SINGAPORE, Aug 29 — To further reduce consumer harm caused by volatile cryptocurrency investments, the Monetary Authority of Singapore (MAS) is considering implementing measures such as customer suitability tests and restricting the use of credit facilities for cryptocurrency trading.

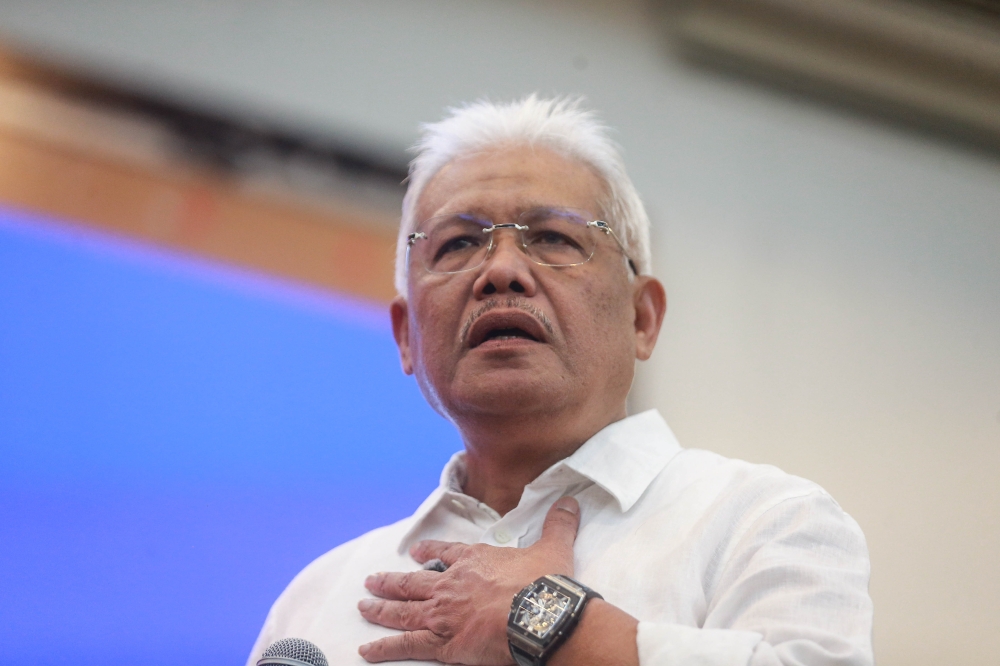

MAS managing director Ravi Menon said today that the central bank is contemplating these moves to add “frictions” on retail access to cryptocurrencies, especially as an outright ban is unlikely to work.

“MAS regards cryptocurrencies as unsuitable for use as money and as highly hazardous for retail investors,” he stressed, in his speech today addressing players and stakeholders of the crypto industry during a seminar.

This is on the back of a few cryptocurrency trading platforms here seeking creditors’ protection in recent months, locking up retail investors’ funds in the process.

The developments, which followed the collapse Terra and its sister token Luna at the start of the year, raised questions on how consumers can be better protected.

During his speech, Menon also sought to further clarify MAS’ stance towards the crypto ecosystem, as he acknowledged that the authority has been seen by some as sending mixed signals with regards to crypto and digital assets.

Risks of cryptocurrency speculations

Menon said that MAS regards cryptocurrencies as unsuitable for use as money, and calls it “highly hazardous for retail investors”.

This is as these tokens lack three fundamental qualities of money: A medium of exchange, store of value and unit of account.

He acknowledged that they serve a useful function within a blockchain network.

“But outside a blockchain network, cryptocurrencies serve no useful function except as a vehicle for speculation,” he said, stressing that MAS has been issuing warnings about their risks since 2017.

“It is very risky for the public to put their monies in such cryptocurrencies, as the perceived valuation of these cryptocurrencies could plummet rapidly when sentiments shift. We have seen this happen repeatedly,” he said.

He also pointed to how since the start of the year, MAS has restricted the promotion of cryptocurrency services at public spaces, which led to the dismantling of Bitcoin Automated Teller Machines and the removal of advertisements.

Yet, despite such moves and multiple warnings by the authorities, surveys have shown that consumers are increasingly trading in the volatile coins, in line with global trends, he said.

Many are enticed by the prospect of sharp price increases and “irrationally oblivious about the risks” of trading, he noted.

Thus, MAS is considering further measures to reduce consumer harm, such as by “adding frictions” on retail access to cryptocurrencies.

“These may include customer suitability tests and restricting the use of leverage and credit facilities for cryptocurrency trading,” he said.

Outright banning access, he said, is not likely to work, owing to the borderless nature of the cryptocurrency world.

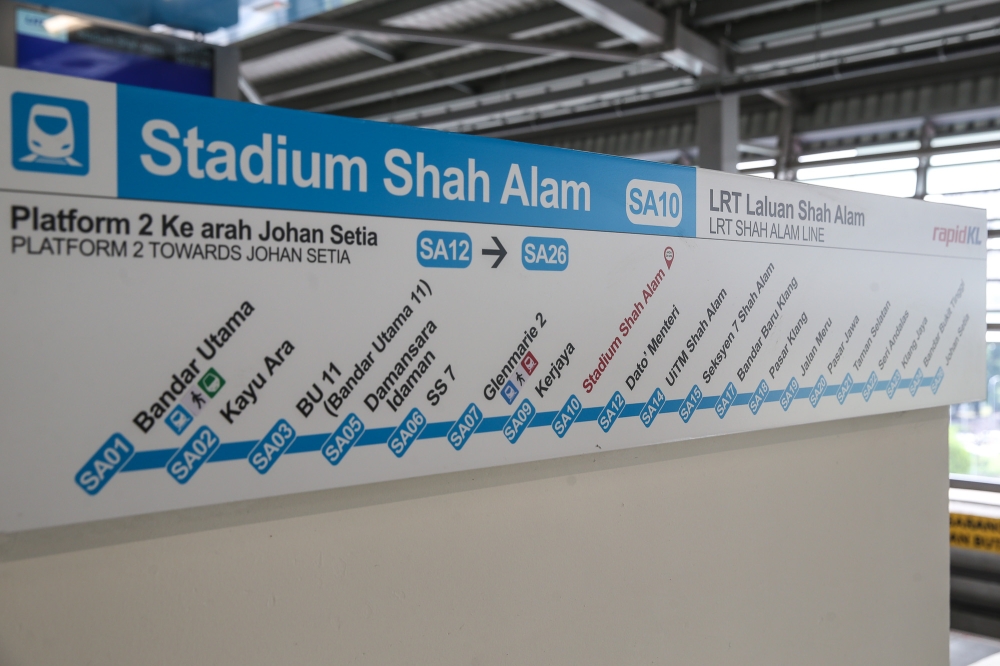

“With just a mobile phone, Singaporeans have access to any number of crypto exchanges in the world and can buy or sell any number of cryptocurrencies,” he said.

Regulations alone insufficient

In this regard, Menon stressed that safeguarding consumers from harm requires a multi-pronged approach beyond just regulations.

First is global cooperation, which is important to minimise regulatory arbitrage, given that cryptocurrency transactions can be conducted from anywhere around the world.

The industry itself, too, has an important role to play in co-creating sensible measures to protect consumer interests.

“MAS has been sharing its concerns with the industry and inviting views on possible measures to minimise harm to consumers. We will publicly consult on the proposals by October this year,” he said.

Just as importantly, he said consumers must take responsibility and exercise judgement and caution.

“No amount of MAS regulation, global cooperation or industry safeguards will protect consumers from losses if their cryptocurrency holdings lose value”.

Regulation and innovation not contradictory

Menon acknowledged that the inherent complexity of the crypto space has made it challenging for authorities to clearly communicate their stance towards it, leading to some concluding that MAS is sending “mixed signals”.

He stressed that the tough stance against cryptocurrency trading does not contradict MAS’ facilitative posture on digital asset activities and crypto technologies in general.

“Crypto technologies are promising and there is great potential to improve financial services — this is a common goal shared by MAS, the financial industry, and the fintech community,” he said.

In pursuit of this goal, Singapore continues being supportive towards innovation in the space as it sees value in certain components of the broader digital asset ecosystem, he said.

“In cross-border payments and settlements, wholesale settlement networks using distributed ledger technologies such as Partior — a joint venture among DBS, JP Morgan and Temasek — are achieving reductions in settlement time from days to mere minutes,” said Menon.

Benefits can also be seen in the trade finance and capital markets, he said.

While MAS’ development strategy makes Singapore one of the most conducive jurisdictions for digital assets, its evolving regulatory approach also makes Singapore “one of the most comprehensive” in managing risks and “among the strictest” in discouraging retail investments.

In all, he said that innovation and regulation can coexist, and are not contradictory.

“It is in fact a synergistic and holistic approach to develop Singapore as an innovative and responsible global digital asset hub.” — TODAY