KUALA LUMPUR, Dec 12 — Former AmBank banker Joanna Yu today confirmed she had offered to cook soup for then client Low Taek Jho — now a fugitive wanted in Malaysia over his role in the 1Malaysia Development Berhad (1MDB) scandal — when he was ill.

Yu, however, said she would help anyone and was friendly with the bank’s clients, and denied that her working ties with Low had caused her to lose objectivity in relation to a RM5 billion Islamic medium-term note (IMTN) or Islamic bond issued by 1MDB’s predecessor Terengganu Investment Authority (TIA) Berhad.

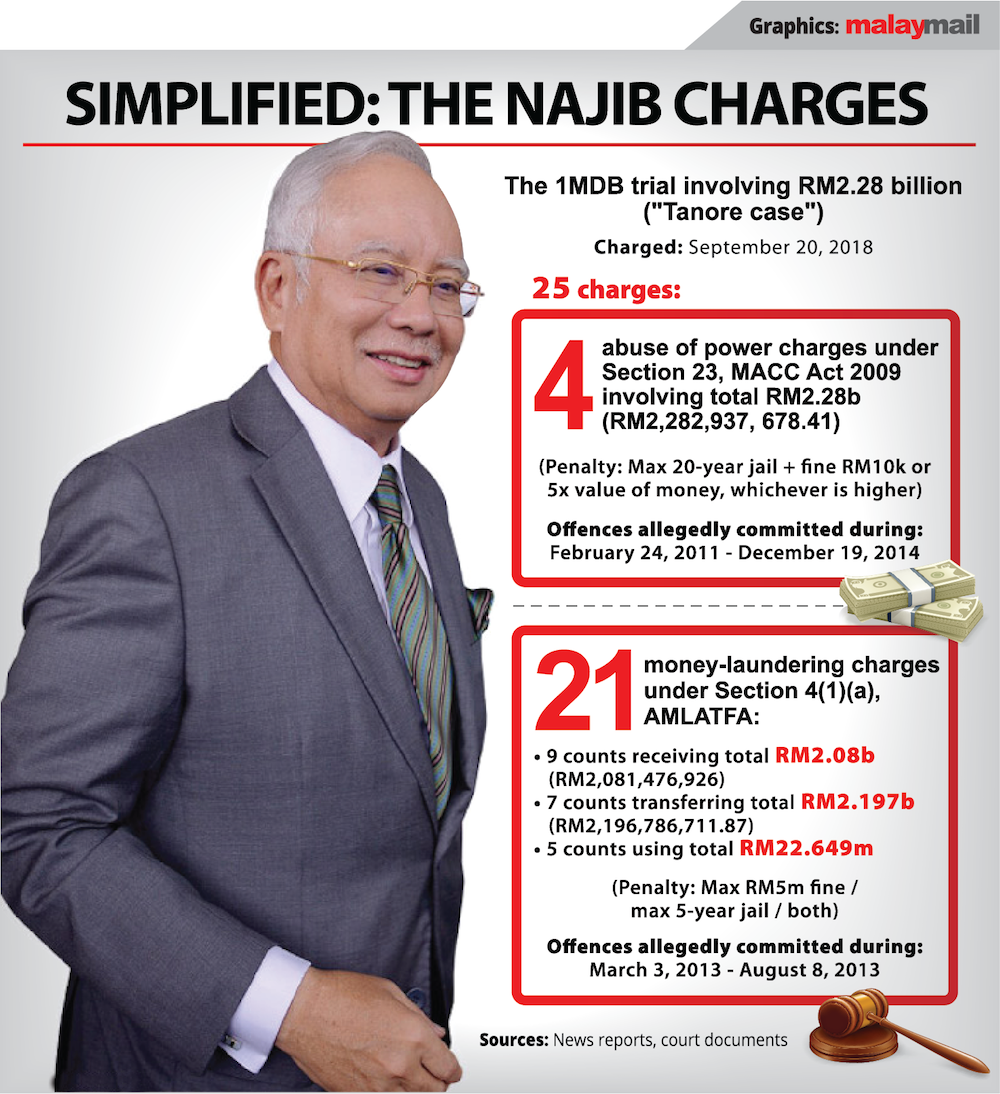

Yu said this while testifying as the 41st prosecution witness in former prime minister Datuk Seri Najib Razak’s trial, where the latter is facing 25 charges over the misappropriation of RM2.28 billion of 1MDB funds said to have entered his personal bank accounts at AmBank.

Today, Najib’s lead defence lawyer Tan Sri Muhammad Shafee Abdullah again grilled Yu over her previous working relationship with Low.

Shafee suggested that Low had become more than a client and had become a “close friend”, but Yu clarified that bankers would treat clients in such a manner: “He was a friend, most of the corporate clients in banks, we call them friends, we don’t call them enemies, we deal with them in a friendly manner.”

Shafee then suggested that Yu’s previous visits to Low in his apartment at Kia Peng were beyond her “call of duty” as she could have met with him in her AmBank office.

Yu pointed out that her visits to the apartment were not by invitation, but were due to Low always avoiding meetings regarding an overdue loan which his company Majestic Masterpiece Sdn Bhd had borrowed from AmBank.

“A lot of times, the loans he had with Majestic Masterpiece, there were payments overdue, when we asked for payments, he was never in town, and he would never want to meet. So I took the opportunity to ask Vern if Jho is in town, can I go and tell him to make payments. Most of the time he wouldn’t want to meet,” she said, referring to Tan Vern Tact as Vern.

Earlier, she had said that repayments for the Majestic Masterpiece loan were rescheduled repeatedly and she had to tell Low to pay the loan but noted that Low would not come to meet AmBank bankers willingly over this matter.

Shafee then asked: “There were times Jho Low was sick, you cooked for him.”

Yu then replied: “I didn’t cook, but I said, ‘if you want, I can’. Suggested I would make some soup for you. If somebody is sick, we would offer.”

Shafee then quipped that no bank has ever offered to cook soup for him even though he was a good client and had been sick often, with Yu then commenting: “Maybe it’s a mother’s instinct.”

Shafee continued to quip that he even lives opposite a bank, before asking: “Do you think it’s appropriate for you as a banker who is dispassionate to the client to offer to make soup for him when he is sick? It’s all in exchanges in BBM messages.” Shafee was referring to BlackBerry Messenger (BBM) text messages.

But Yu said “there’s no intention of anything”, with Shafee then repeating his question: “The question is, is it appropriate?”. Yu then said: “I would assist anyone.”

At this point, High Court judge Datuk Collin Lawrence Sequerah interjected to ask what the objective of Shafee’s question is.

Shafee explained: “The objective of this is something of this was allowed to happen because there is no objective assessment — the IMTN is one, there are many we will come to — you allowed yourself to be so close to him that you lost objectivity.”

Yu then denied losing objectivity.

Najib’s 1MDB trial will resume tomorrow, with Shafee expected to further cross-examine Yu.

Last week, Shafee also grilled Yu about her relationship with Low and suggested that Low’s apartment doubled up as Low’s office.

Yu had last week confirmed that Low had a habit of calling bankers over to his apartment instead of going to the bank, and said her meetings at Low’s apartment were part of her duties as a relationship manager at AmBank and that there were always other individuals present at those meetings.

‘Unseen hands’

Among other things, Yu today confirmed that Najib did not attend any of the meetings between AmBank and 1MDB’s predecessor TIA regarding TIA’s issuance of the RM5 billion Islamic bond in 2009, suggesting she was unsure if Najib was in TIA or had been part of any bond meetings that did not involve AmBank.

As for the RM5 billion bond issued by TIA in May 2009, the company had only received more than RM4.3 billion from the bond, as it was estimated to have lost between RM500 million to RM600 million in potential profits to a bond-flipping exercise by the Thai-based Country Group Securities PCL and Singapore-based Aktis Capital Singapore Pte Ltd.

Financial paper The Edge previously reported Country Group and Aktis Capital as having bought RM3.8 billion and RM700 million respectively of TIA’s RM5 billion government-guaranteed Islamic bond in May 2009 at a discount of RM87.92 instead of the face value of RM100, before flipping it or reselling it at between RM100 to RM105 to obtain the profit estimated at about RM600 million.

Yu today confirmed she was not aware at that time that both Country Group and Aktis Capital were both connected to Low, and said she was now aware of this connection “following recent reports”. She agreed that Low benefitted from the bond-flipping as these two companies belong to him.

Shafee suggested the selling of parts of the RM5 billion bond to the two companies was done to benefit Low, former 1MDB officials Datuk Shahrol Azral Ibrahim Halmi and Casey Tang, and AmBank and Yu herself.

But Yu disagreed: “That’s not true, I’ve never benefitted and I don’t think the bank benefitted anything, apart from doing exercise for the client, arranging the exercise.” AmBank was paid a fee for its role in helping TIA issue the RM5 billion Islamic bond.

While Shafee suggested that Low and individuals in AmBank had managed to organise a scheme where individuals would benefit while causing losses to the bank’s client TIA, Yu replied: “I honestly don’t know whether it involved individuals within the bank.”

Shafee questioned if it was a “coincidence” that the two companies which bought parts of TIA’s RM5 billion bond happened to be connected to Low, but Yu pointed out that her superior in the bank had actually met these two companies back in 2009 and they would not have known of the connection to Low.

As Shafee continued to press her on whether it was a “coincidence” to have the two Low-linked entities involved in the bond purchase as secondary subscribers, Yu replied: “Knowing it now, then I believe there must be unseen hands at that point of time.”

Shafee interrupted her mid-sentence and remarked: “Unseen hands — basically it’s a polite word to say there were conspirators in the way the bond was being handled.”

Yu replied: “I believe because when you mentioned they are all Jho’s companies.”