KUALA LUMPUR, Sept 13 — The Edge Group publisher Datuk Ho Kay Tat asked authorities today to justify criminally charging two journalists over a businessman’s claim of defamation from two articles on penny stock manipulation published in 2020 and 2021.

Earlier today, former editor-in-chief of The Edge Azam Aris was charged with two counts of criminal defamation against a Malaysian businessman and four firms in the offending reports.

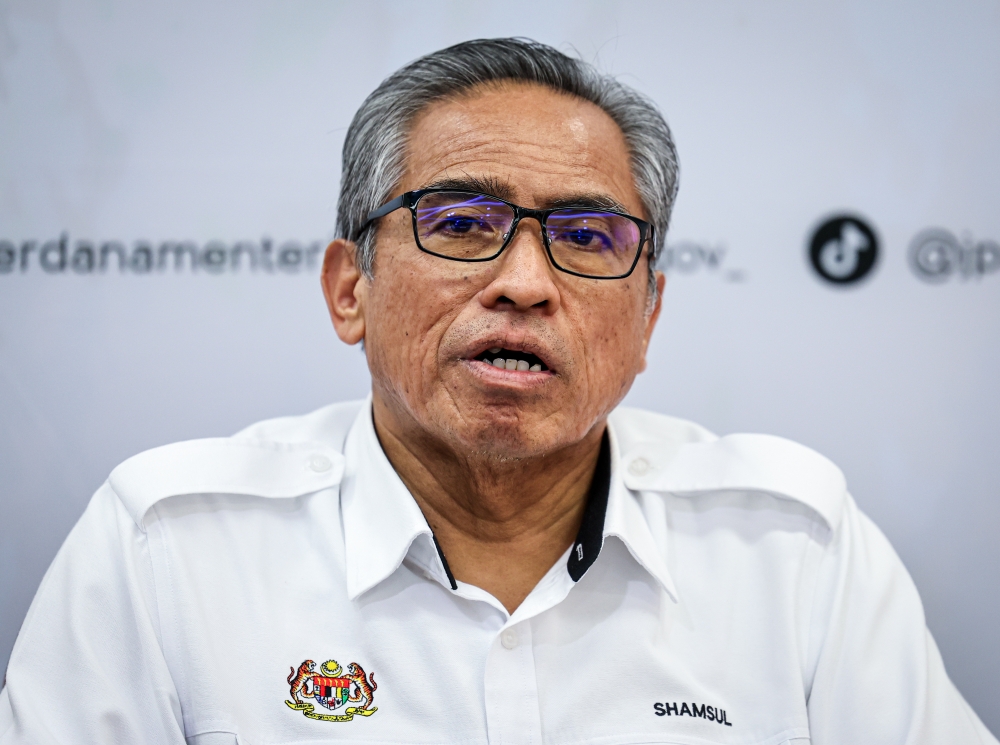

The current editor of The Edge, M. Shanmugam, was also named in the complaint but has not yet been charged.

Defamation is typically a civil dispute over alleged harm to a person or entity’s reputation, but some jurisdictions including Malaysia also have laws that allow for the matter to be treated as a crime.

“As a media that reports on the stock market and corporate sector extensively, we have a responsibility to highlight important matters to the investing public — including alerting them about how stock prices are being manipulated,” Ho said in a statement today.

“We are, therefore, baffled as to why the police and the Deputy Public Prosecutor’s (DPP) Office of Kuala Lumpur are pressing criminal defamation charges against us for informing investors about stock market manipulation.

“Where is the defamation?” Ho asked, adding the authorities should have advised the complainants to take up the matter in the civil courts rather than using public resources to treat the matter as a crime.

Ho said that the two articles titled “Hidden Hands Behind Penny Stocks Surge Under Scrutiny” (April 12, 2021) and “Hidden Hands Behind Penny Stock Surge” (September 21, 2020) were extensively researched using data and information sourced from Bursa Malaysia and company annual reports.

During several meetings with the investigating officers, Ho claimed that they were told to reveal the journalists involved in the article despite the potential dangers to them.

Ho said that manipulating the market will not only wreak havoc on the orderly function of the stock market but damage the reputation of Bursa Malaysia and cause innocent people to lose money.

“Regulators like Bursa Malaysia and the Securities Commission frequently advise investors to be cautious.

“The volatile trading of penny stocks which took place in 2020 and early 2021 has abated, following our last article in April 2021 and after warnings by market regulators.

“Many people have lost money as the prices of these stocks have collapsed. However, the losses would have been much more had the manipulation continued in a big way,” Ho said.

The charges against Azam were filed under Section 500 of the Penal Code, which is punishable by up to two years’ imprisonment, a fine, or both if convicted.

Azam, who left The Edge last November, claimed trial to both charges.

Shanmugam, who is currently abroad, will be charged upon his return.