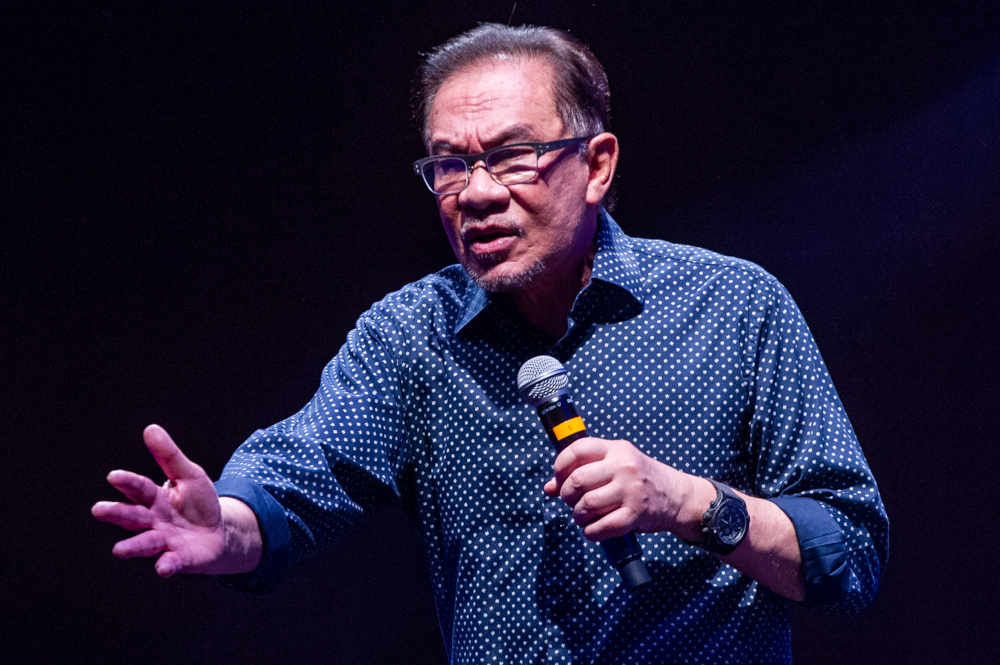

KUALA LUMPUR, April 6 — Opposition Leader Datuk Seri Anwar Ibrahim today raised what he said was a lack of initiative by the Perikatan Nasional (PN) government to bolster investor confidence in Malaysia’s financial system.

The PKR leader claimed that local financial institutions are still being plagued by the 1Malaysia Development Berhad (1MDB) scandal and that neither the current government nor Bank Negara Malaysia (BNM) were taking proactive steps to address this.

“Unfortunately, until all the ghosts of the 1MDB scandal are exorcised, Malaysia will remain the target of doubts from investors and other domestic and international financial institutions.

“This will further undermine confidence in the Malaysian economy, which is already low due to the actions of the PN government,” he said in a statement on Facebook.

According to Anwar, BNM has yet to clarify claims that fugitive financier Low Taek Jho — commonly known as Jho Low — had made payments to the family of former central bank governor.

Anwar did not name the former BNM governor, but was likely referring to Tan Sri Zeti Akhtar Aziz.

Several news outlets, including The Straits Times previously cited Singapore government officials saying they had alerted BNM in 2015 and 2016 about questionable bank transfers totalling some RM66 million from Low’s accounts to those owed by Zeti’s husband and son as far back as 2008.

Zeti denied the allegations last December, calling them false and malicious.

However, the allegations were picked up by former prime minister Datuk Seri Najib Razak who is appealing against his conviction of several corruption, money laundering, and power abuse amounting to RM42 million owned by SRC International Sdn Bhd, a former subsidiary of 1MDB. The appeal is currently being heard in the appellate court.

Anwar questioned the recent appointment of a senior banker who has links to the 1MDB scandal as Chairman of Malaysia Development Bank Limited, an entity owned by the Ministry of Finance (MoF).

He added that the same banker is seeking to acquire substantial shares in Ambank’s fundraising exercise via a Singapore private equity company.

“The timing and the involvement of particular parties in Ambank’s private placement exercise raises concerns about governance and transparency and we wish to know whether BNM has conducted adequate due diligence to ensure this transaction meets the highest standards.

“Observers will wonder based on these facts whether the seeds of the next major financial sector scandal are being planted today by the actions of the Ministry of Finance and BNM,” he said.

He added, “In the absence of any Parliamentary oversight it would be hard to argue the case otherwise.”