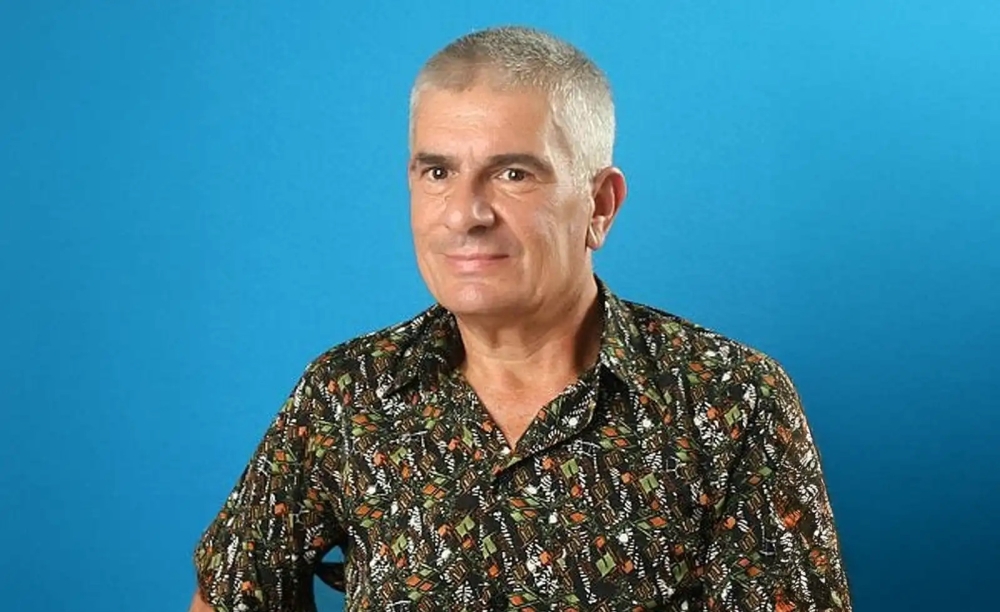

KUALA LUMPUR, July 27 — The eight individuals claiming to be the Sulu sultan’s heirs are not entitled to get more than RM5,300 every year from Malaysia, as that was the fixed amount that has been agreed to in agreements dating back to 1878 and 1903 in relation to Sabah, former attorney general (AG) Tan Sri Tommy Thomas said today.

Thomas noted that the Sulu sultan had on January 22, 1878 signed a grant that granted and ceded lands in Sabah “forever and in perpetuity” to two men who were the representatives of the British North Borneo Company, stressing that this was not a lease and that it was for a fixed amount of 5,000 dollars per year.

“The ‘consideration’ for the cession was compensation in the sum of 5,000 dollars per annum, impliedly also for ever. That sum is fixed, and not subject to any increase or review,” he said in a lengthy statement published by financial daily The Edge’s website.

Later, the Sulu sultan on April 22, 1903 signed a confirmatory deed with the British North Borneo governor EW Birch, to confirm that some islands which were not named in the 1878 document were also ceded or given to the government of British North Borneo, with the “cession” money increased by 300 dollars a year.

Thomas noted that from 1903, “the annual compensation has been fixed at 5,300 dollars”.

Later, in 1946, when North Borneo — as Sabah was known — became a colony of the United Kingdom, the British government became successor in title to the British North Borneo Company and this government paid the annual 5,300 dollars to the Sulu claimants between 1946 and 1963.

With the formation of Malaysia in 1963, Malaysia then continued making such annual payments and without interruption until 2013.

At another point in his statement, Thomas stressed that the amount that must be paid every year to the Sulu claimants was already fixed in 1878 and 1903, and that it only amounts to RM5,300 annually by Malaysia.

“The only loss that the Sulu Claimants suffered was the loss of the annual compensation sum of RM5,300/-: no more or no less,” he said, when referring to the disruption of payments by Malaysia since 2013 after an armed intrusion of Sabah by men claiming to be linked to a self-styled Sulu sultan.

Thomas said he had as the attorney-general in a September 19, 2019 letter wrote to the Sulu claimants’ lawyer, offering the payment of arrears from 2013 to 2019 amounting to RM37,100 together with 10 per cent simple interest of RM11,130, and that the total RM48,230 would have meant there would be no longer be any dispute between Malaysia and the Sulu claimants.

But Thomas noted that the Sulu claimants’ lawyer Paul Cohen had in an October 21, 2019 letter rejected the offer for RM48,230 for his clients, with the UK-based lawyer claiming that there was an “imbalance” between the yearly RM5,300 payment and the “actual value” of Sabah in light of the “unanticipated discovery and development of certain substantial natural resources (hydrocarbons, crops and others)”.

But Thomas said the Sulu claimants are not entitled at all to make such an argument over what Sabah is worth now in 2022, as the Sulu sultan had already given away Sabah when he signed the 1878 documents and no longer owns these lands.

“However, the 1878 Grant contains no right for the Claimant to make such extravagant, unsustainable claims in law if a breach of contract on the part of Malaysia occurs,” he said.

“‘The actual value of the territory’, viz, the market value in 2022 of the lands ceded to the North Borneo Company in 1878 can never be the subject of any claim by the Claimants. It is hopelessly remote and scandalously opportunistic by any yardstick.

Thomas said that from January 22, 1878 onwards which was the grant was signed, the land of Sabah never belonged to the Sulu sultan and the title, ownership and sovereignty of the lands had also been given away by him.

Thomas said it would be legally unsustainable to make any claim to the land of Sabah after the 1878 event, pointing out that in fact no such claim had been made for the next 130 years and only surfaced for the first time in the Sulu claimants’ arbitration bid in Spain in 2018.

Thomas also alleged that the Spanish arbitrator Gonzalo Stampa — whose appointment as arbitrator had been challenged by Malaysia — was a “rogue” arbitrator who had “rewrote” the 1878 document when deciding on February 28, 2022 to order Malaysia to pay US$14.9 billion to the eight Sulu claimants.

“It is a claim that has no basis in fact or law. What the Sulu Claimants are demanding is a unilateral re-writing of the 1878 Grant. No doubt Stampa when awarding US$14.9 billion in his Award re-wrote the terms of the 1878 Grant,” he said.

While insisting that Stampa’s US$14.9 billion arbitration award is invalid and unenforceable, Thomas also pointed out that Malaysia as a sovereign country has state immunity where it cannot be sued in the courts of other countries against its will.

Even while disputing the entire arbitration, Thomas also said the US$14.9 billion award was made against the government of Malaysia and which means only Malaysia’s assets can be subject to execution.

Thomas claimed that the Sulu claimants’ UK-based lawyer Paul Cohen should know that Malaysia enjoys such “state immunity” in all the local courts of every nation where Malaysia’s assets are located, and claimed that the latter sought to overcome this by seeking to have Petronas’ subsidiaries’ assets in Luxembourg seized.

“But Petronas is a separate entity from Malaysia. The award does not bind Petronas, and cannot be enforced against the assets of Petronas,” Thomas said of the US$14.9 billion award.

Thomas said it was deeply troubling that Stampa — whom he described as a “rogue operator” acting in breach of court orders within his own country — could issue a multi-billion-dollar award against the Malaysian government, which is one of the largest awards ever issued against a country.

“It is particularly outrageous because the basis of that multi-billion dollar award is an alleged breach of a contract worth only RM 5,300 per annum,” he said.

On July 12, authorities in Luxembourg seized the assets of two Petronas subsidiaries — reportedly worth over US$2 billion (RM8.9 billion) — on behalf of the Sulu claimants who were seeking to enforce the US$14.9 billion arbitration award.

On July 12, Petronas said these two subsidiaries had previously divested or sold its entire assets in the Republic of Azerbaijan and had already repatriated the proceeds from the divestment exercise, adding that it viewed the actions taken against the company as “baseless” and is working vigorously to defend its legal position on this matter.