KUALA LUMPUR, Sept 20 — For the past decade, individual taxpayers have emerged as the unsung heroes of Malaysia’s fiscal landscape by contributing roughly 25 per cent of all income tax revenue.

According to the Inland Revenue Board’s (IRB) data made available to the public at open data portal data.gov.my, individuals paid RM33.8 billion in income tax in total, a notable jump from the RM27.1 billion recorded in 2021.

However, the pinnacle of individual contributions — since data was first made available in 1970 — was in 2020, when the nation’s taxpayers collectively paid RM39 billion.

That year also saw individuals contributing its biggest proportion of income tax at 34.6 per cent.

The proportion followed a rising trend since 2011, which however dipped in 2021 when individuals contributed to just 20.8 per cent of total income tax revenue.

In 2022, the breakdown of taxpayers’ status revealed that 1,251,614 individuals filed their taxes solo, while a whopping 2,936,129 chose the joint filing route, typically as husbands and wives.

On the flip side, 1,472,038 individuals were spared the taxman’s call last year due to their income falling below the taxable threshold.

Similarly, the number of those who fell below the taxable threshold peaked in 2020 at 1,629,474.

While individuals have been diligent in their tax contributions, the corporate sector continued to contribute to the bulk of income tax revenue.

In 2022, corporations contributed RM82.1 billion, edging out the previous year’s RM79.8 billion by a narrow margin.

In fact, 2022 marked a historic year for Malaysia’s fiscal health, with the government collecting a record-breaking RM153.5 billion in total taxes. The last time such a figure was achieved was in 2019, with RM134.7 billion.

An intriguing aspect of the data lies in the revelation that since 2013, only 733,389 more individuals have joined the ranks of taxpayers. In 2013, a modest 3,454,354 tax filings were made, compared to the 4,187,743 filed in 2022, underscoring the need for a larger tax base to sustain the nation’s financial well-being.

In comparison, the Department of Statistics stated in July that the country’s total population this year is expected to rise to 33.4 million as compared to 32.7 million in 2022.

This would make those who are taxable merely around 12.5 per cent of the total population.

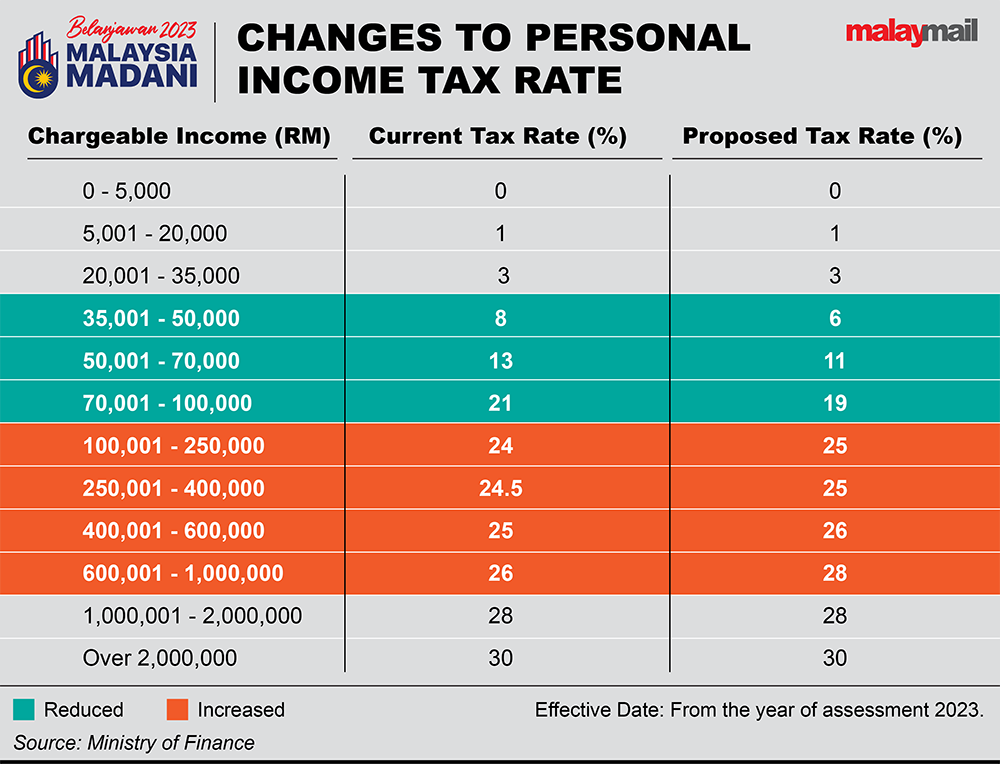

While re-tabling Budget 2023 in February, Prime Minister Datuk Seri Anwar Ibrahim announced that residents earning between RM35,000 and RM100,000 annually will have their personal income tax rate lowered by two percentage points.

At the same time, the government will raise the tax rate of those earning between RM100,000 and RM1 million by 0.5 to 2 percentage points, depending on their income brackets — affecting less than 150,000 taxpayers.