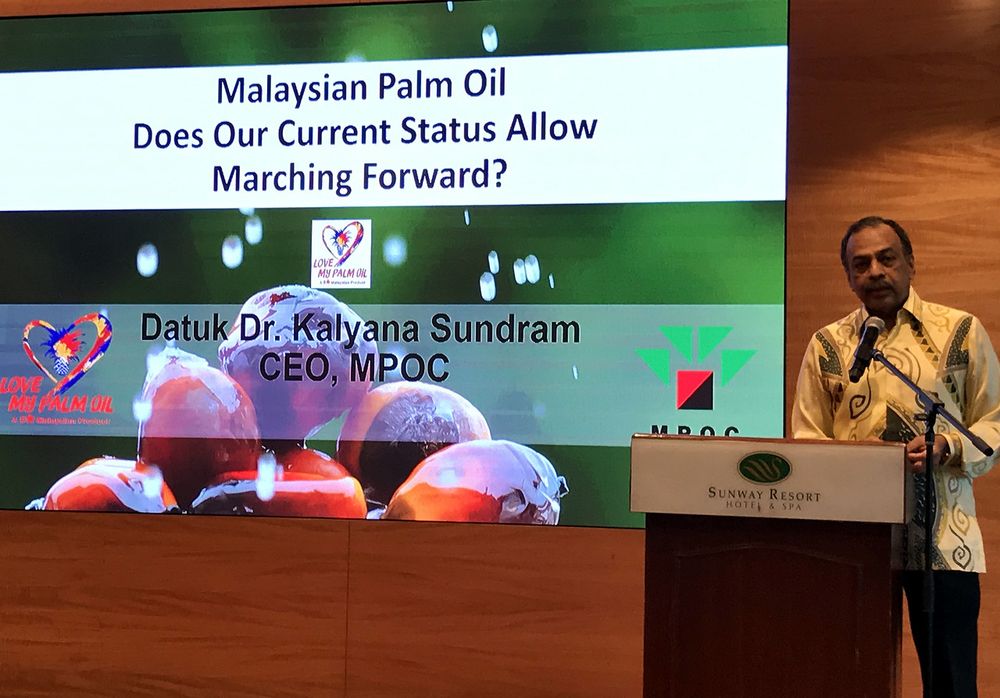

KUALA LUMPUR, Dec 21 — The reinstatement of crude palm oil (CPO) export tax starting next month is unlikely to affect demand for the local commodity in the European Union (EU), according to the Malaysian Palm Oil Council (MPOC).

Its chief executive officer, Datuk Dr Kalyana Sundram, said the EU market is less troubled by the pricing mechanism and more concerned about the quality and sustainability of the products, which Malaysia’s CPO can offer.

“What would happen is, for the markets which prefer CPO — particularly India, which prefers it over refined palm oil — they might look for the best pricing in the global arena. So our CPO exports to India may be reduced as a result of the tax, but there are other players in India who are also buying refined palm oil products, and they will continue buying.

“Overall, the CPO export tax would not have a major impact on the industry,” he told Bernama after delivering his keynote address at the Second Global Indian Millers Conference here today.

Kalyana said so far this year, the EU has imported about 2.2 million tonnes of palm oil from Malaysia compared with 1.91 million tonnes for the whole of 2018.

Of the 2.2 million tonnes, he said, 1.4 million tonnes were used in the food industry while the remaining 800,000 tonnes went to the renewable energy industry in the continent.

“Malaysia is quite lucky because of the quality assurance of our palm oil and our long-term partnerships with some of the major food multinational companies in Europe,” he said.

On the EU’s plan to phase out palm biofuels by 2030, he said Malaysia would lodge a complaint with the World Trade Organisation over the EU’s move, and expected to find new markets for the extra 800,000 tonnes of the palm oil.

“We will find new markets in Africa, Asean, China or India, so it will be seen as a rebranding or refocusing of Malaysia’s palm oil destinations.

“And at the end of the day, it will be a zero-sum game,” he said.

Asked if the CPO export tax would make the local commodity less competitive in the global market, Kalyana shrugged off the concerns as he said Indonesia would also take a similar approach next year.

The Indonesian government was reportedly as saying in September that it would impose export levies for CPO products and its derivatives from Jan 1, 2020.

“So everything is normalised,” said Kalyana.

Early this month, the Malaysian Palm Oil Board said the government would raise the export duty for January buying to five per cent from the current exempted rate after calculating the reference point for January’s buying at RM2,571.16 per tonne.

It will be the first time the tax is raised since August last year, when an export tax of 4.5 per cent was imposed. From May 1 to Dec 31 this year, the government gave a tax-free exemption for CPO exports to boost palm oil exports and expand into new markets. — Bernama