KUALA LUMPUR, Sept 11 — The Center for Market Education (CME) has issued a stark warning about the difficulties faced by South-east Asian countries in implementing effective income tax collection and the heavy reliance on indirect taxes.

The report argued that these challenges, combined with a lack of a coherent regulatory framework, are reportedly undermining legitimate businesses, stifling innovation, and fueling illicit trade across the region.

The think-tank sounded the alarm during the launch of its latest report, titled “Indirect Taxation and Innovation: An Asean Framework” at a policy forum in Kuala Lumpur.

The report articulates how untransparent and unpredictable tax regimes have fostered an environment ripe for smuggling syndicates and created regressive tax burdens on lower-income households, thereby diminishing governments’ tax revenues.

The report urges governments to act swiftly, capturing this opportunity for reform to reclaim lost tax revenues and redirect them into meaningful fiscal investments.

It also includes case studies from Malaysia, the Philippines, and other regional neighbours, illustrating how flawed excise systems diminish fiscal predictability, weaken institutional trust, and hinder innovation-driven growth.

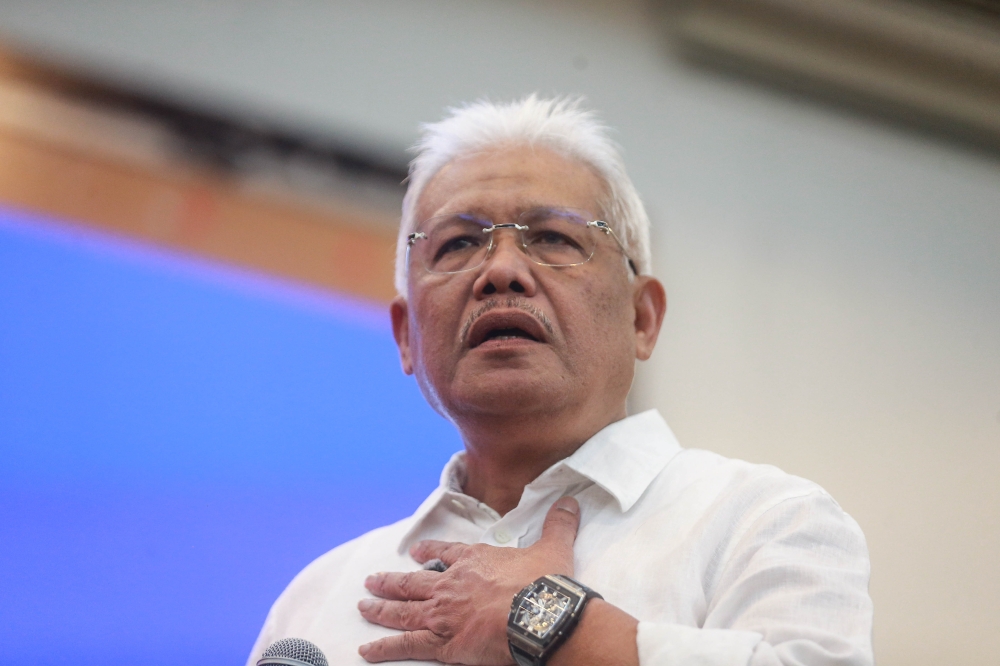

During the presentation, CME chief executive officer and the lead author of the report Carmelo Ferlito described their findings as a wake-up call for policymakers to seize the chance for reform.

Ferlito pointed out the complications arising from excise duties, which are frequently fragmented due to their blend of ad valorem and per-unit measures, and the product-specific nature of such taxes.

“Such gaps may potentially lead to negative consequences by encouraging smuggling activities and indirectly financing certain cartels.

“Illicit trade can also deprive the government of tax revenue collection,” he added.

Ferlito emphasised that tax policy should avoid penalising consumers and emboldening criminals.

“The goal should be to create environmental stability, predictability, and confidence to foster business investment and innovation,” he said.

A key highlight in the report focused on Malaysia, using the country as a case study.

A significant tobacco excise hike in 2015 led to a 41.7 per cent increase in illicit cigarette sales within one year, ballooning the black market by 72.9 per cent by 2020.

However, Malaysia has observed a reduction in illicit cigarette volumes recently due to a temporary halt on further tax increases and stronger enforcement measures.

This makes for an opportune time to implement a multi-year tax calendar as a recent survey by Merdeka Center showed 65 per cent of respondents supported such a tax calendar which allowed for moderate and predictable increases.

The event also featured a panel discussion between Ferlito, tax policy senior advisor Veerinderjeet Singh and Australian Association of Convenience Stores chief executive officer Theo Foukkare where they discussed potential regional actions.

Veerinderjeet advocated for Malaysia and other Asean countries to adopt more transparent, rules-based tax systems to rekindle investor confidence.

“The value-added tax (VAT) system is a well-tested system that is in operation in many nations.

“Asean nations should work together to ensure that the VAT, goods and services tax (GST) or sales or service taxes are integrated and aligned so that arbitrage opportunities are curtailed,” he added.

Joining the discussion online from Australia, Foukkare recounted lessons from Australia, where illicit tobacco networks contribute to organised crime.

“In Australia, we have a clear example of the negative impact resulting from ill-conceived tax policies.

“Escalating excise taxes on legal tobacco have driven consumers to the black market, which is now dominated by international criminal groups,” Foukkare said.

Looking ahead, CME proposed a reform agenda centred on stability, simplicity, and fairness.

Key recommendations included the adoption of a rationalised VAT, supported by moderate, predictable, and transparent excise systems, along with tax calendars that enable businesses to anticipate and respond to changes.

“Excise taxation should not be a guessing game for businesses. Predictability is not just good for planning; it is a public good that helps governments and companies alike,” said Ferlito.

Veerinderjeet also suggested a five- to 10-year fiscal consolidation roadmap to broaden revenue collection and control expenditure, proposing engagement with business and civil groups to refine such strategies.