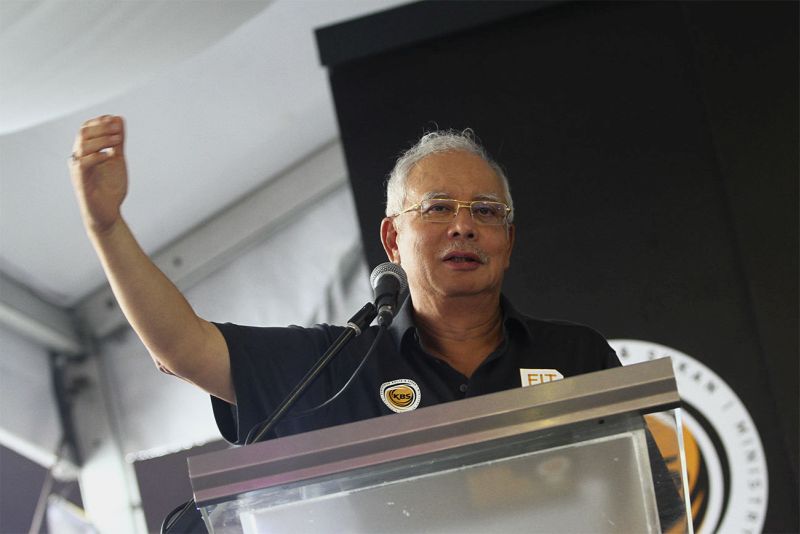

KUALA LUMPUR, March 25 ― Prime Minister Datuk Seri Najib Razak today defended sovereign investment fund 1 Malaysia Development Berhad’s (1MDB) commission payout to US-based investment banker Goldman Sachs for raising several of its bonds.

In a written reply to Petaling Jaya Utara MP Tony Pua, Najib who is also Finance Minister said that the fee earned by Goldman Sachs from raising bonds for 1MDB was appropriate given the size of the bonds, the tenure, the illiquidity and the credit risk involved as many other bonds were issued at a “normal” discounted price.

“Any difference between the issue price and the nett profit from the bonds is not just made up of the commission and other expenditures but also the effective yield of the bonds, which takes into account the discounts and the remaining bond tenure,” Najib added.

He however did not specify the breakdown of the amount of the commissions paid to Goldman Sachs- as requested Pua, for raising three series of bonds for 1MDB Global Investment, 1MDB Energy and 1MDB Energy (Langat) Limited valued at US$3 billion, US$1.75 billion and US$1.75 billion respectively.

Last year, Pua urged Putrajaya to reveal the parties who were purportedly paid millions of ringgit in commission by 1MDB in 2012 and 2013 when it raised RM1.52 billion in bonds in those two years.

He based his queries on a report by business daily The Edge Weekly which had revealed that 1MDB had paid RM1.52 billion in commissions when the entity raised its loans.

The Edge report also revealed that the standard fees payable to investment bankers for other entities and governments ranges between only 0.1 per cent and 2 per cent, raising concerns that 1MDB meanwhile had overpaid.