KUALA LUMPUR, July 5 — The Malaysian chapter of global insurance giant AIA has extended coverage of one of its products to include mental health amid growing concern over mental illness cases in the country.

The policy is an “enhancement” of its A-Health Plus package, which allows subscribers to claim up to RM1,500 a year in psychiatric consultation fees at any private or government hospitals for six mental health conditions, the company announced in a statement yesterday.

They are major depressive disorders, post-partum depression, schizophrenia, bipolar disorder, obsessive-compulsive disorder and Tourette Syndrome.

AIA said the new enhancement is part of AIA’s commitment to tackle the rise in mental health problems so Malaysians could “live healthier, longer and better lives.

“Mental health continues to remain a challenge for both the public and health industry due to the lack of data and understanding,” Chief Marketing Officer of AIA Bhd Heng Zee Wang said in the statement.

“While there is definitely more work to be done — AIA is happy to do whatever we can at this point to move the needle forward. One of the first steps we thought to address was seeking treatment, often one of the first barriers in the journey to mental health recovery,” he added.

“With this new feature, AIA hopes to enable more Malaysians to take that first step to seek professional help.”

The announcement comes after the Health Ministry in May encouraged insurance companies to provide coverage for mental illness, even as almost two out of 10 teenagers reported depression.

Deputy Health Minister Dr Lee Boon Chye said mental illness was a major problem in Malaysia.

The 2015 National Health and Morbidity Survey by the Ministry of Health (MoH) showed that 4.2 million Malaysians suffer from mental health problems.

The numbers indicate a two-fold increase in prevalence over the past decade with numbers rising from 10.7 per cent in 1996 to 29.2 per cent in 2015.

Experts said the sharp rise in mental health-related cases should already prompt policymakers to find a workable solution quick. They warned about the problem’s potential to drain state coffers since majority of Malaysians cannot afford to seek private treatment.

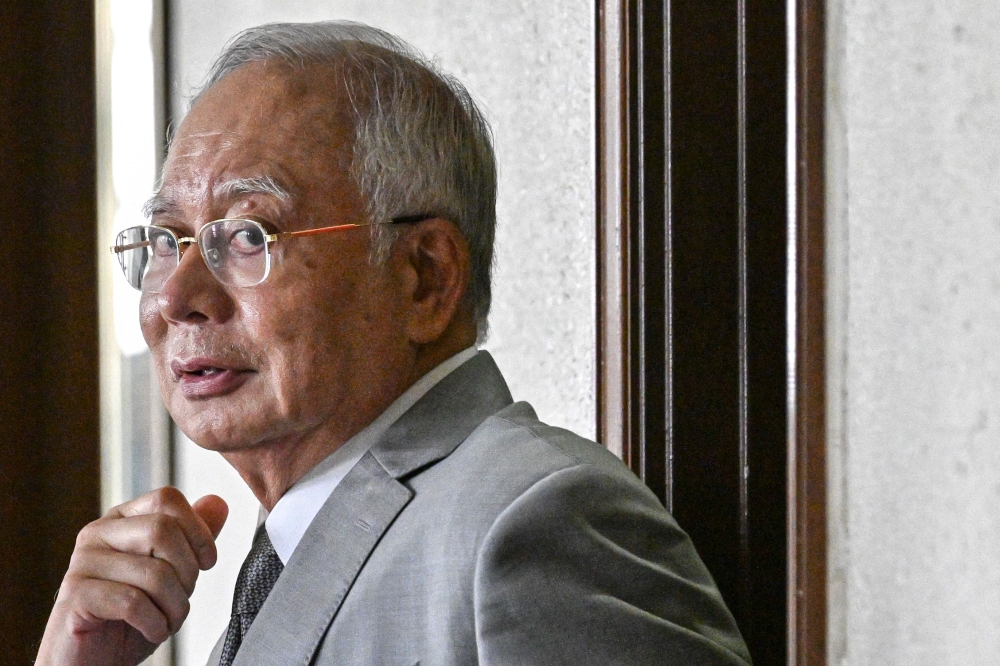

Malaysia Psychiatric Association patron Tan Sri Lee Lam Thye earlier this month said MoH must start the ball rolling for insurance coverage for mental health care and treatment for Malaysians.

AIA’s A-Plus Health premium was launched in 2018 as a medical rider that can be attached to AIA’s regular premium investment-linked plan, A-LifeLink 2 as well as A-Life Joy 2.

The company said the rider comes with a first-in-market feature called the Health Wallet. For every year that a customer does not make a claim from A-Plus Health, an amount will be credited into his/her Health Wallet, up to 10 times.

Currently, the customer can use the amount accumulated in the Health Wallet for the following preventive care services and additional medical expenses that are typically not covered by most medical plans.