PETALING JAYA, Sept 8 — Malaysian Institute of Estate Agents and consumer groups are urging the government to ban bulk property purchases as they could inflate prices and deprive first-time buyers of the chance to own a home.

Federation of Malaysian Consumers Association (Fomca) president Datuk Paul Selvaraj said bulk purchases of property should be banned as there was an urgent need for affordable housing, especially in the Klang Valley.

Selvaraj said priority should be given to first-time buyers and not to bulk buyers, whom he likened to “property speculators”.

“For the average Malaysian family, a house will be their biggest expenditure, which justifies the need for stronger regulation to support first-time purchasers,” he told Malay Mail.

He called for developers to show social consciousness when selling their units.

“The units should be sold with priority given to those who buy to stay.”

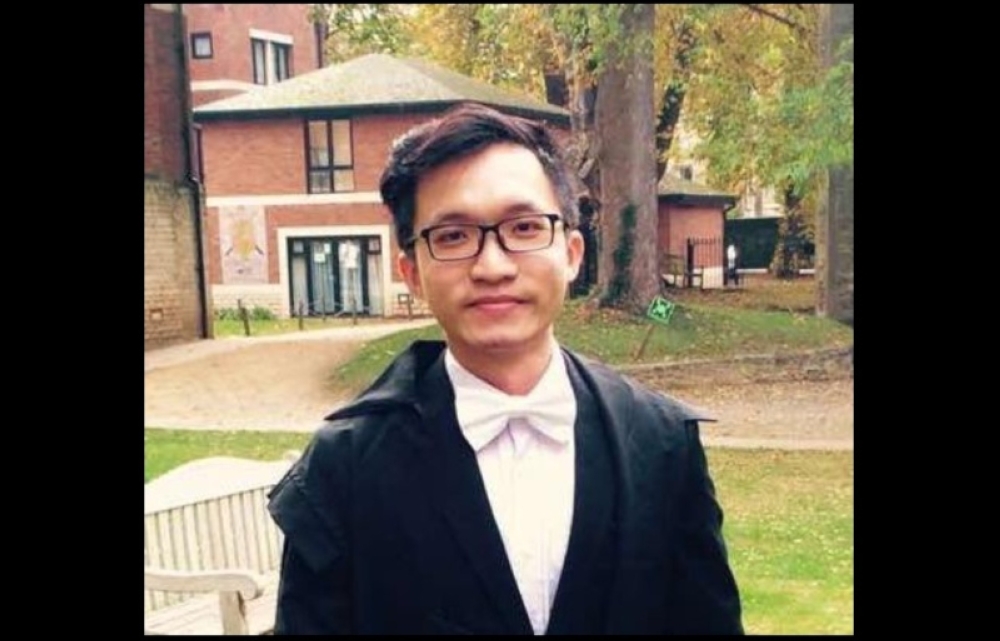

National House Buyers Association secretary-general Chang Kim Leong said he was unhappy as he felt the Urban Wellbeing, Housing and Local Government Ministry had made an “about-turn” in regulating bulk and group property purchasing activities.

“Prior to this, developers selling more than four units of their properties to a single buyer needed to obtain prior approval from the Controller of Housing.

“Now, those who want to purchase multiple properties merely have to register their names with the ministry. Will this be an effective measure to regulate bulk property purchases?”

He said the ministry should also rope in the Inland Revenue Board (LHDN) to investigate bulk purchases in order to prevent buyers from buying properties at a discounted price and then selling them for a higher profit margin.

Leong said a worrying tendency was that of cash-strapped developers to have direct links to property investor clubs, a trend he labelled “property insider trading”.

“The clubs purchase the majority of lots of an available property, then the developers sell the remainder at trumped-up prices, before the clubs release their own property bit by bit,” he said.

Leong said the clubs caused young adults to be influenced by “property gurus” who claimed to know a shortcut to great wealth when they were actually combining their resources to purchase properties in bulk cheaply at the expense of genuine, stay-in buyers.

“This practice of investor clubs needs to be outlawed.”

Malaysian Institute of Estate Agents (MIEA) deputy president Erick Kho said bulk-buying turned housing into a profit-making business and created an unnatural scenario of demand and supply.

“The buyers will negotiate with the developers, saying they will purchase a certain amount of units in order to receive a discounted price from the price offered to the public.

“After the purchase, they will hold the property until they can achieve a certain profit margin from a sale.”

Kho said the buyers which usually grouped together to form “investor clubs” usually targeted properties attractive to first-time buyers within the popular RM300,000 to RM500,000 range, which they could then inflate prices from five per cent all the way up to 15 per cent.

“They will resell them, pushing the prices higher and further. We know many cannot afford the prices of the houses in Klang Valley now.”

He said bulk-buyers usually looked for slow selling properties that were in close proximity to hot properties in Kuala Lumpur and more recently in Johor.

“The hot property developers will not be willing to sell it to the group buyers at a cheaper price.”

“On the other hand, the slow-selling developers want to break even so they don’t mind selling for a discount that can even be up to 15 per cent,” he said.

Kho added that investors who purchased the property were making a risky decision.

“Chances are if the property is not selling well to the point the developer has to offer such discounts to stabilise the situation, the development may fail.”

He said while members of the investor clubs made money from the transactions of property, almost none of them had licenses to do so.

“The authorities must ensure action is taken to prosecute them under the Real Estate Negotiator’s Act.”

Muslim Consumers Association Malaysia chief activist Datuk Nadzim Johan said if the government wanted to ban group or bulk purchases, it could do so with future developments, but not with projects already underway.

“They must ensure the industry is prepared for such a change,” he said.

Penang housing committee chairman Jagdeep Singh Deo had recently called for the ban on bulk property buying to curb speculation.