TOKYO, Jan 27 ― The yen rose and the yuan fell in offshore trade today as worries that China is struggling to contain the spread of a pneumonia-like virus sparked a bout of risk aversion.

Japan's currency, often sought as a safe-haven in times of uncertainty, rose to the highest in almost three weeks versus the dollar, while the yuan fell to its lowest since January 8.

China's Cabinet announced it will extend the Lunar New Year holidays to February 2, to strengthen the prevention and control of the new coronavirus, state broadcaster CCTV reported early today. The holidays had been due to end on January 30.

Hong Kong has also banned the entry of visitors from China's Hubei province, where the new coronavirus outbreak was first reported, highlighting the difficulty officials face during a peak travel season.

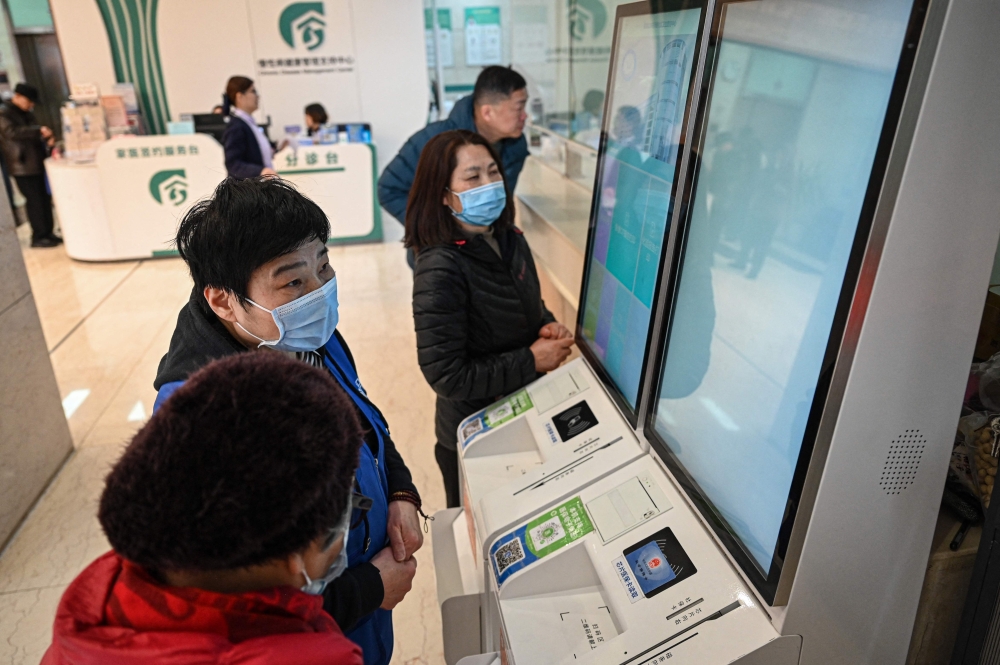

Health authorities around the world are racing to prevent a pandemic of the virus, which has infected more than 2,000 people in China and killed 76.

There are concerns that tourism and consumer spending could take a hit if the virus spreads further, which would discourage investors from taking on excessive risk.

“There is a lot of uncertainty about how much further the virus will spread, and this is behind the moves in currencies,” said Yukio Ishizuki, foreign exchange strategist at Daiwa Securities in Tokyo.

“I thought dollar/yen would be supported at 109, but it broke through that, so now the next target is 108.50. This risk-off mood is likely to continue for a while.”

The yen rose 0.3 per cent to 108.91 per dollar today, reaching its strongest level since January 8.

Japan's currency also jumped around 0.5 per cent versus the Australian and New Zealand dollars as worries about the virus drew traders toward safe-haven currencies and away from currencies that are more sensitive to risk.

In the offshore market, the yuan fell more than 0.3 per cent to 6.9625 against the dollar, its weakest since January 8.

The dollar index against a basket of six major currencies was little changed at 97.884.

Traders said market moves could be exaggerated due to low liquidity, because financial markets in China, Hong Kong, and Australia are closed for holidays.

The virus, which emerged late last year from illegally traded wildlife at an animal market in the central Chinese city of Wuhan, has spread to other countries, including Singapore, South Korea, Canada, Japan, and the United States.

China's Hubei province, where Wuhan is located, said today that 76 people have died and 1,423 new cases of the coronavirus outbreak have been identified as of end of yesterday.

The outbreak has evoked memories of Severe Acute Respiratory Syndrome (SARS) in 2002-2003, another coronavirus which broke out in China and killed nearly 800 people in a global pandemic. ― Reuters