WASHINGTON, July 30 — The Federal Reserve opened a two-day policy meeting today, poised to cut the key US lending rate for the first time in more than a decade amid rising economic uncertainties.

The Federal Open Market Committee raised the benchmark interest rate four times last year but has signalled that it will backtrack given worrying signs in the United States and major trading partners amid President Donald Trump’s aggressive trade tactics.

Moments earlier, Trump continued his high-pressure campaign demanding more stimulus to the economy, telling reporters he wants to see a “large cut” by the Fed.

“I’m very disappointed in the Fed,” he said.

Markets overwhelmingly expect the central bank will cut the key lending rate by 25 basis points on Wednesday — the first decrease in more than a decade — amid a slowing global economy hit by trade uncertainty and sluggish business investment.

That would undo the Fed’s most recent increase in December, which was the last of four in 2018 as the US economy picked up steam.

The Fed was then working to “normalise” monetary policy, raising the rates off zero to ensure it would have ammunition to help support the economy in the event of a downturn.

But Trump seems to be calling for a deeper cut of 50 basis points or perhaps more — a move typically used only when the economy is experiencing a steep slowdown.

The current economic expansion is now entering its 11th year, making it the longest on record. And with steady job growth, low unemployment and asset prices running high, economists are split as to whether the world’s largest economy needs stimulus.

Fed Chairman Jerome Powell, the target of Trump’s ceaseless barbs, has signaled the bank is likely to lower rates due to economic uncertainties, including Trump’s protracted trade wars with China and Europe which have helped cause business investment to fall sharply.

The Commerce Department today confirmed that inflation remained tame last month, meaning there is slim likelihood of a breakout in price pressures.

While other economists say rate the increase in December was a mistake, many say the Fed is likely to roll out one or two more rate cuts in coming months.

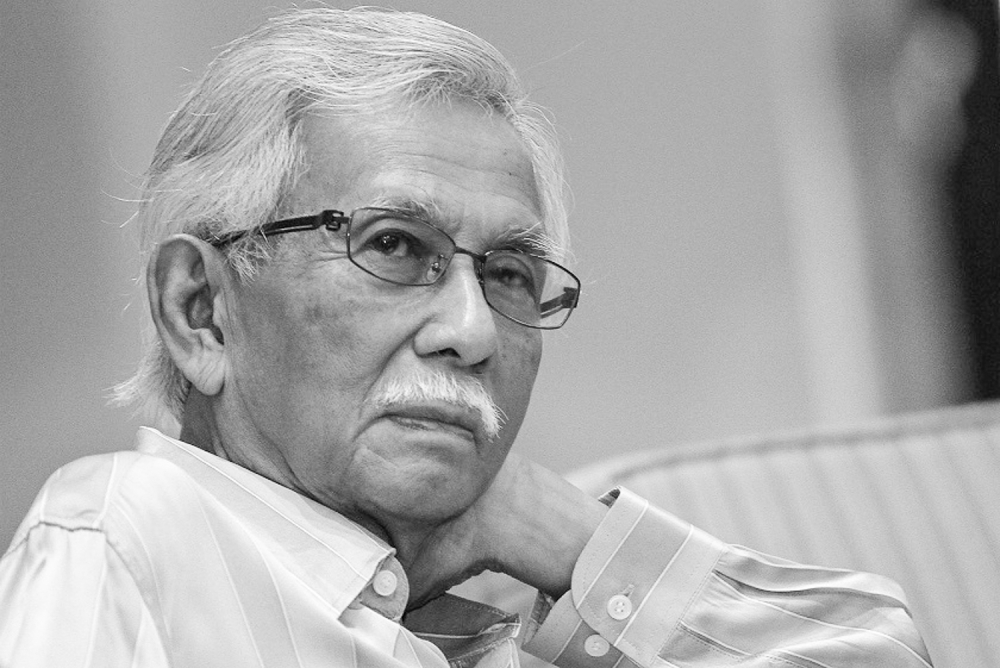

“I think they probably did go too far,” said economist Adam Posen, former member of the Bank of England’s policy board.

But he told AFP the mistake only became clear in hindsight.

“You should view this as an error by Fed but within the normal bounds,” he said.

Posen, head of the Peterson Institute for International Economics, said he expects one more rate cut this year. — AFP