WASHINGTON, Oct 31 — US trade policy and its impact on business investment, manufacturing and exports were a key factor in the Federal Reserve's decision to cut rates, chair Jerome Powell said yesterday.

But the Fed also signalled in its statement that it does not plan to make any more rate cuts in the near future. Trade is playing an important part in that decision, too, Powell explained in a press conference after the rate cut.

“Weakness in global growth and trade developments have weighed on the economy,” Powell said, explaining why he would cut rates. But, he added, “We also see the risks to the outlook perhaps having moved in a positive direction, although that remains to be seen.”

The “principal risks” the Fed has been monitoring are slowing global growth and trade policy developments, he elaborated in response to a reporter's question, adding he was mostly referring to trade developments.

Powell and other Fed bankers are optimistic that the United States and China will sign a preliminary agreement, calling a truce to their 16-month trade war, he said.

“We have that Phase One potential agreement with China which, if signed and put into effect, could have the effect of reducing trade tensions and reducing uncertainty,” Powell said. “That would bode well for business confidence and perhaps activity over time.”

If the economy was to experience “a sustained reduction in trade tensions, a broad reduction in trade tensions, and a resolution of these uncertainties, that would bode well for business sentiment,” Powell said, which could ultimately affect economic activity.

Investors are also optimistic about a “Phase One” deal, and drove the S&P 500 to a historic intraday high this week on expectations it could be imminent.

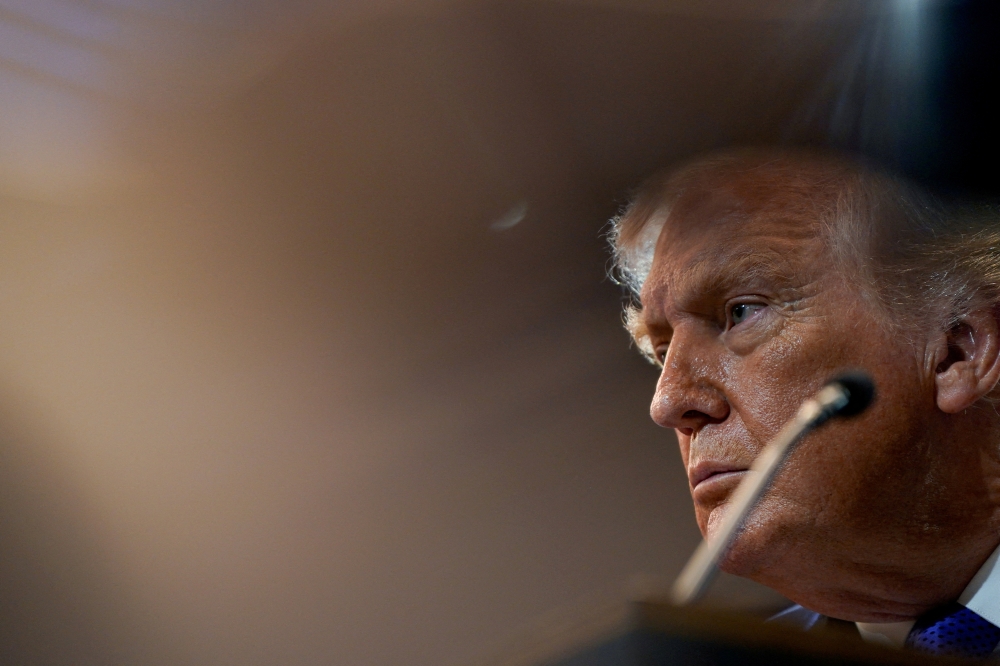

United States President Donald Trump and Chinese President Xi Jinping could sign a deal on the sidelines of the meeting Asia Pacific Economic Cooperation meeting in mid-November, US officials promised after trade talks ended earlier this month.

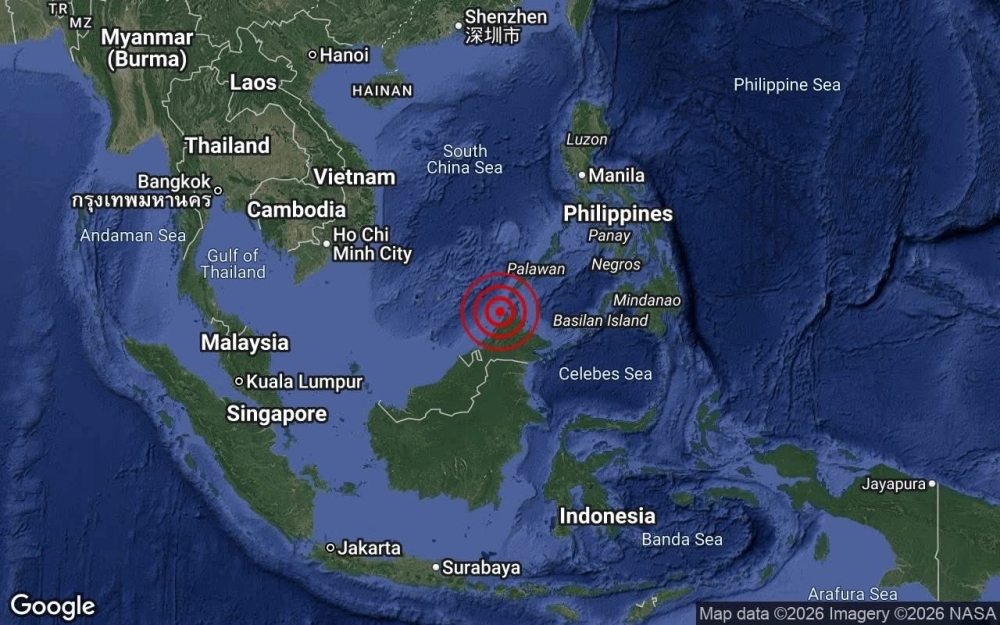

When such a deal might be signed is now unclear, though, after the Chilean government called off the meeting in Santiago yesterday, citing security concerns.

Negative impacts from the Trump administration's trade policies, and particularly the way the tariff war with China has slowed economies around the world, were the main topic of a meeting of central bankers at the International Monetary Fund earlier this month.

Global GDP in 2019 is expected to slow to 3 per cent, the slowest growth in a decade, the IMF said, because of the trade wars. — Reuters