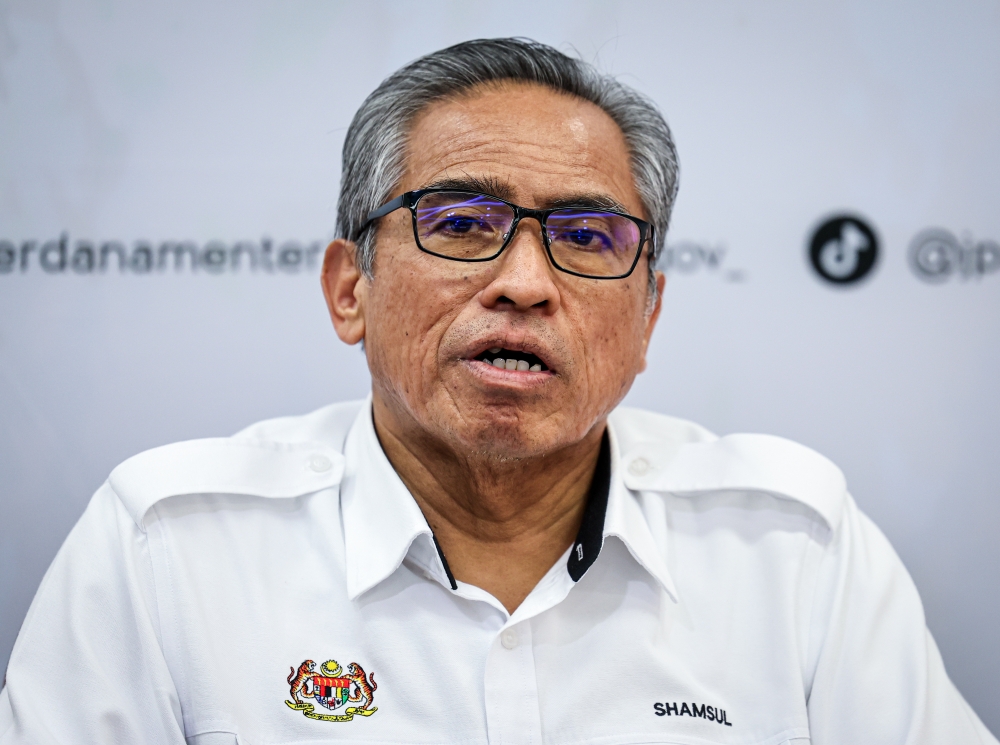

PUTRAJAYA, June 22 — Domestic Trade and Cost of Living (KPDN) Minister Datuk Seri Salahuddin Ayub today announced several affordable insurance and takaful packages under Putrajaya's Rahmah initiative, provided by Allianz General Insurance Bhd, Etiqa General Insurance Bhd, and Etiqa General Takaful Bhd.

The Rahmah Insurance Package provides coverage for personal accidents up to RM50,000 and benefits including reimbursement of medical expenses at government hospitals and emergency relief payments in the event of flood evacuation up to RM750 depending on the chosen plan, he told reporters at a press conference at his ministry here.

“The new benefit is added at no additional cost with an annual premium at the rate of RM53.50 and RM79.50, including sales tax,” he said.

He added that Allianz is also offering a MotorcyclePlus additional coverage of RM10,000 for both the rider and passenger as well as a hospital allowance through an insurance policy based on the registered motorcycle engine capacity.

Those who opt for Allianz’s MotorcyclePlus Comprehensive Policy will enjoy all benefits of the MotorcyclePlus package on top of special perils coverage and roadside assistance of up to 50km and flood relief benefits of up to RM1,000 without costs,.

“I think those in the gig economy, such as FoodPanda and Grab, should come forward to get this protection since many of them use motorcycles,” he said.

Etiqa is offering a Rahmah Insurance Package of its own along with a Rahmah Takaful Package which provides compensation for disability or death due to accidents or illnesses of up to RM80,000 with the payment of RM5 monthly or RM36 annually, inclusive of sales tax.

Salahuddin said both packages are available to Malaysians aged between 16 and 65 years and can be renewed until the policy holder is 70 years of age.

“KPDN hopes that all plans offered through these two initiatives will help support more Malaysians, especially those in the B40, to own insurance or takaful coverage, next to applying the importance of owning insurance or takaful for the protection of one’s self and property,” he said.

The Payung Rahmah initiative was introduced in January this year as a short-term strategy for mitigating the inflation squeeze for those in the bottom 40 per cent of income earners (B40).

Soon after the launch of Menu Rahmah, an initiative which provided meals for RM5, Salahuddin reportedly announced that the initiative had attracted the interests of other sectors.

It has since grown to include fast food brands, eyewear, automotive services and hypermarket discounts, among others.