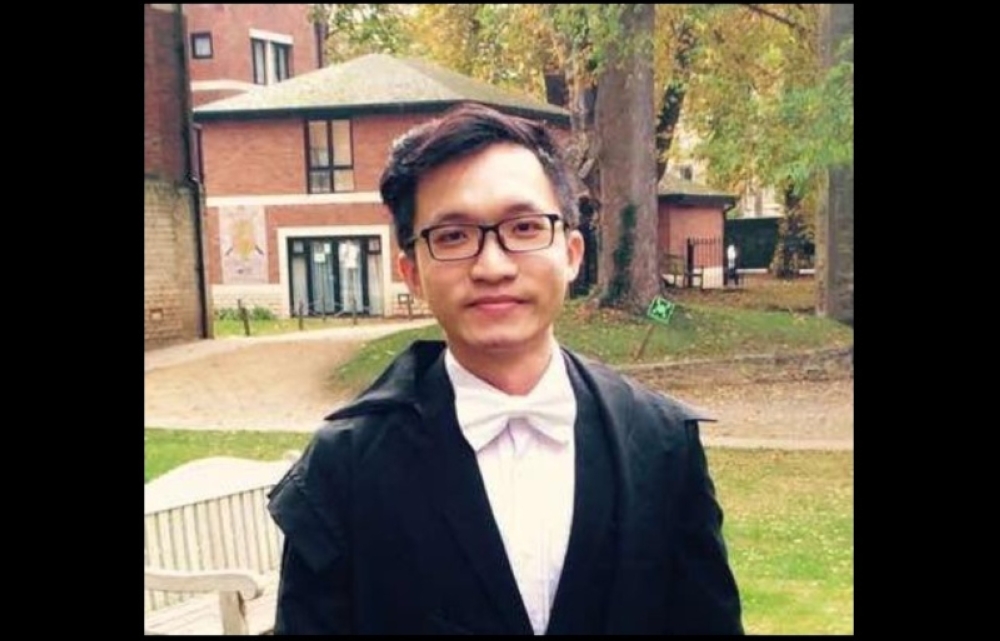

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the FBM KLCI closed marginally higher with buying mainly on consumer, utilities and banks, with profit-taking on Petronas-linked stocks.

“Regional market tone remained cautious following President Donald Trump’s plan to issue official communications today on revised US tariff rates to key global economies.

“To date, the US has signed trade deals only with the UK and Vietnam, and a limited framework with China. As for the local bourse, sentiment remains positive thanks to the return of foreign funds,” he told Bernama.

Among heavyweights, Maybank lost 6.0 sen to RM9.74, Public Bank added 8.0 sen to RM4.38, Tenaga Nasional ticked up 4.0 sen to RM14.06, CIMB dropped 2.0 sen to RM6.77, and IHH Healthcare went down 10 sen to RM6.75.

As for the most active stocks, Borneo Oil was flat at half-a-sen, Zetrix AI improved 2.0 sen to 99.5 sen, Nationgate went up 11 sen to RM1.78, NexG was 1.0 sen higher at 40 sen and Tanco dropped 1.0 sen to 89 sen. — Bernama