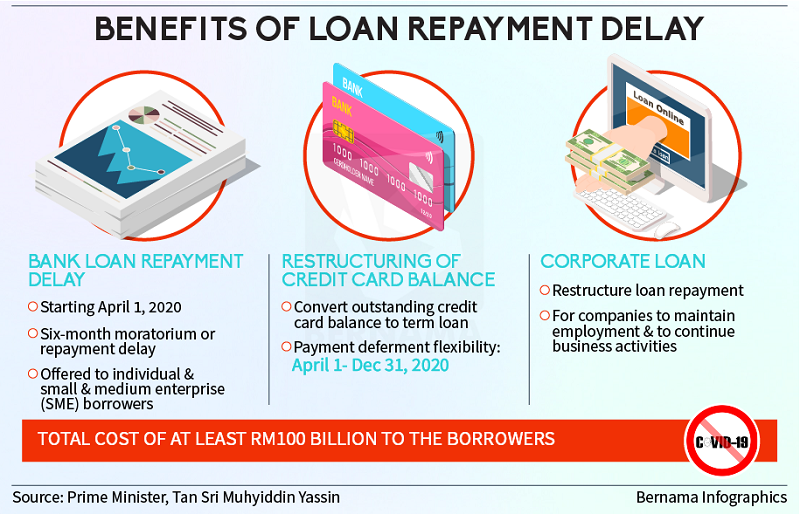

KUALA LUMPUR, March 27 — Public Bank is providing a six-month moratorium for the monthly instalment payments of loans to all eligible individual and business customers, with no compounded interest from April 1 to Sept 30, 2020.

For Islamic financing, the profit would continue to accrue on the outstanding principal amount, and such profit will not be compounded as well, in line with the Shariah principles, it said in a statement today.

Managing director Tan Sri Tay Ah Lek said Public Bank further extends the relief assistance to its customers by not charging any compounding interest on the interest that accrues during the moratorium period following Bank Negara Malaysia’s announcement on March 25, 2020.

“With the escalating Covid-19, Public Bank is very concerned about its impact on the nation and hopes this extended financial assistance will provide additional relief to its customers,” he said. — Bernama