KUALA LUMPUR, Oct 3 — As Malaysia grapples with a new wave of Covid-19 infections, Umno president Datuk Seri Ahmad Zahid Hamidi tday asked the federal government to consider putting back a moratorium on loans until the year end.

The Bagan Datok MP also asked banks to delay bankruptcy proceedings against borrowers who failed to service their loans.

“Umno asks the government to consider an automatic extension on the moratorium starting from October to December 2020 to help the rakyat facing the second wave of Covid-19.

“Banks need to stop auction proceedings and bankrupt declarations if there are people who can’t afford to pay their loans after the moratorium period ends due to job loss,” he tweeted.

UMNO minta kjn timbangkan lanjutan moratorium automatik mula Okt hingga Dis 2020 bg bantu rakyat hadapi gelombang 2 Covid-19. Bank perlu hentikan prosiding lelongan & pengisytiharan muflis jika ada rakyat tidak mampu bayar pinjaman slps tempoh moratorium tamat kerana tiada kerja. pic.twitter.com/AKW1b7eNaZ

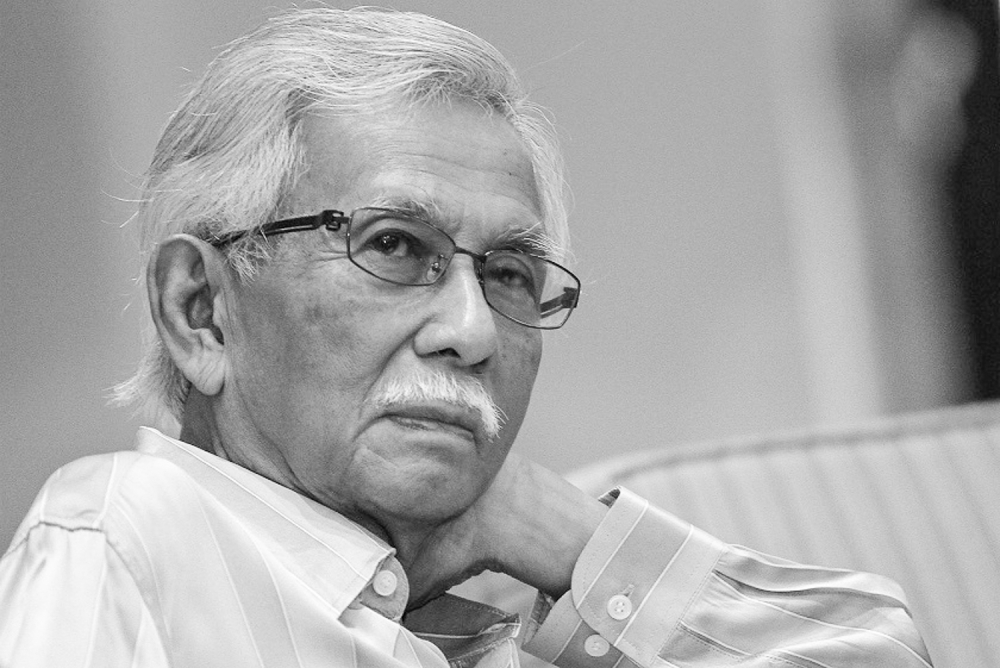

— Ahmad Zahid Hamidi (@DrZahidHamidi) October 3, 2020

Zahid’s plea comes after Malaysia recorded another 317 new Covid-19 cases today. The infections were all transmitted locally following a rise in the number infected travellers returning to the peninsula after crossing the South China Sea to Sabah.

Opposition Leader Datuk Seri Anwar Ibrahim had last month similarly called on the Perikatan Nasional (PN) government to carry out a more targeted moratorium on loans for those economically affected by the pandemic and ensuing three-month lockdown back in March.

The Port Dickson MP claimed that banks in the country had only contacted 1.4 million of their 8.3 million borrowers.

On September 30, the final day of loan moratorium period, Bank Negara Malaysia (BNM) said about 500,000 applications for repayment assistance have been received and 98 percent been approved .

In a statement BNM said that the 500,000 applications are merely a sixth of the three million borrowers BNM had anticipated will need help under the targeted loan repayment assistance.

The central bank also said borrowers who have lost their jobs this year and are still unemployed will be able to freeze loan repayments by a further three months, while borrowers whose salaries have been cut due to Covid-19 will be offered reduced loan instalments in proportion to their salary reduction, depending on the type of financing.