KUALA LUMPUR, Aug 18 — A former CEO of 1Malaysia Development Berhad (1MDB) today disagreed in court to suggestions that he had committed various offences such as criminal breach of trust and money-laundering when the government-owned company’s subsidiary transferred US$175 million in 2014 to a company now known to be a fake entity.

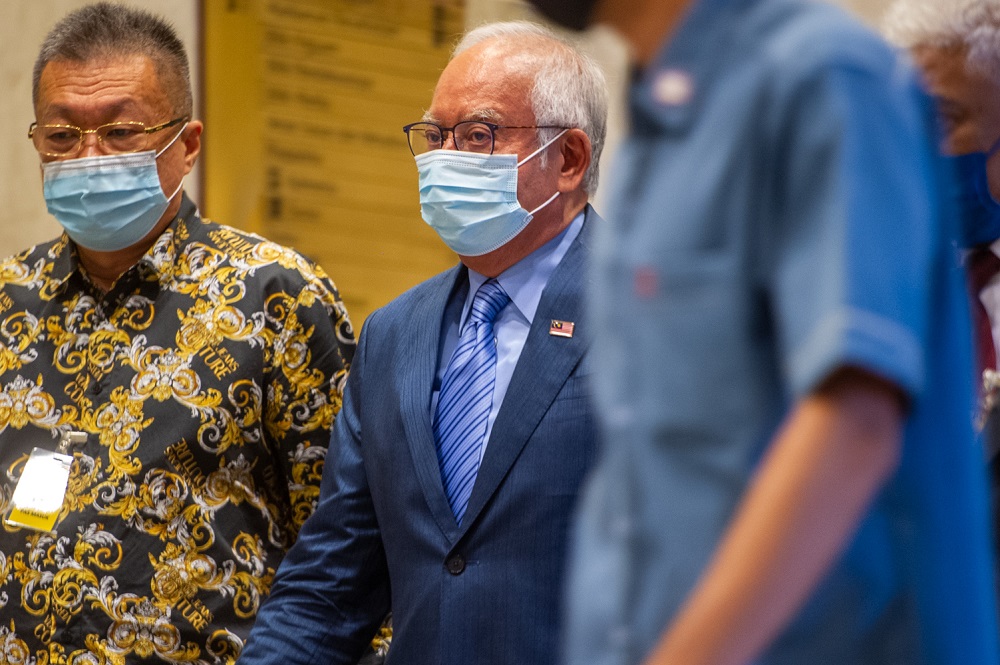

The former 1MDB CEO Mohd Hazem Abd Rahman denied such suggestions while testifying as the 10th prosecution witness against former prime minister Datuk Seri Najib Razak in the latter’s trial involving more than RM2 billion of 1MDB funds.

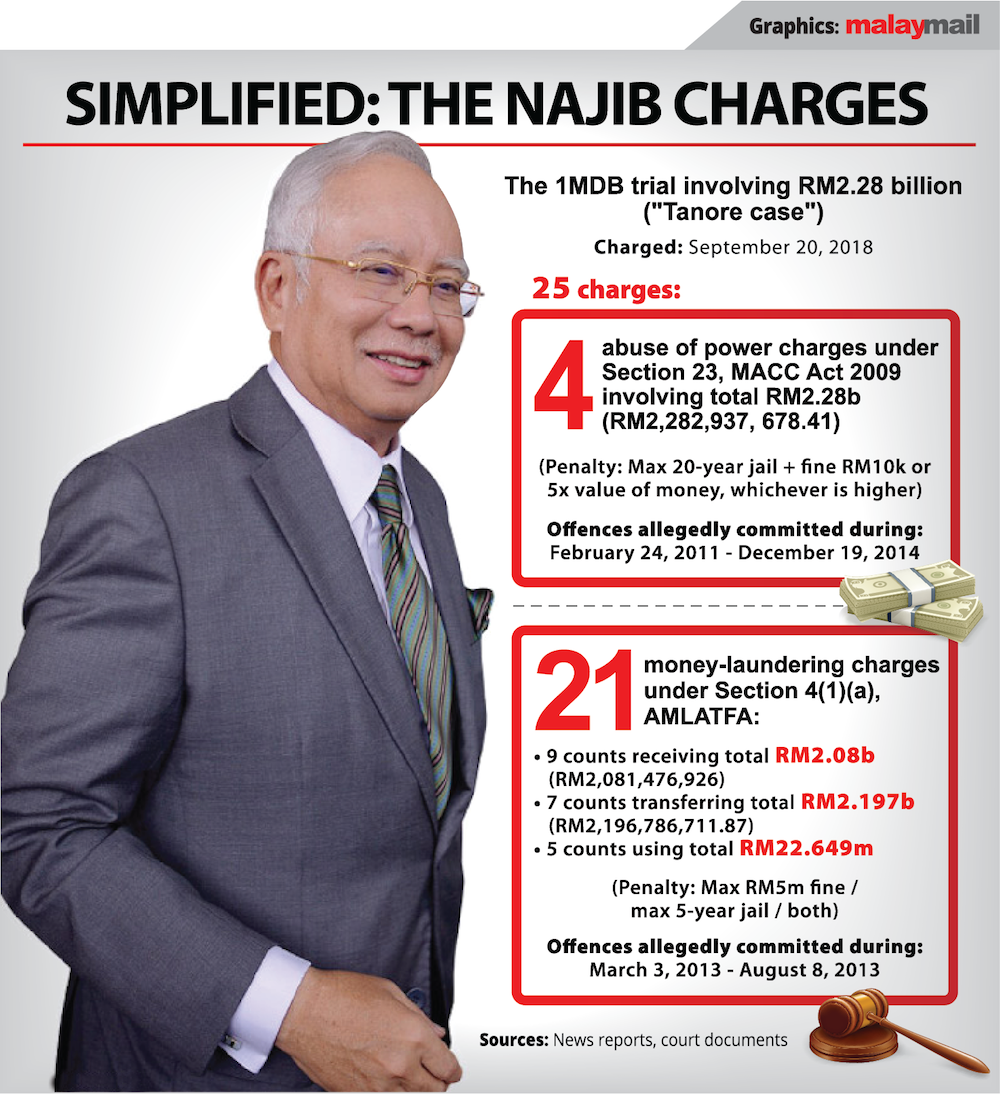

In defending his client Najib who is facing charges of power abuse and money laundering in the 1MDB trial, lawyer Tan Sri Muhammad Shafee Abdullah quizzed Hazem over 1MDB documents and bank documents in relation to the transfer of US$175 million.

A 1MDB subsidiary known as 1MDB Energy Holdings Limited had in 2014 borrowed a total of US$1.225 billion from Deutsche Bank via two loans (US$250 million in May 2014 and US$975 million in September 2014).

1MDB had taken up the loans totalling US$1.225 billion to buy back the options it had given to a real entity — Abu Dhabi’s Aabar PJS Investments — to take up shares in two 1MDB subsidiaries when 1MDB was raising US$3.5 billion in funds previously to buy independent power plants.

But bank documents previously produced in court had shown that 1MDB Energy Holdings Limited had paid a total of US$856 million from the total US$1.225 billion borrowed to two companies now known to be fake — namely US$175 million to the fake Aabar PJS Investments Limited in British Virgin Islands (BVI), and US$223.333 million and US$457,984,607 to the fake Aabar PJS Investments Limited incorporated in Seychelles.

On the first day of the trial, the prosecution had said it would prove some of the funds that were transferred to the two fake Aabar entities had in 2014 allegedly made their way to Najib’s bank account in 2014, namely two separate sums in pound sterling that were equivalent to RM4,093,500 and RM45,837,485.70.

Today, Shafee zeroed in on the US$250 million loan which was released by Deutsche Bank on May 26, 2014 and with the bulk of over US$239 million paid out on May 28, 2014 to the Falcon Bank account in Hong Kong of the 1MDB subsidiary, which was then transferred US$175 million also on May 28, 2014 to the fake Aabar BVI’s BSI bank account in Lugano, Switzerland.

Prior to these events in 2014, Hazem had on April 28, 2014 signed on behalf of 1MDB Energy Holdings Limited an option buyback agreement with the fake Aabar, to state that the 1MDB entity would commit to paying US$989 million to buy back the options and that US$175 million of the US$989 million would be paid first upon the date of the agreement.

Among other documents scrutinised by Najib’s lawyer in the trial today was a May 22, 2014 decision by the 1MDB board of directors through a directors’ circular resolution, where the directors signed on to the resolution instead of holding a meeting to agree to terminate the original granting of options to Aabar and to agree for 1MDB Energy Holdings Limited to borrow up to US$300 million from Deutsche Bank. Although the 1MDB board approved a loan of up to US$300 million, the 1MDB subsidiary eventually took up US$250 million in a loan from Deutsche Bank.

Today, Shafee suggested to Hazem that there was no approval from the 1MDB board of directors when the 1MDB entity borrowed US$250 million from Deutsche Bank, but Hazem disagreed and cited the May 22, 2014 directors’ circular resolution.

Shafee claimed the directors’ circular resolution was a “fabricated” document, with Hazem agreeing that he had no other collaborative document for his assertion that the 1MDB board had approved the borrowing of funds from Deutsche Bank.

Hazem disagreed with Shafee’s suggestion that the only reason why he had signed the April 28, 2014 agreement with the fake Aabar was because he knew it was needed to justify the transfer of funds to the fake Aabar.

Hazem disagreed that he had known the US$175 million was not going to be used to buy back the options from Aabar when he had signed the April 28, 2014 agreement, agreeing that he genuinely believed the US$175 million would be used for the option buyback and that he now knows the option buyback never happened.

Hazem disagreed with Shafee’s suggestion that he had known that the US$175 million borrowed by 1MDB were being misappropriated for the benefit of Low Taek Jho or Jho Low and his alleged co-conspirators — 1MDB officials Azmi Tahir, Jasmine Loo, Terence Geh and Aabar officials Mohamed Badawy Al Husseiny and Khadem Al-Qubaisi, also disagreeing he was part of such a team.

Shafee suggested that Hazem had provided banks with the fraudulent justification for the transfer of US$175 million to the fake Aabar through his signing of the April 28, 2014 agreement, but Hazem disagreed.

Shafee: I further put to you that by executing it (the April 28, 2014 agreement), you have committed together with others, the crime of criminal breach of trust under the Penal Code, what do you say to that? Which means you compromised company funds, you took company funds and you committed criminal breach of trust to benefit others.

Hazem: I disagree.

Shafee continued to accuse Hazem of committing other crimes in relation to 1MDB, even going on to suggest that it is Hazem and not his client Najib that should be put on trial over 1MDB matters.

Shafee: You also committed the crime of money laundering, my client shouldn’t be there, it is you and others. Namely by disguising proceeds of unlawful activities and at the same time removing that fund from Malaysia into a non-authorised foreign entity, it matches exactly what you are doing.

Shafee: You see, you say this is meant for this option buyback, but in fact it’s not true, there was no option buyback. So the payment is a disguise so that you can transmit the money to benefit someone else.

Hazem: I disagree.

Shafee: Now you also committed the offence of abuse of position, abuse of power, because as CEO of 1MDb, you enabled and facilitated the misappropriation of the US$250 million, you facilitated it for the sole benefit of Jho Low, you and the conspirators.

Hazem: I disagree.

Hazem further disagreed that he was used by Low or that he had aided Azmi and Geh in committing the alleged criminal breach of trust over the US$175 million.

Hazem also disagreed with Shafee’s suggestion that the 1MDB board of directors’ resolution was backdated to May 22, 2014 in order to cover up the fraudulent act committed.

The afternoon session of today’s trial had started at 3pm and ended at around 5.15pm, following a shortened morning session due to Najib having to meet with Umno leaders on the selection of a candidate for the new prime minister.

Najib’s 1MDB trial resumes tomorrow morning, with Najib’s lawyers to continue cross-examining Hazem.

High Court judge Collin Lawrence Sequerah today decided that the lunch break will be shortened tomorrow in order to make up for lost time, remarking: “We keep losing a lot of time, little pockets here and there, when you add it up, we are losing out on time, as it is Hazem has been here how many months.”

The judge also asked what stage the defence team was at in cross-examining Hazem, with Shafee saying that Najib’s legal team had prepared about 200 pages of questions and that they have so far gone through about 73 pages of the questions.

.jpg)