KUALA LUMPUR, Dec 23 — The sight of aircraft grounded and parked globally in March this year due to travel restrictions and border closures imposed to control the spread of the novel coronavirus was just a beginning of the grave consequences that was in store for the sector throughout 2020.

Air demand continued to plummet thereafter as countries were hit by the second, third and some fourth waves of Covid-19 infections, making it difficult for air travel to be back in business.

Revenue streams were eventually paralysed, workforce furloughed, airports closed, deferment of new aircraft delivery and aircraft production halted.

Even as some sectors and industries have started to see green shoots or have recovered fully, the aviation industry doesn’t seem to be as lucky, not until 2024 at least.

Not the first crisis, but definitely the worst

The aviation world has survived various shocking events — the 9/11 terrorist attacks, 2003 SARS outbreak, 1997/98 and 2007/08 financial crises and global recessions; but nothing comes close to what Covid-19 has done.

According to the International Air Transport Association (Iata), global carriers would lose US$84.3 billion (RM341 billion) this year, making it the worst year in the aviation history, with air traffic not recovering fully until 2024.

Closer to home, Transport Minister Datuk Seri Wee Ka Siong had, on July 21, told Parliament that the Malaysian aviation industry is expected to lose RM13 billion this year, including a RM10.9 billion loss from local-based airlines — Malaysia Airlines Bhd (MAB), AirAsia Group Bhd and Malindo Airways Sdn Bhd.

Airport operators, Malaysia Airports Holdings Bhd (MAHB) and Senai Airport Terminal Services Sdn Bhd stand to lose a combined RM2.1 billion this year, he said.

Endau Analytics aviation analyst Shukor Yusof said 2020 would be seen as the ‘annus horribilis’.

Compared to 2014 when the local industry experienced two major catastrophes involving Malaysia Airlines’ MH370 and MH17 besides AirAsia Indonesia’s QZ850, the situation then and now was different but “in history, this is the worst!” he said.

The Malaysian Aviation Commission (Mavcom) expects passenger traffic this year to contract by between 72.8 per cent and 75.7 per cent year-on-year (yoy) to between 26.6 million and 29.7 million passengers.

It said local passenger traffic dropped to its lowest in the Malaysian aviation history, recording only 802,525 passengers in the second quarter, down 97.0 per cent yoy from 26.7 million passengers in the same quarter last year.

In the first half of 2020 (1H20), Air Traffic Rights (ATR) applications fell substantially by 55.6 per cent yoy against the same period in 2019.

Border restrictions

Covid-19 spread exponentially faster than SARS and travel nowadays has made the world far more interconnected than in 2003, leaving civil aviation authorities with no choice other than imposing travel restrictions and closure of international borders.

The government has implemented the movement control order (MCO) since March 18 with commercial airlines significantly reducing their overall network, starting with routes connecting China.

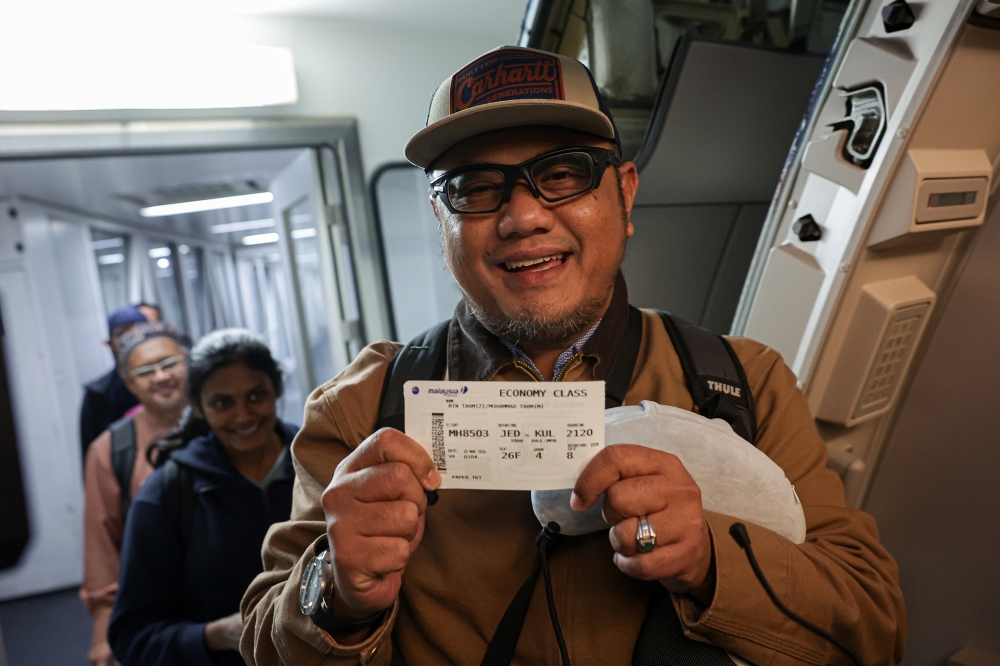

Operations were limited to domestic services and rescue flights with Wisma Putra repatriating Malaysians stranded overseas, as well as humanitarian services sending home foreign citizens that were stranded in the country.

Airlines had to make last minute cancellations to abide by the restrictions, with some re-routing passengers via reallocation onto other carriers which caused an additional cost to their operations.

In the first half of the year, a total of 169,728 domestic and international flights involving three national airlines, namely MAB, AirAsia and Malindo were cancelled, affecting 4.316 million passengers.

To address this situation, passengers were offered ticket refund, travel voucher, unlimited flexibility in travel date change, waiver of certain fees, and many more.

Mavcom registered some 2,340 ticket refund cases from consumers in 1H20 due to flight cancellation resulting from Covid-19, of the total, 2,146 were for refund requests and the remaining for change of flight dates.

Cargo on demand

Despite a huge contraction in passenger load factor, cargo movements on the other hand were making a healthy growth with the transportation of medical equipment such as disposable masks, rubber gloves and protective suits, which were mostly manufactured in Asia.

The surging e-commerce, food and other perishable items also contributed to the overall demand.

Some airlines removed the passenger seats from aircraft to turn them into instant freighters in order to catch up with the sudden spike in cargo demand.

Cargo operators, MASkargo and Teleport had to change their freighter schedules to manage high priority cargo movements and work day and night to ensure the shipments, especially medical supplies, arrive safely at the respective destinations.

Teleport recorded a positive earnings before interest, taxes, depreciation, and amortisation (Ebitda) of RM20 million for the third quarter ended Sept 30, 2020 despite a decline in revenue from impacted cargo capacity.

Major downsizing and restructuring

The Covid-19 pandemic adverse effects on the aviation industry have seen many airlines resorting to undertake massive downsizing measures, including lower operation cost, salary cut across the board, layoffs, corporate and debt restructuring, and even closing subsidiaries.

AirAsia had retrenched 10 per cent of its 24,000 employees to ensure its survival, Malindo Airways terminated the services of 2,200 employees, while Malaysia Aviation Group (MAG) offered an early retirement scheme to employees, including those from MAB and Firefly.

On October 6, MAB announced an urgent restructuring of a whopping RM16 billion worth of debt and had reached out to creditors for negotiations as the government would no longer be pumping any cash or capital through its sole shareholder, Khazanah Nasional Bhd.

Should the negotiations fail, MAB would be forced to undertake a winding down process and MAG might consider to execute an alternative plan of turning Firefly into Malaysia’s new national airline.

As for AirAsia X, the long-haul carrier has proposed a debt restructuring scheme to reconstitute the US$15.3 billion of unsecured debt into a principal amount of US$48 million (RM200 million) and have the rest waived.

Due to insolvency caused by the social consequences of the Covid-19 pandemic, AirAsia has closed its operation in Japan after the airline group's 33 per cent affiliate AirAsia Japan Co Ltd (AAJ) filed for bankruptcy with the Tokyo District Court.

Over 23,000 flyers were left without refunds.

Survival mode on vaccine prospects

Airlines were bleeding significantly with many going on survival mode as cash flow dried up faster than expected and to stay afloat until restriction on flying is lifted.

MAHB posted a net loss of RM431.17 million in the nine months ended September 30, 2020 (9M20) against a net profit of RM507.53 million in the same period last year, while revenue shrank to RM1.6 billion from RM3.87 billion previously.

AirAsia Group Bhd recorded a net loss of RM2.66 billion in 9M20 against a net profit of RM80.72 million, while revenue dropped to RM2.89 billion from RM9,09 billion.

Meanwhile, its sister company AirAsia X’s net loss widened to RM1.16 billion during the same period from RM393.67 million previously.

Despite many industries have started walking on the recovery path following the easing of the MCO, the aviation industry is still in limbo as to when it can “fully operate”, given that the domestic market was not enough to fill the empty stomach.

The positive development on Covid-19 vaccines, especially those made by Pfizer and BioNTech, has indeed sparked hope for a faster recovery in passenger air travel on the reopening of international borders.

Airlines and cargo operators have declared their readiness and commitment to prioritise cargo capacity to transport Covid-19 vaccines when they become available. — Bernama