KUALA LUMPUR, March 27 — The biggest shareholder of MBM Resources Bhd, Med-Bumikar Mara Sdn Bhd, and its wholly-owned subsidiary Central Shore Sdn Bhd (CSSB) have rejected UMW Holdings Bhd's offer to take over the company.

In a Bursa Malaysia filing yesterday, UMW said Med-Bumikar Mara Sdn Bhd and CSSB had separately rejected its offer to acquire their collective 50.07 per cent of equity interest in MBM.

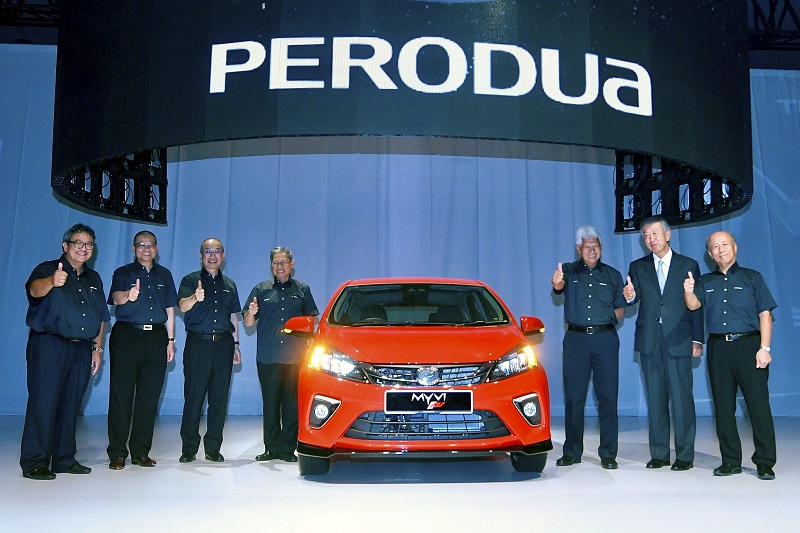

However, the diversified group said it would continue to engage Med-Bumikar and CSSB on its intention to take control of MBM and gain a higher stake in carmaker Perusahaan Otomobil Kedua Sdn Bhd (Perodua), The Star reported.

“Accordingly, UMW has notified Med-Bumikar and CSSB respectively in writing of its decision to extend the period for which MBM’s offer shall continue to be valid, from March 28 to April 30,” it said.

Early this month, UMW made an offer to buy all the ordinary shares in MBM controlled by Med-Bumikar and CSSB, both representing a 50.07 per cent interest in MBM worth RM501 million.

The offer came after UMW proposed to buy 14 million ordinary shares, or 10 per cent in Perodua held by Permodalan Nasional Bhd (PNB) Equity Resource Corp Sdn Bhd (PERC), at a price of RM417.5 million.

For MBM, it owns a 22.58 per cent of effective equity interest in Perodua.

Additionally, the proposals to take over MBM and acquire an additional 10 per cent stake in Perodua from PERC would increase UMW’s interest in Perodua to 70.6 per cent.

Its wholly owned subsidiary, UMW Corporation Sdn Bhd, currently holds a 38 per cent equity interest in Perodua and based on UMW’s offer for PERC, Perodua would be valued at about RM4.18 billion.