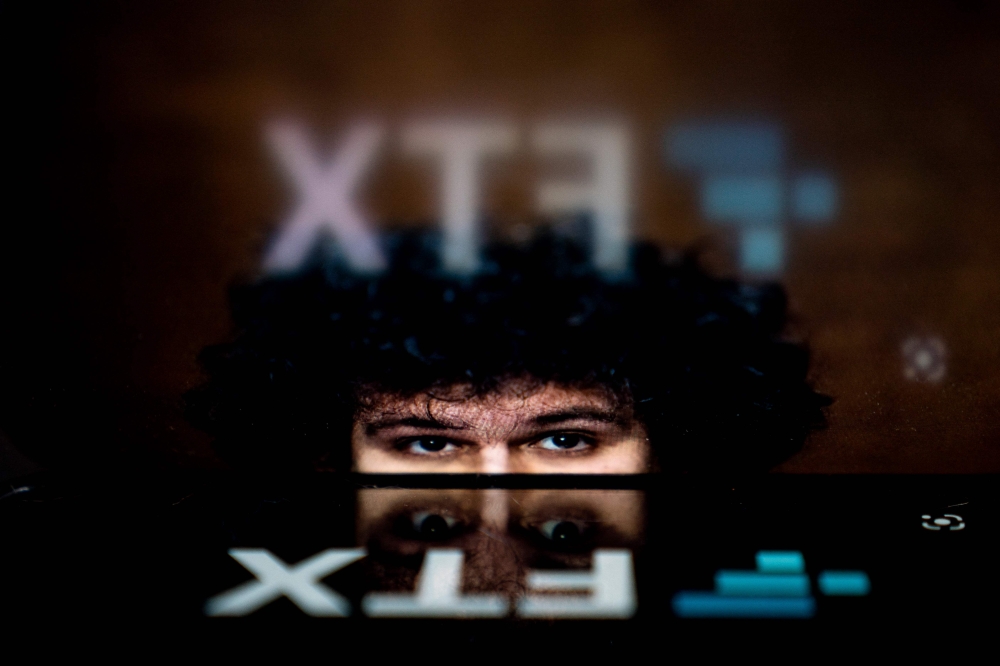

WASHINGTON, March 26 — FTX, the bankrupt company once run by disgraced crypto king Sam Bankman-Fried, will sell two-thirds of its shares in hot AI startup Anthropic for US$880 million (RM4.1 billion), a court filing said yesterday.

The shares in Anthropic were considered plum assets in the remains of the FTX empire that collapsed in late 2022, when revelations showed occurrences of massive fraud by Bankman-Fried and his close associates.

Bankman-Fried, 32, was found guilty in November 2023 on a raft of charges and is set to be sentenced at a federal court in New York on Thursday, with prosecutors seeking a 40 to 50 years in prison.

The biggest chunk of the Anthropic shares will go to ATIC Third International Investment Company, which is affiliated to the Mubadala sovereign wealth fund in the United Arab Emirates, the court filing said.

ATIC will pay US$500 million for its stake in Anthropic, the document showed, while about 20 other buyers, including Bankman-Fried’s former employer Jane Street Global Trading, will make out the rest.

The move will make a tidy profit for FTX, which invested US$500 million in generative AI startup Anthropic in 2021, at the height of the company’s stature as a cryptocurrency giant.

Founded that year, Anthropic was created by former employees of OpenAI, the company behind ChatGPT.

The company is best known for its chatbot Claude and has made waves for its mission to release AI models with stricter guardrails than those from ChatGPT and other chatbot rivals.

The bankruptcy proceedings for FTX have been complex and contentious with court-appointed CEO, John J. Ray III, tasked with recovering assets for creditors.

FTX has said it expects to repay customers in full and reported it had US$6.4 billion in cash as of late February, according to the Wall Street Journal. — AFP