KUCHING, July 12 — Sarawak police have identified 2,354 mule bank accounts in the state in the first six months of this year.

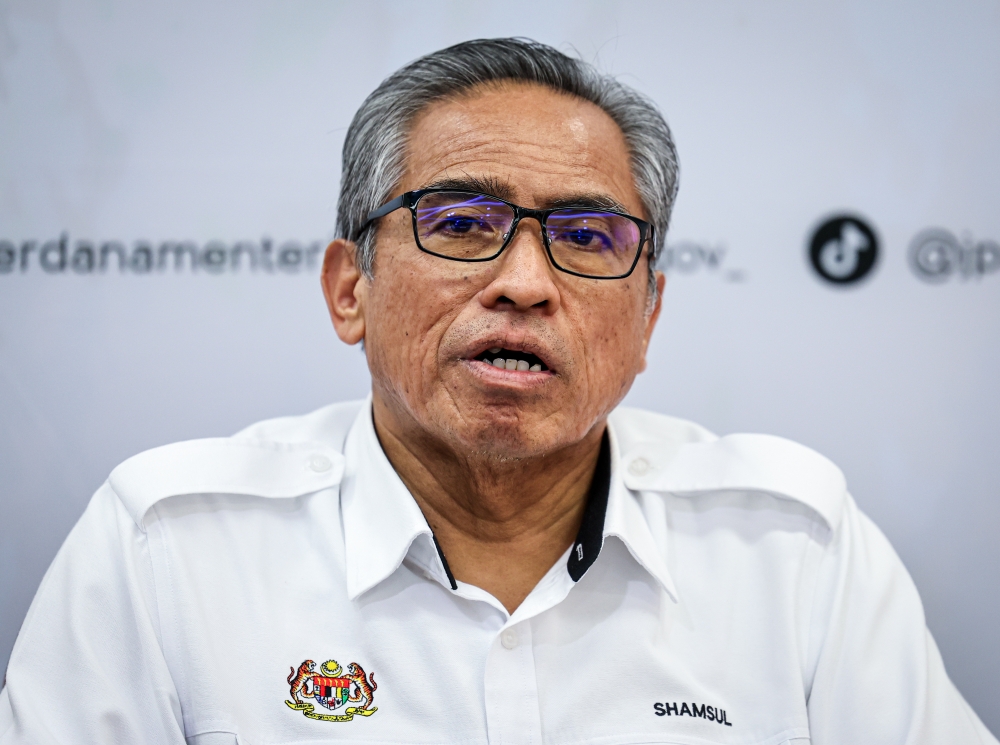

Sarawak police commissioner Datuk Mohd Azman Ahmad Sapri warned the public not to “rent” out or surrender their banking details and ATM cards to become mule accounts for scam syndicates.

“These accounts have been identified to be involved in online purchase scams, part-time job offer scams, as well as other scams which have recorded more than RM40 million in losses to their victims,” Mohd Azman told a press conference at the Sarawak Police Contingent Headquarters here today.

He said investigations of the cases led by the Sarawak Commercial Crime Investigation Department (CCID) has resulted in 444 account holders being arrested and charged in court between January and June.

Mohd Azman said based on their analysis, the account holders were promised between RM50 and RM1,000 to surrender their bank accounts to the syndicates.

“The mule account holders also claimed that they did not know how their accounts were being used until they were arrested by the police,” he said.

The syndicates, he said, would lure in prospective mule account holders by offering various part-time jobs with the prospect of gaining commission.

He added that the modus operandi of these syndicates is largely to target new graduates, housewives, pensioners, and jobless individuals who need fast and easy cash.

Once a syndicate has taken hold of a mule account, he explained that the account would be used by the syndicate to transfer the money of victims through various layers or accounts to avoid being detected by the authorities.

He pointed out that within 30 minutes, the money could be transferred through several layers via online banking to other bank accounts either locally or overseas.

Mohd Azman stressed the public should not accept any job offers that require them to surrender their bank accounts and ATM cards.

“The public are also advised to not accept an offer from any individual(s) who wants to use your bank account to receive and send money,” he added.

He said offences related to mule accounts could be charged in court under Section 109 of the Penal Code for abetment; Section 411 of the Penal Code for dishonestly receiving stolen property; Section 424 of the Penal Code for dishonestly or fraudulently assisting in the removal or concealment of consideration; or Section 420 of the Penal Code for cheating. — Borneo Post Online