PETALING JAYA, April 30 — With Malaysians forced to stay home during the nationwide shutdown, the Movement Control Order (MCO) has changed the way we watch television.

TV viewing during the MCO saw a 30 per cent increase with almost one million viewers per average minute, according to a Nielsen Television Audience Measurement.

Since the first confirmed Covid-19 case was reported on January 25, an average minute rating was recorded at a whopping 4.4 million, an increase of 950,000 compared to the previous figure of 3.5 million.

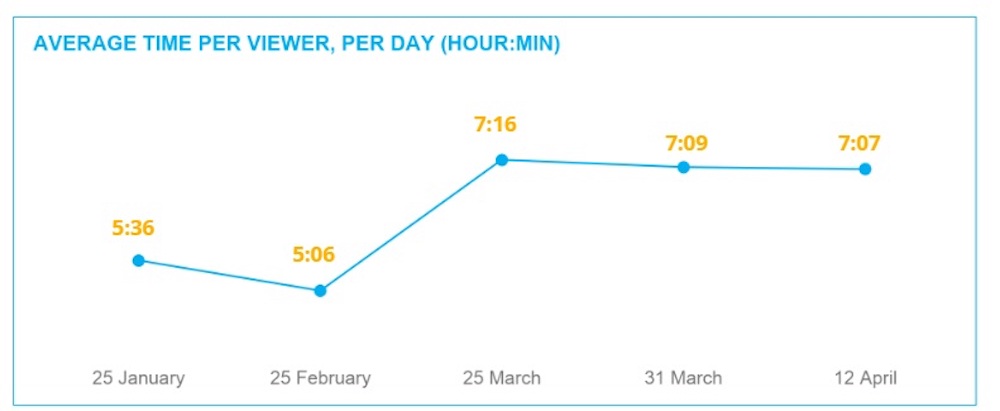

Audiences in Malaysia watched an average of seven hours and seven minutes of TV a day, 27 per cent higher compared to the end of January.

A distinct change was seen in the distribution and size of three time-defined consumer segments often used in television rating analysis.

On January 25, viewers in the Medium category who typically watch eight to 16 hours a day saw a distribution of 49 per cent but as the Covid-19 situation worsened, that figure leapt to 58 per cent by April 12.

Light viewers — those who watch zero to eight hours a day — on the other hand, saw a drop from 44 per cent to 32 per cent in the same period.

News, reality TV and cookery and female orientated programmes saw significant spikes during the MCO.

“To look at it in a more simplistic way, at the end of January a daily total of around 29 million hours of television viewing was being consumed by the population, but by April 12 this had risen to 43 million hours, a staggering 49 per cent increase,” Nielsen Media Malaysia managing director Jon-Paul Best said.

Best said increases were seen across both free-to-air and paid platforms.

“While we expected a rise in viewing as more people tune in to television to stay informed as well as to stave off boredom, we are surprised by the extent of the increase, which has surpassed viewing levels seen before the recent digital revolution.”

While all broadcasters recorded a rise in viewership, they can fluctuate on a day-to-day basis according to genre and programming schedule.

But tough times lie ahead despite the upsurge that is reflective of families and households congregating to watch the telly.

Despite higher viewing rates, overall year-on-year advertising spending fell almost 25 per cent comparing March 2020 against March 2019.

The analysis said advertisers need to invest and reinvent amid the coronavirus pandemic.

The eight per cent decline in overall advertising spend from February to March signals that companies are cautious about advertising.

Providing a larger picture for the impact of this decline, travel and tourism, fast food, entertainment, airlines and department stores were the most severely hit, recording a 25 per cent difference in like-for-like advertising figures against March 2019.

“Some businesses have questioned the benefit of advertising at this time if the population is severely limited in terms of what it can buy.

“However, as supermarkets remain open and as FMCG brands are some of the biggest advertisers, we believe that now is the time to invest in reaching out across all key media platforms, when consumers are most attentive and are looking for empathy.

“For those products and services still available, consumers need reassurance, so companies should remain engaged and ensure that their brands and products remain relevant,” Best said.